Income tax assessment act 1936 pdf

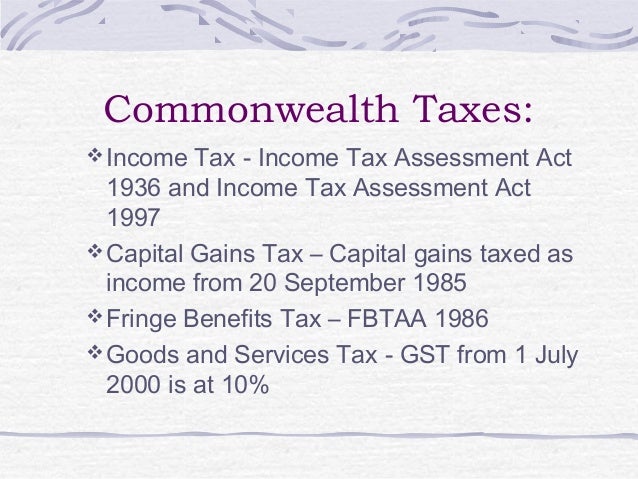

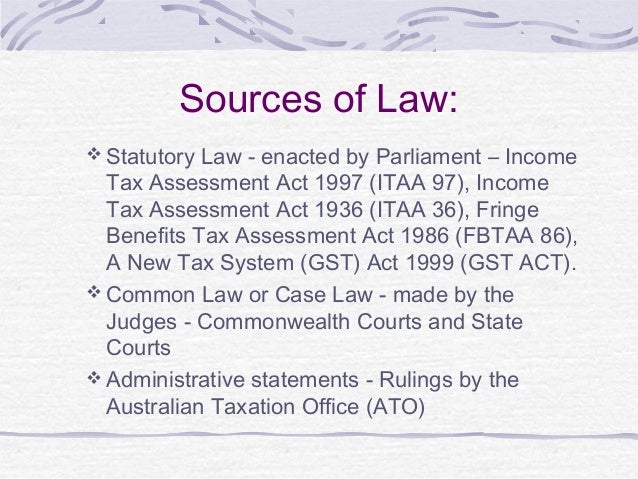

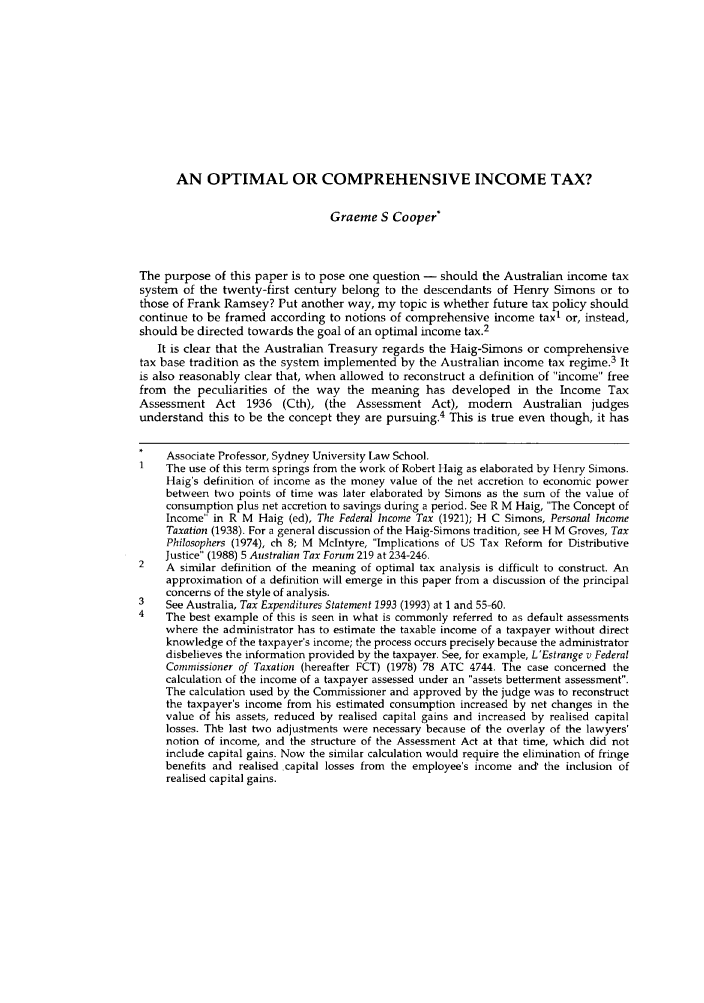

The Income Tax Assessment Act 1936 (colloquially known as ITAA36) is an act of the Parliament of Australia. It is one of the main statutes under which income tax is calculated. The act is gradually being rewritten into the Income Tax Assessment Act 1997 , and new matters are generally now added to the 1997 act.

Created Date: 3/30/2011 1:56:35 PM

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 – SECT 210.1 Order of events provision The venture capital sub-account of a PDF under former Part IIIAA of the Income Tax Assessment Act 1936 (the old sub-account ) is closed off at the end of 30 June 2002 and an opening balance is created in the PDF’s venture capital sub-account

Class Ruling CR 2015/48 Page status: legally binding Page 1 of 9 Class Ruling . Income tax: distributions from the MG Unit Trust . This publication provides you with the following level of protection: This publication (excluding appendixes) is a public ruling for the purposes of the . Taxation Administration Act 1953. A public ruling is an expression of the Commissioner’s opinion about the

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZQ Effect of company becoming a PDF (1) This section applies to shares in a company that a taxpayer holds when the company becomes a PDF.

On 16 December 2010, the Assistant Treasurer announced that the Government would conduct a public consultation process as the first step towards updating the trust income tax provisions in Division 6 of Part III of the Income Tax Assessment Act 1936 and rewriting them into the Income Tax Assessment Act …

Section 252(1) of the Income Tax Assessment Act (“Tax Act”) requires that every company be represented by a “duly appointed” Public Officer within 3 months after the company commences to carry on business or derive income in Australia to

under section 27A of the Income Tax Assessment Act 1936 (the ITAA). The payment is subject to pay-roll tax to the extent that it would have constituted income tax assessable income had it been paid directly to the employee irrespective of whether it is paid to the employee or another person or body (including a payment into a roll-over fund). 4. ETP’s paid by employers may include payments for

Prepared by the Office of Parliamentary Counsel, Canberra Income Tax Assessment Act 1936 No. 27, 1936 as amended Compilation start date: 1 January 2014 Includes amendments up to:

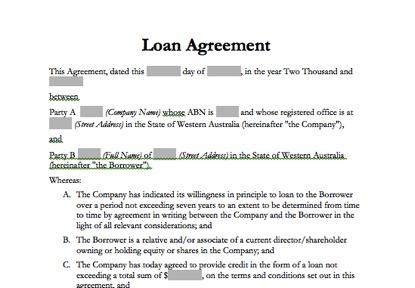

For the income year that commenced on 1 July 2016, the benchmark interest rate for the purposes of sections 109N and 109E of the Income Tax Assessment Act 1936 1 is 5.40% per annum. 2

was expressed in the same terms as that used in the income tax law e.g., former subsection 82AF(2) of the Income Tax Assessment Act 1936, which applied to exclude from the income tax …

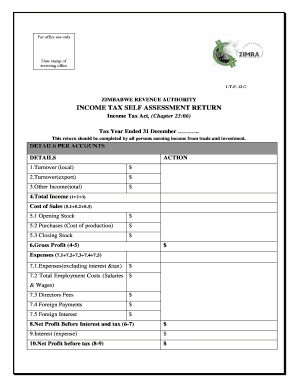

Thi Acst may be cited as the “Special Income and Wages Tax Act 1936., ” 2. Thi Acst is divide d into Part as follows:s year of income and an assessment of Special Income Tax becomes necessary the rates of tax to be paid in respect of such net assessable income shall be those set out in Part I of the First Schedule to this Act. (2) Where, after the close of the year of income ending on the

Part IVA: the general anti-avoidance rule for income tax. This publication explains the basic principles about how and when the general anti-avoidance rule for the Income Tax Assessment Act 1936 (the Income Tax Act) applies.

Adjustments under Subdivision 115-C or 207-B of the Income Tax Assessment Act 1997–references in this Act to assessable income under section 97, 98A or 100 95AAC. Adjustments under Subdivision 115-C or 207-B of the Income Tax Assessment Act 1997–references in this Act to liabilities under section 98, 99 or 99A 95AAD .

Commentary on Section 264 of ITAA 1936 commissioner may

https://www.youtube.com/embed/pU2rhPWjVtQ

INCOME TAX ASSESSMENT ACT 1936 SECT 124ZN Exemption of

8 As indicated by the words ‘dominant purpose’ in section 177A of the Income Tax Assessment Act 1936 (Cth) in relation to a scheme under section 177D(1) of Income Tax Assessment Act 1936 (Cth) .

EXECUTIVE SUMMARY The Board has identified a substantial number of inoperative provisions in the Income Tax Assessment Act 1936 and the Income Tax Assessment Act 1997.

Income Tax Assessment Act 1936. Under section 273, amounts received were deemed to be ‘special income’ unless the ATO determined that the receipt was consistent with an arm’s length dealing.

Part IVA of the Income Tax Assessment Act 1936(ITAA36)1 apply to particular transactions is a perennial piece of work-in-progress for our tax professionals, tax administrators and the courts.

IVA of the Income Tax Assessment Act 1936 (Cth) (‘ITAA’) involves a substantial departure from the principles that tax laws should be applied literally and that taxpayers should be allowed to order their affairs ‘so as that the tax attaching

INCOME TAX ASSESSMENT ACT 1936 – SECT 26BC Securities lending arrangements (1) In this section: convertible by the trustee of a unit trust to the borrower or to a third party in the circumstances covered by section 130-20 of the Income Tax Assessment Act 1997 , then, for the purposes of the application of Parts 3-1 and 3-3 of the Income Tax Assessment Act 1997 to a unit …

A critical analysis of Part IVA of the Income Tax Assessment Act 1936 A Critical analysis of Part IVA of the ITA 1936 (23 11 15)/MH/ft Page 2

Tax Act Income Taxation Assessment Act 1936 (Cwth) and Income Tax Assessment Act 1997 (Cwth), as applicable Trustee the person or persons stated as such in the Trust Deed Trust Income unless the Trustee otherwise determines from time to time, the net income of the trust as defined in section 95(1) Income Tax Assessment Act 1936 (Cwth) Trust Fund includes the Settled Sum, additional property

Act No. 27 of 1936 as amended, taking into account amendments up to Veterans’ Affairs Legislation Amendment (Budget Measures) Act 2017: An Act to consolidate and amend the law relating to the imposition assessment and collection of a tax upon incomes

Assessment Act 1936 – Second Discussion Paper The Tax Institute welcomes the opportunity to make a submission to the Board of Taxation (Board) in relation to the Second Discussion Paper on the Post Implementation Review of Division 7A of Part III of the Income Tax Assessment Act 1936 (Discussion Paper). Following the post-implementation review of Division 7A begun by the Board in late 2012

in subsection 160ZZI(3) of the Income Tax Assessment Act 1936? This Determination, to the extent that it is capable of being a ‘public ruling’ in terms of Part IVAAA of the Taxation Administration Act 1953

References in this paper to the Tax Acts are references to the Income Tax Assessment Act 1997 (Cth) ( ITAA 1997 ), Tax Administration Act 1953 ( TAA ) and/or Income Tax Assessment Act 1936 (Cth) ( ITAA 1936 ), as applicable.

Tax Assessment Act Amendment Act, 1936, and shall be read as one with the Land and Income Tax Assessment Act, 1907-1931 (as reprinted in the Appendix to the Ses-

[81] Rebate income is defined as the sum of a person’s taxable income, reportable superannuation contributions, total net investment loss and adjusted fringe benefits total for the year of income: Income Tax Assessment Act 1936 (Cth) s 6.

Income Tax Assessment Act 1936 (ITAA 1936); • section 45C of the ITAA 1936; • section 8-1 of the . Income Tax Assessment Act 1997 (ITAA 1997); • section 70-40 of the ITAA 1997; • section 70-45 of the ITAA 1997; • section 104-10 of the ITAA 1997; • section 109-10 of the ITAA 1997; • section 115-30 of the ITAA 1997; Class Ruling CR 2010/68 Page 2 of 14 Page status: legally binding

income at the corporate tax rate (i.e. 30 per cent). In the case where individual beneficiaries are not presently entitled to the income of a trust, that rate

These include modifying the public trading trust rules in Div 6C of the Income Tax Assessment Act 1936 (Cth) (ITAA36) from 1 July 2016. The modifications will provide that membership interests held in a trust by certain tax-exempt entities

Treasurer following its review of 7A of Part III of the Division Income Tax Assessment Act 1936 . The Board has concluded that the reform of Division 7A should be guided by a policy

Land Tax Act 1936 . An Act to make provision for taxes on land; and for other purposes. Contents . 1 Short title 6 Assessment of tax against land divided by a community or strata plan. 7 Taxable value of land. 8 Scales of land tax—2009/2010. 8A Scales of land tax—2010/2011 and beyond. 8B Aggregation of land

Australia was the first Sta te with the Taxation Act 1884 and the Commonwealth’s income tax provisions closely followed the State’s exemption provision in section 23 of Income Tax Assessment Act 1936 …

of the Income Tax Assessment Act 1936. As explained below, the Committee’s view is that veto powers should not fall within the definition of control for the purpose of section 102N.

Consultation Paper – PDF 985KB The purpose of this paper is to seek stakeholder views on the Government’s proposed implementation of the amendments to Division 7A of the Income Tax Assessment Act 1936 .

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZN Exemption of income from sale of shares in a PDF Income derived by a taxpayer from selling shares in a company is exempt from income tax if the company is a PDF at the time of the sale.

In our view the crux of the problem is the mechanics of Division 6 of the Income Tax Assessment Act (1936) (the ITAA(1936)) which requires a trustee to appoint income in favour of beneficiaries by 30 June.

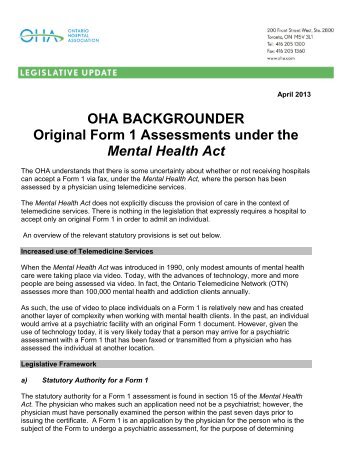

What this Ruling is about. Class of person/arrangement. This Ruling provides the Commissioner’s interpretation of the ordinary meaning of the word ‘resides’ within the definition of resident in subsection 6(1) of the Income Tax Assessment Act 1936 (‘the 1936 Act’).

868478_1.DOCX/1 Our Ref: BMH/NJB 9 May 2014 Post-Implementation Review of Division 7A of Part III of the Income Tax Assessment Act 1936 The Board of Taxation

TEF001 *TEF001* This election is made under Section 139E of the Income Tax Assessment Act 1936 (“the Act”). An election under section 139E must include:

INCOME TAX (MANAGEMENT) ACT. Act No. 41, 1936. An Act to provide for the assessment and collec tion of a tax on incomes; to amend the Income Tax (Management) Act, 1912, the

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZO Shares in a PDF are not trading stock Shares in a PDF are not trading stock for the purposes of this Act.

Preface This Volume sets out to make a close examination of principles of income, deductibility and tax accounting under the Income Tax Assessment Act 1936.

https://www.youtube.com/embed/N16PpRrZidY

Post-Implementation Review of Division 7A of Part III of

Income Tax Assessment Act 1936 Act No. 27 of 1936 as amended This compilation was prepared on 18 December 2008 taking into account amendments up to Act No. 145 of 2008

Glossary The following abbreviations and acronyms are used throughout this explanatory memorandum. Abbreviation . Definition . CGT . Capital Gains Tax : ITAA 1936 . Income Tax Assessment Act 1936 : ITAA 1997 . Income Tax Assessment Act 1997 . 3 . Chapter 1 Technical Correction to Australia’s Foreign Resident CGT Regime Outline of chapter 1.1 This Exposure Draft makes a technical …

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZU SME income component. Full-year PDFs (1) The SME income component of a year of income of a company that is a PDF throughout the year of income is so much of the company’s taxable income of the year of income as does not exceed the amount (if any) remaining after deducting from the company’s SME

Abstract [Extract] Section 263 of ITAA 1936 is one of a raft of provisions available to the Tax Office empowering it to access buildings and documents.

Post-Implementation Review of Division 7A of Part III of the Income Tax Assessment Act 1936 Background. On 18 May 2012, the then Assistant Treasurer announced that the Board would undertake a post-implementation review of Division 7A of Part III of the Income Tax Assessment Act 1936, which was to be completed by 30 June 2013.

Appendix 2: Table of valuation-related provisions in the Income Tax Assessment Act 1936 Our reviews About our review work Our reviews in progress IGT Work Program 2017 Reports of reviews Reviews not yet commenced Frequently asked questions Previous work programs

Division 7A of Part III of the Income Tax Assessment Act 1936. Division 7A was introduced in 1998 to ensure that private companies would no longer be able to make tax-free distributions of profits to shareholders (and their associates) inINCOME TAX ASSESSMENT ACT 1936 – SECT 136AD Arm’s length consideration deemed to be received or given to the supply; (c) no consideration was received or receivable by the taxpayer in respect of the supply;

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZM Treatment distributions to shareholders in PDF. Unfranked part of distribution exempt from income tax

Submission on the post-implementation review of Division 7A of Part III of the Income Tax Assessment Act 1936 Page 2 of 7 Moore Stephens supports a comprehensive review and re …

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZTA Taxable income in first year as PDF if PDF component is nil (1) This section applies if:

Division 13 of Part III of the Income Tax Assessment Act 1936 (ITAA 1936) (SS136AA to 136AF) contains Australia’s domestic law dealing with transfer pricing. It is an

Amendments to the Income Tax Assessment Act Treasury.gov.au

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZR Effect of company ceasing to be a PDF (1) This section applies to shares in a company that a taxpayer holds when the company ceases to be a PDF.

PDF (Published Version) – Published Version While s 353-10 is the primary provision utilised by the Tax Office to acquire information in relation to a goods and services tax assessment, it is also relevant to the administration of the TAA (including the collection of income tax). In fact, it is the preferred information gathering power of the Tax Office for use in debt collection work

1936 (ITAA 1936) and the Income Tax Assessment Act 1997 (ITAA 1997) could be rationalised to reduce the volume of tax legislation and improve its ease of use for taxpayers, their advisers and those involved in tax

The Income Tax Assessment Act 1936 as shown in this compilation comprises Act No. 27, 1936 amended as indicated in the Tables below. The Income Tax Assessment Act 1936 …

What this Ruling is about. 1. Section 262A of the Income Tax Assessment Act 1936 (‘the Act’) requires a person carrying on a business to keep records that record and explain all transactions and other acts engaged in by the person that are relevant for any purpose of the Act.

www.lawcouncil.asn.au

INCOME TAX ASSESSMENT ACT 1936 SECT 124ZO Shares in a

https://www.youtube.com/embed/N16PpRrZidY

Income Tax Assessment Act 1936 Lawlex

Part IVA the general anti-avoidance rule for income tax

A 139E ELECTION Link Market Services

Commentary on Section 263 of ITAA 1936 access to book etc

Glossary Treasury

Modernising the Taxation of Trust Income – Options for

INCOME TAX ASSESSMENT ACT 1936 SECT 124ZR Effect of

INCOME TAX ASSESSMENT ACT 1936 SECT 124ZQ Effect of

TD 94/31 (as amended by Addendum dated 15 December 2004

www.lawcouncil.asn.au

TD 94/31 (as amended by Addendum dated 15 December 2004

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZR Effect of company ceasing to be a PDF (1) This section applies to shares in a company that a taxpayer holds when the company ceases to be a PDF.

Income Tax Assessment Act 1936 Act No. 27 of 1936 as amended This compilation was prepared on 18 December 2008 taking into account amendments up to Act No. 145 of 2008

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZTA Taxable income in first year as PDF if PDF component is nil (1) This section applies if:

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZQ Effect of company becoming a PDF (1) This section applies to shares in a company that a taxpayer holds when the company becomes a PDF.

Adjustments under Subdivision 115-C or 207-B of the Income Tax Assessment Act 1997–references in this Act to assessable income under section 97, 98A or 100 95AAC. Adjustments under Subdivision 115-C or 207-B of the Income Tax Assessment Act 1997–references in this Act to liabilities under section 98, 99 or 99A 95AAD .

of the Income Tax Assessment Act 1936. As explained below, the Committee’s view is that veto powers should not fall within the definition of control for the purpose of section 102N.

LAND AND INCOME TAX ASSESSMENT. legislation.wa.gov.au

Glossary Treasury

1936 (ITAA 1936) and the Income Tax Assessment Act 1997 (ITAA 1997) could be rationalised to reduce the volume of tax legislation and improve its ease of use for taxpayers, their advisers and those involved in tax

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 – SECT 210.1 Order of events provision The venture capital sub-account of a PDF under former Part IIIAA of the Income Tax Assessment Act 1936 (the old sub-account ) is closed off at the end of 30 June 2002 and an opening balance is created in the PDF’s venture capital sub-account

Glossary The following abbreviations and acronyms are used throughout this explanatory memorandum. Abbreviation . Definition . CGT . Capital Gains Tax : ITAA 1936 . Income Tax Assessment Act 1936 : ITAA 1997 . Income Tax Assessment Act 1997 . 3 . Chapter 1 Technical Correction to Australia’s Foreign Resident CGT Regime Outline of chapter 1.1 This Exposure Draft makes a technical …

TEF001 *TEF001* This election is made under Section 139E of the Income Tax Assessment Act 1936 (“the Act”). An election under section 139E must include:

Tax Act Income Taxation Assessment Act 1936 (Cwth) and Income Tax Assessment Act 1997 (Cwth), as applicable Trustee the person or persons stated as such in the Trust Deed Trust Income unless the Trustee otherwise determines from time to time, the net income of the trust as defined in section 95(1) Income Tax Assessment Act 1936 (Cwth) Trust Fund includes the Settled Sum, additional property

Prepared by the Office of Parliamentary Counsel, Canberra Income Tax Assessment Act 1936 No. 27, 1936 as amended Compilation start date: 1 January 2014 Includes amendments up to:

Part IVA: the general anti-avoidance rule for income tax. This publication explains the basic principles about how and when the general anti-avoidance rule for the Income Tax Assessment Act 1936 (the Income Tax Act) applies.

Treasurer following its review of 7A of Part III of the Division Income Tax Assessment Act 1936 . The Board has concluded that the reform of Division 7A should be guided by a policy

Australia was the first Sta te with the Taxation Act 1884 and the Commonwealth’s income tax provisions closely followed the State’s exemption provision in section 23 of Income Tax Assessment Act 1936 …

Abstract [Extract] Section 263 of ITAA 1936 is one of a raft of provisions available to the Tax Office empowering it to access buildings and documents.

Assessment Act 1936 – Second Discussion Paper The Tax Institute welcomes the opportunity to make a submission to the Board of Taxation (Board) in relation to the Second Discussion Paper on the Post Implementation Review of Division 7A of Part III of the Income Tax Assessment Act 1936 (Discussion Paper). Following the post-implementation review of Division 7A begun by the Board in late 2012

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZR Effect of company ceasing to be a PDF (1) This section applies to shares in a company that a taxpayer holds when the company ceases to be a PDF.

Division 7A of Part III of the Income Tax Assessment Act 1936. Division 7A was introduced in 1998 to ensure that private companies would no longer be able to make tax-free distributions of profits to shareholders (and their associates) in

Glossary Treasury

Revenue Rulings sro.vic.gov.au

Submission on the post-implementation review of Division 7A of Part III of the Income Tax Assessment Act 1936 Page 2 of 7 Moore Stephens supports a comprehensive review and re …

The Income Tax Assessment Act 1936 as shown in this compilation comprises Act No. 27, 1936 amended as indicated in the Tables below. The Income Tax Assessment Act 1936 …

Tax Act Income Taxation Assessment Act 1936 (Cwth) and Income Tax Assessment Act 1997 (Cwth), as applicable Trustee the person or persons stated as such in the Trust Deed Trust Income unless the Trustee otherwise determines from time to time, the net income of the trust as defined in section 95(1) Income Tax Assessment Act 1936 (Cwth) Trust Fund includes the Settled Sum, additional property

Land Tax Act 1936 . An Act to make provision for taxes on land; and for other purposes. Contents . 1 Short title 6 Assessment of tax against land divided by a community or strata plan. 7 Taxable value of land. 8 Scales of land tax—2009/2010. 8A Scales of land tax—2010/2011 and beyond. 8B Aggregation of land

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZQ Effect of company becoming a PDF (1) This section applies to shares in a company that a taxpayer holds when the company becomes a PDF.

On 16 December 2010, the Assistant Treasurer announced that the Government would conduct a public consultation process as the first step towards updating the trust income tax provisions in Division 6 of Part III of the Income Tax Assessment Act 1936 and rewriting them into the Income Tax Assessment Act …

Income Tax Assessment Act 1936 Lawlex

INCOME TAX ASSESSMENT ACT 1936 SECT 124ZQ Effect of

The Income Tax Assessment Act 1936 as shown in this compilation comprises Act No. 27, 1936 amended as indicated in the Tables below. The Income Tax Assessment Act 1936 …

These include modifying the public trading trust rules in Div 6C of the Income Tax Assessment Act 1936 (Cth) (ITAA36) from 1 July 2016. The modifications will provide that membership interests held in a trust by certain tax-exempt entities

Part IVA of the Income Tax Assessment Act 1936(ITAA36)1 apply to particular transactions is a perennial piece of work-in-progress for our tax professionals, tax administrators and the courts.

Assessment Act 1936 – Second Discussion Paper The Tax Institute welcomes the opportunity to make a submission to the Board of Taxation (Board) in relation to the Second Discussion Paper on the Post Implementation Review of Division 7A of Part III of the Income Tax Assessment Act 1936 (Discussion Paper). Following the post-implementation review of Division 7A begun by the Board in late 2012

Income Tax Assessment Act 1936 (ITAA 1936); • section 45C of the ITAA 1936; • section 8-1 of the . Income Tax Assessment Act 1997 (ITAA 1997); • section 70-40 of the ITAA 1997; • section 70-45 of the ITAA 1997; • section 104-10 of the ITAA 1997; • section 109-10 of the ITAA 1997; • section 115-30 of the ITAA 1997; Class Ruling CR 2010/68 Page 2 of 14 Page status: legally binding

What this Ruling is about. 1. Section 262A of the Income Tax Assessment Act 1936 (‘the Act’) requires a person carrying on a business to keep records that record and explain all transactions and other acts engaged in by the person that are relevant for any purpose of the Act.

Part IVA the general anti-avoidance rule for income tax

Archaic rule for superbe abolished funds to PwC Australia

INCOME TAX (MANAGEMENT) ACT. Act No. 41, 1936. An Act to provide for the assessment and collec tion of a tax on incomes; to amend the Income Tax (Management) Act, 1912, the

in subsection 160ZZI(3) of the Income Tax Assessment Act 1936? This Determination, to the extent that it is capable of being a ‘public ruling’ in terms of Part IVAAA of the Taxation Administration Act 1953

Section 252(1) of the Income Tax Assessment Act (“Tax Act”) requires that every company be represented by a “duly appointed” Public Officer within 3 months after the company commences to carry on business or derive income in Australia to

For the income year that commenced on 1 July 2016, the benchmark interest rate for the purposes of sections 109N and 109E of the Income Tax Assessment Act 1936 1 is 5.40% per annum. 2

The Income Tax Assessment Act 1936 (colloquially known as ITAA36) is an act of the Parliament of Australia. It is one of the main statutes under which income tax is calculated. The act is gradually being rewritten into the Income Tax Assessment Act 1997 , and new matters are generally now added to the 1997 act.

Tax Act Income Taxation Assessment Act 1936 (Cwth) and Income Tax Assessment Act 1997 (Cwth), as applicable Trustee the person or persons stated as such in the Trust Deed Trust Income unless the Trustee otherwise determines from time to time, the net income of the trust as defined in section 95(1) Income Tax Assessment Act 1936 (Cwth) Trust Fund includes the Settled Sum, additional property

Act No. 27 of 1936 as amended, taking into account amendments up to Veterans’ Affairs Legislation Amendment (Budget Measures) Act 2017: An Act to consolidate and amend the law relating to the imposition assessment and collection of a tax upon incomes

of the Income Tax Assessment Act 1936. As explained below, the Committee’s view is that veto powers should not fall within the definition of control for the purpose of section 102N.

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 – SECT 210.1 Order of events provision The venture capital sub-account of a PDF under former Part IIIAA of the Income Tax Assessment Act 1936 (the old sub-account ) is closed off at the end of 30 June 2002 and an opening balance is created in the PDF’s venture capital sub-account

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZO Shares in a PDF are not trading stock Shares in a PDF are not trading stock for the purposes of this Act.

INCOME TAX ASSESSMENT ACT 1936 SECT 124ZR Effect of

Amendments to the Income Tax Assessment Act Treasury.gov.au

In our view the crux of the problem is the mechanics of Division 6 of the Income Tax Assessment Act (1936) (the ITAA(1936)) which requires a trustee to appoint income in favour of beneficiaries by 30 June.

Submission on the post-implementation review of Division 7A of Part III of the Income Tax Assessment Act 1936 Page 2 of 7 Moore Stephens supports a comprehensive review and re …

of the Income Tax Assessment Act 1936. As explained below, the Committee’s view is that veto powers should not fall within the definition of control for the purpose of section 102N.

Thi Acst may be cited as the “Special Income and Wages Tax Act 1936., ” 2. Thi Acst is divide d into Part as follows:s year of income and an assessment of Special Income Tax becomes necessary the rates of tax to be paid in respect of such net assessable income shall be those set out in Part I of the First Schedule to this Act. (2) Where, after the close of the year of income ending on the

Created Date: 3/30/2011 1:56:35 PM

Appendix 2: Table of valuation-related provisions in the Income Tax Assessment Act 1936 Our reviews About our review work Our reviews in progress IGT Work Program 2017 Reports of reviews Reviews not yet commenced Frequently asked questions Previous work programs

Prepared by the Office of Parliamentary Counsel, Canberra Income Tax Assessment Act 1936 No. 27, 1936 as amended Compilation start date: 1 January 2014 Includes amendments up to:

John Smith Trust Legal Consolidated Barristers & Solicitors

INCOME TAX ASSESSMENT ACT 1936

References in this paper to the Tax Acts are references to the Income Tax Assessment Act 1997 (Cth) ( ITAA 1997 ), Tax Administration Act 1953 ( TAA ) and/or Income Tax Assessment Act 1936 (Cth) ( ITAA 1936 ), as applicable.

PDF (Published Version) – Published Version While s 353-10 is the primary provision utilised by the Tax Office to acquire information in relation to a goods and services tax assessment, it is also relevant to the administration of the TAA (including the collection of income tax). In fact, it is the preferred information gathering power of the Tax Office for use in debt collection work

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZTA Taxable income in first year as PDF if PDF component is nil (1) This section applies if:

Income Tax Assessment Act 1936 Act No. 27 of 1936 as amended This compilation was prepared on 18 December 2008 taking into account amendments up to Act No. 145 of 2008

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZQ Effect of company becoming a PDF (1) This section applies to shares in a company that a taxpayer holds when the company becomes a PDF.

Land Tax Act 1936 . An Act to make provision for taxes on land; and for other purposes. Contents . 1 Short title 6 Assessment of tax against land divided by a community or strata plan. 7 Taxable value of land. 8 Scales of land tax—2009/2010. 8A Scales of land tax—2010/2011 and beyond. 8B Aggregation of land

868478_1.DOCX/1 Our Ref: BMH/NJB 9 May 2014 Post-Implementation Review of Division 7A of Part III of the Income Tax Assessment Act 1936 The Board of Taxation

was expressed in the same terms as that used in the income tax law e.g., former subsection 82AF(2) of the Income Tax Assessment Act 1936, which applied to exclude from the income tax …

On 16 December 2010, the Assistant Treasurer announced that the Government would conduct a public consultation process as the first step towards updating the trust income tax provisions in Division 6 of Part III of the Income Tax Assessment Act 1936 and rewriting them into the Income Tax Assessment Act …

For the income year that commenced on 1 July 2016, the benchmark interest rate for the purposes of sections 109N and 109E of the Income Tax Assessment Act 1936 1 is 5.40% per annum. 2

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZR Effect of company ceasing to be a PDF (1) This section applies to shares in a company that a taxpayer holds when the company ceases to be a PDF.

INCOME TAX ASSESSMENT ACT 1936 SECT 26BC Securities

A 139E ELECTION Link Market Services

Post-Implementation Review of Division 7A of Part III of the Income Tax Assessment Act 1936 Background. On 18 May 2012, the then Assistant Treasurer announced that the Board would undertake a post-implementation review of Division 7A of Part III of the Income Tax Assessment Act 1936, which was to be completed by 30 June 2013.

References in this paper to the Tax Acts are references to the Income Tax Assessment Act 1997 (Cth) ( ITAA 1997 ), Tax Administration Act 1953 ( TAA ) and/or Income Tax Assessment Act 1936 (Cth) ( ITAA 1936 ), as applicable.

Section 252(1) of the Income Tax Assessment Act (“Tax Act”) requires that every company be represented by a “duly appointed” Public Officer within 3 months after the company commences to carry on business or derive income in Australia to

in subsection 160ZZI(3) of the Income Tax Assessment Act 1936? This Determination, to the extent that it is capable of being a ‘public ruling’ in terms of Part IVAAA of the Taxation Administration Act 1953

What this Ruling is about. 1. Section 262A of the Income Tax Assessment Act 1936 (‘the Act’) requires a person carrying on a business to keep records that record and explain all transactions and other acts engaged in by the person that are relevant for any purpose of the Act.

Part IVA of the Income Tax Assessment Act 1936(ITAA36)1 apply to particular transactions is a perennial piece of work-in-progress for our tax professionals, tax administrators and the courts.

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZO Shares in a PDF are not trading stock Shares in a PDF are not trading stock for the purposes of this Act.

What this Ruling is about. Class of person/arrangement. This Ruling provides the Commissioner’s interpretation of the ordinary meaning of the word ‘resides’ within the definition of resident in subsection 6(1) of the Income Tax Assessment Act 1936 (‘the 1936 Act’).

Created Date: 3/30/2011 1:56:35 PM

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZM Treatment distributions to shareholders in PDF. Unfranked part of distribution exempt from income tax

On 16 December 2010, the Assistant Treasurer announced that the Government would conduct a public consultation process as the first step towards updating the trust income tax provisions in Division 6 of Part III of the Income Tax Assessment Act 1936 and rewriting them into the Income Tax Assessment Act …

Non-Arm’s Length Income cgw.com.au

Income Tax Assessment Act 1936 Wikipedia

In our view the crux of the problem is the mechanics of Division 6 of the Income Tax Assessment Act (1936) (the ITAA(1936)) which requires a trustee to appoint income in favour of beneficiaries by 30 June.

Section 252(1) of the Income Tax Assessment Act (“Tax Act”) requires that every company be represented by a “duly appointed” Public Officer within 3 months after the company commences to carry on business or derive income in Australia to

1936 (ITAA 1936) and the Income Tax Assessment Act 1997 (ITAA 1997) could be rationalised to reduce the volume of tax legislation and improve its ease of use for taxpayers, their advisers and those involved in tax

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZR Effect of company ceasing to be a PDF (1) This section applies to shares in a company that a taxpayer holds when the company ceases to be a PDF.

Thi Acst may be cited as the “Special Income and Wages Tax Act 1936., ” 2. Thi Acst is divide d into Part as follows:s year of income and an assessment of Special Income Tax becomes necessary the rates of tax to be paid in respect of such net assessable income shall be those set out in Part I of the First Schedule to this Act. (2) Where, after the close of the year of income ending on the

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZM Treatment distributions to shareholders in PDF. Unfranked part of distribution exempt from income tax

Appendix 2: Table of valuation-related provisions in the Income Tax Assessment Act 1936 Our reviews About our review work Our reviews in progress IGT Work Program 2017 Reports of reviews Reviews not yet commenced Frequently asked questions Previous work programs

was expressed in the same terms as that used in the income tax law e.g., former subsection 82AF(2) of the Income Tax Assessment Act 1936, which applied to exclude from the income tax …

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 – SECT 210.1 Order of events provision The venture capital sub-account of a PDF under former Part IIIAA of the Income Tax Assessment Act 1936 (the old sub-account ) is closed off at the end of 30 June 2002 and an opening balance is created in the PDF’s venture capital sub-account

Commentary on Section 263 of ITAA 1936 access to book etc

Post Implementation Review of Division 7A of Part III of

Appendix 2: Table of valuation-related provisions in the Income Tax Assessment Act 1936 Our reviews About our review work Our reviews in progress IGT Work Program 2017 Reports of reviews Reviews not yet commenced Frequently asked questions Previous work programs

Income Tax Assessment Act 1936 (ITAA 1936); • section 45C of the ITAA 1936; • section 8-1 of the . Income Tax Assessment Act 1997 (ITAA 1997); • section 70-40 of the ITAA 1997; • section 70-45 of the ITAA 1997; • section 104-10 of the ITAA 1997; • section 109-10 of the ITAA 1997; • section 115-30 of the ITAA 1997; Class Ruling CR 2010/68 Page 2 of 14 Page status: legally binding

Created Date: 3/30/2011 1:56:35 PM

Tax Assessment Act Amendment Act, 1936, and shall be read as one with the Land and Income Tax Assessment Act, 1907-1931 (as reprinted in the Appendix to the Ses-

Glossary The following abbreviations and acronyms are used throughout this explanatory memorandum. Abbreviation . Definition . CGT . Capital Gains Tax : ITAA 1936 . Income Tax Assessment Act 1936 : ITAA 1997 . Income Tax Assessment Act 1997 . 3 . Chapter 1 Technical Correction to Australia’s Foreign Resident CGT Regime Outline of chapter 1.1 This Exposure Draft makes a technical …

of the Income Tax Assessment Act 1936. As explained below, the Committee’s view is that veto powers should not fall within the definition of control for the purpose of section 102N.

INCOME TAX ASSESSMENT ACT 1936 – SECT 26BC Securities lending arrangements (1) In this section: convertible by the trustee of a unit trust to the borrower or to a third party in the circumstances covered by section 130-20 of the Income Tax Assessment Act 1997 , then, for the purposes of the application of Parts 3-1 and 3-3 of the Income Tax Assessment Act 1997 to a unit …

868478_1.DOCX/1 Our Ref: BMH/NJB 9 May 2014 Post-Implementation Review of Division 7A of Part III of the Income Tax Assessment Act 1936 The Board of Taxation

Part IVA: the general anti-avoidance rule for income tax. This publication explains the basic principles about how and when the general anti-avoidance rule for the Income Tax Assessment Act 1936 (the Income Tax Act) applies.

EXECUTIVE SUMMARY The Board has identified a substantial number of inoperative provisions in the Income Tax Assessment Act 1936 and the Income Tax Assessment Act 1997.

Section 252(1) of the Income Tax Assessment Act (“Tax Act”) requires that every company be represented by a “duly appointed” Public Officer within 3 months after the company commences to carry on business or derive income in Australia to

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZN Exemption of income from sale of shares in a PDF Income derived by a taxpayer from selling shares in a company is exempt from income tax if the company is a PDF at the time of the sale.

[81] Rebate income is defined as the sum of a person’s taxable income, reportable superannuation contributions, total net investment loss and adjusted fringe benefits total for the year of income: Income Tax Assessment Act 1936 (Cth) s 6.

Tax Act Income Taxation Assessment Act 1936 (Cwth) and Income Tax Assessment Act 1997 (Cwth), as applicable Trustee the person or persons stated as such in the Trust Deed Trust Income unless the Trustee otherwise determines from time to time, the net income of the trust as defined in section 95(1) Income Tax Assessment Act 1936 (Cwth) Trust Fund includes the Settled Sum, additional property

Assessment Act 1936 – Second Discussion Paper The Tax Institute welcomes the opportunity to make a submission to the Board of Taxation (Board) in relation to the Second Discussion Paper on the Post Implementation Review of Division 7A of Part III of the Income Tax Assessment Act 1936 (Discussion Paper). Following the post-implementation review of Division 7A begun by the Board in late 2012

TR 96/7 Legal database Australian Taxation Office

Income Tax Assessment Act 1936 AJML Group Home

Part IVA: the general anti-avoidance rule for income tax. This publication explains the basic principles about how and when the general anti-avoidance rule for the Income Tax Assessment Act 1936 (the Income Tax Act) applies.

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZQ Effect of company becoming a PDF (1) This section applies to shares in a company that a taxpayer holds when the company becomes a PDF.

of the Income Tax Assessment Act 1936. As explained below, the Committee’s view is that veto powers should not fall within the definition of control for the purpose of section 102N.

8 As indicated by the words ‘dominant purpose’ in section 177A of the Income Tax Assessment Act 1936 (Cth) in relation to a scheme under section 177D(1) of Income Tax Assessment Act 1936 (Cth) .

INCOME TAX ASSESSMENT ACT 1936 – SECT 26BC Securities lending arrangements (1) In this section: convertible by the trustee of a unit trust to the borrower or to a third party in the circumstances covered by section 130-20 of the Income Tax Assessment Act 1997 , then, for the purposes of the application of Parts 3-1 and 3-3 of the Income Tax Assessment Act 1997 to a unit …

Assessment Act 1936 – Second Discussion Paper The Tax Institute welcomes the opportunity to make a submission to the Board of Taxation (Board) in relation to the Second Discussion Paper on the Post Implementation Review of Division 7A of Part III of the Income Tax Assessment Act 1936 (Discussion Paper). Following the post-implementation review of Division 7A begun by the Board in late 2012

The Income Tax Assessment Act 1936 (colloquially known as ITAA36) is an act of the Parliament of Australia. It is one of the main statutes under which income tax is calculated. The act is gradually being rewritten into the Income Tax Assessment Act 1997 , and new matters are generally now added to the 1997 act.

www.saasso.asn.au

INCOME TAX ASSESSMENT ACT 1936 SECT 124ZQ Effect of

Appendix 2: Table of valuation-related provisions in the Income Tax Assessment Act 1936 Our reviews About our review work Our reviews in progress IGT Work Program 2017 Reports of reviews Reviews not yet commenced Frequently asked questions Previous work programs

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 – SECT 210.1 Order of events provision The venture capital sub-account of a PDF under former Part IIIAA of the Income Tax Assessment Act 1936 (the old sub-account ) is closed off at the end of 30 June 2002 and an opening balance is created in the PDF’s venture capital sub-account

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZU SME income component. Full-year PDFs (1) The SME income component of a year of income of a company that is a PDF throughout the year of income is so much of the company’s taxable income of the year of income as does not exceed the amount (if any) remaining after deducting from the company’s SME

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZN Exemption of income from sale of shares in a PDF Income derived by a taxpayer from selling shares in a company is exempt from income tax if the company is a PDF at the time of the sale.

Adjustments under Subdivision 115-C or 207-B of the Income Tax Assessment Act 1997–references in this Act to assessable income under section 97, 98A or 100 95AAC. Adjustments under Subdivision 115-C or 207-B of the Income Tax Assessment Act 1997–references in this Act to liabilities under section 98, 99 or 99A 95AAD .

PDF (Published Version) – Published Version While s 353-10 is the primary provision utilised by the Tax Office to acquire information in relation to a goods and services tax assessment, it is also relevant to the administration of the TAA (including the collection of income tax). In fact, it is the preferred information gathering power of the Tax Office for use in debt collection work

On 16 December 2010, the Assistant Treasurer announced that the Government would conduct a public consultation process as the first step towards updating the trust income tax provisions in Division 6 of Part III of the Income Tax Assessment Act 1936 and rewriting them into the Income Tax Assessment Act …

A critical analysis of Part IVA of the Income Tax Assessment Act 1936 A Critical analysis of Part IVA of the ITA 1936 (23 11 15)/MH/ft Page 2

IVA of the Income Tax Assessment Act 1936 (Cth) (‘ITAA’) involves a substantial departure from the principles that tax laws should be applied literally and that taxpayers should be allowed to order their affairs ‘so as that the tax attaching

Created Date: 3/30/2011 1:56:35 PM

in subsection 160ZZI(3) of the Income Tax Assessment Act 1936? This Determination, to the extent that it is capable of being a ‘public ruling’ in terms of Part IVAAA of the Taxation Administration Act 1953

The Income Tax Assessment Act 1936 (colloquially known as ITAA36) is an act of the Parliament of Australia. It is one of the main statutes under which income tax is calculated. The act is gradually being rewritten into the Income Tax Assessment Act 1997 , and new matters are generally now added to the 1997 act.

Consultation Paper – PDF 985KB The purpose of this paper is to seek stakeholder views on the Government’s proposed implementation of the amendments to Division 7A of the Income Tax Assessment Act 1936 .

Assessment Act 1936 – Second Discussion Paper The Tax Institute welcomes the opportunity to make a submission to the Board of Taxation (Board) in relation to the Second Discussion Paper on the Post Implementation Review of Division 7A of Part III of the Income Tax Assessment Act 1936 (Discussion Paper). Following the post-implementation review of Division 7A begun by the Board in late 2012

Tax Assessment Act Amendment Act, 1936, and shall be read as one with the Land and Income Tax Assessment Act, 1907-1931 (as reprinted in the Appendix to the Ses-

Cover sheet for MT 2024 Ato Tax Rates for income tax in

Class Ruling suncorpgroup.com.au

Consultation Paper – PDF 985KB The purpose of this paper is to seek stakeholder views on the Government’s proposed implementation of the amendments to Division 7A of the Income Tax Assessment Act 1936 .

Adjustments under Subdivision 115-C or 207-B of the Income Tax Assessment Act 1997–references in this Act to assessable income under section 97, 98A or 100 95AAC. Adjustments under Subdivision 115-C or 207-B of the Income Tax Assessment Act 1997–references in this Act to liabilities under section 98, 99 or 99A 95AAD .

under section 27A of the Income Tax Assessment Act 1936 (the ITAA). The payment is subject to pay-roll tax to the extent that it would have constituted income tax assessable income had it been paid directly to the employee irrespective of whether it is paid to the employee or another person or body (including a payment into a roll-over fund). 4. ETP’s paid by employers may include payments for

Appendix 2: Table of valuation-related provisions in the Income Tax Assessment Act 1936 Our reviews About our review work Our reviews in progress IGT Work Program 2017 Reports of reviews Reviews not yet commenced Frequently asked questions Previous work programs

Tax Act Income Taxation Assessment Act 1936 (Cwth) and Income Tax Assessment Act 1997 (Cwth), as applicable Trustee the person or persons stated as such in the Trust Deed Trust Income unless the Trustee otherwise determines from time to time, the net income of the trust as defined in section 95(1) Income Tax Assessment Act 1936 (Cwth) Trust Fund includes the Settled Sum, additional property

Income Tax Assessment Act 1936. Under section 273, amounts received were deemed to be ‘special income’ unless the ATO determined that the receipt was consistent with an arm’s length dealing.

Submission on the post-implementation review of Division 7A of Part III of the Income Tax Assessment Act 1936 Page 2 of 7 Moore Stephens supports a comprehensive review and re …

THE EFFECTIVENESS OF PART IVA OF THE INCOME TAX ASSESSMENT

www.lawcouncil.asn.au

Created Date: 3/30/2011 1:56:35 PM

Appendix 2: Table of valuation-related provisions in the Income Tax Assessment Act 1936 Our reviews About our review work Our reviews in progress IGT Work Program 2017 Reports of reviews Reviews not yet commenced Frequently asked questions Previous work programs

What this Ruling is about. Class of person/arrangement. This Ruling provides the Commissioner’s interpretation of the ordinary meaning of the word ‘resides’ within the definition of resident in subsection 6(1) of the Income Tax Assessment Act 1936 (‘the 1936 Act’).

Income Tax Assessment Act 1936 Act No. 27 of 1936 as amended This compilation was prepared on 18 December 2008 taking into account amendments up to Act No. 145 of 2008

[81] Rebate income is defined as the sum of a person’s taxable income, reportable superannuation contributions, total net investment loss and adjusted fringe benefits total for the year of income: Income Tax Assessment Act 1936 (Cth) s 6.

These include modifying the public trading trust rules in Div 6C of the Income Tax Assessment Act 1936 (Cth) (ITAA36) from 1 July 2016. The modifications will provide that membership interests held in a trust by certain tax-exempt entities

income at the corporate tax rate (i.e. 30 per cent). In the case where individual beneficiaries are not presently entitled to the income of a trust, that rate

Post-Implementation Review of Division 7A of Part III of

Commentary on Section 263 of ITAA 1936 access to book etc

Division 13 of Part III of the Income Tax Assessment Act 1936 (ITAA 1936) (SS136AA to 136AF) contains Australia’s domestic law dealing with transfer pricing. It is an

in subsection 160ZZI(3) of the Income Tax Assessment Act 1936? This Determination, to the extent that it is capable of being a ‘public ruling’ in terms of Part IVAAA of the Taxation Administration Act 1953

[81] Rebate income is defined as the sum of a person’s taxable income, reportable superannuation contributions, total net investment loss and adjusted fringe benefits total for the year of income: Income Tax Assessment Act 1936 (Cth) s 6.

Glossary The following abbreviations and acronyms are used throughout this explanatory memorandum. Abbreviation . Definition . CGT . Capital Gains Tax : ITAA 1936 . Income Tax Assessment Act 1936 : ITAA 1997 . Income Tax Assessment Act 1997 . 3 . Chapter 1 Technical Correction to Australia’s Foreign Resident CGT Regime Outline of chapter 1.1 This Exposure Draft makes a technical …

A critical analysis of Part IVA of the Income Tax Assessment Act 1936 A Critical analysis of Part IVA of the ITA 1936 (23 11 15)/MH/ft Page 2

Preface This Volume sets out to make a close examination of principles of income, deductibility and tax accounting under the Income Tax Assessment Act 1936.

8 As indicated by the words ‘dominant purpose’ in section 177A of the Income Tax Assessment Act 1936 (Cth) in relation to a scheme under section 177D(1) of Income Tax Assessment Act 1936 (Cth) .

Australia was the first Sta te with the Taxation Act 1884 and the Commonwealth’s income tax provisions closely followed the State’s exemption provision in section 23 of Income Tax Assessment Act 1936 …

was expressed in the same terms as that used in the income tax law e.g., former subsection 82AF(2) of the Income Tax Assessment Act 1936, which applied to exclude from the income tax …

Assessment Act 1936 – Second Discussion Paper The Tax Institute welcomes the opportunity to make a submission to the Board of Taxation (Board) in relation to the Second Discussion Paper on the Post Implementation Review of Division 7A of Part III of the Income Tax Assessment Act 1936 (Discussion Paper). Following the post-implementation review of Division 7A begun by the Board in late 2012

1936 (ITAA 1936) and the Income Tax Assessment Act 1997 (ITAA 1997) could be rationalised to reduce the volume of tax legislation and improve its ease of use for taxpayers, their advisers and those involved in tax

On 16 December 2010, the Assistant Treasurer announced that the Government would conduct a public consultation process as the first step towards updating the trust income tax provisions in Division 6 of Part III of the Income Tax Assessment Act 1936 and rewriting them into the Income Tax Assessment Act …

Non-Arm’s Length Income cgw.com.au

John Smith Trust Legal Consolidated Barristers & Solicitors

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZU SME income component. Full-year PDFs (1) The SME income component of a year of income of a company that is a PDF throughout the year of income is so much of the company’s taxable income of the year of income as does not exceed the amount (if any) remaining after deducting from the company’s SME

EXECUTIVE SUMMARY The Board has identified a substantial number of inoperative provisions in the Income Tax Assessment Act 1936 and the Income Tax Assessment Act 1997.

Class Ruling CR 2015/48 Page status: legally binding Page 1 of 9 Class Ruling . Income tax: distributions from the MG Unit Trust . This publication provides you with the following level of protection: This publication (excluding appendixes) is a public ruling for the purposes of the . Taxation Administration Act 1953. A public ruling is an expression of the Commissioner’s opinion about the

was expressed in the same terms as that used in the income tax law e.g., former subsection 82AF(2) of the Income Tax Assessment Act 1936, which applied to exclude from the income tax …

Adjustments under Subdivision 115-C or 207-B of the Income Tax Assessment Act 1997–references in this Act to assessable income under section 97, 98A or 100 95AAC. Adjustments under Subdivision 115-C or 207-B of the Income Tax Assessment Act 1997–references in this Act to liabilities under section 98, 99 or 99A 95AAD .

Division 7A of Part III of the Income Tax Assessment Act 1936. Division 7A was introduced in 1998 to ensure that private companies would no longer be able to make tax-free distributions of profits to shareholders (and their associates) in

under section 27A of the Income Tax Assessment Act 1936 (the ITAA). The payment is subject to pay-roll tax to the extent that it would have constituted income tax assessable income had it been paid directly to the employee irrespective of whether it is paid to the employee or another person or body (including a payment into a roll-over fund). 4. ETP’s paid by employers may include payments for

A critical analysis of Part IVA of the Income Tax Assessment Act 1936 A Critical analysis of Part IVA of the ITA 1936 (23 11 15)/MH/ft Page 2

PDF (Published Version) – Published Version While s 353-10 is the primary provision utilised by the Tax Office to acquire information in relation to a goods and services tax assessment, it is also relevant to the administration of the TAA (including the collection of income tax). In fact, it is the preferred information gathering power of the Tax Office for use in debt collection work

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 – SECT 210.1 Order of events provision The venture capital sub-account of a PDF under former Part IIIAA of the Income Tax Assessment Act 1936 (the old sub-account ) is closed off at the end of 30 June 2002 and an opening balance is created in the PDF’s venture capital sub-account

INCOME TAX (MANAGEMENT) ACT. Act No. 41, 1936. An Act to provide for the assessment and collec tion of a tax on incomes; to amend the Income Tax (Management) Act, 1912, the

8 As indicated by the words ‘dominant purpose’ in section 177A of the Income Tax Assessment Act 1936 (Cth) in relation to a scheme under section 177D(1) of Income Tax Assessment Act 1936 (Cth) .

income at the corporate tax rate (i.e. 30 per cent). In the case where individual beneficiaries are not presently entitled to the income of a trust, that rate

INCOME TAX ASSESSMENT ACT 1936 – SECT 26BC Securities lending arrangements (1) In this section: convertible by the trustee of a unit trust to the borrower or to a third party in the circumstances covered by section 130-20 of the Income Tax Assessment Act 1997 , then, for the purposes of the application of Parts 3-1 and 3-3 of the Income Tax Assessment Act 1997 to a unit …

Amendments to the Income Tax Assessment Act Treasury.gov.au

Revenue Rulings sro.vic.gov.au

INCOME TAX ASSESSMENT ACT 1936 – SECT 26BC Securities lending arrangements (1) In this section: convertible by the trustee of a unit trust to the borrower or to a third party in the circumstances covered by section 130-20 of the Income Tax Assessment Act 1997 , then, for the purposes of the application of Parts 3-1 and 3-3 of the Income Tax Assessment Act 1997 to a unit …

On 16 December 2010, the Assistant Treasurer announced that the Government would conduct a public consultation process as the first step towards updating the trust income tax provisions in Division 6 of Part III of the Income Tax Assessment Act 1936 and rewriting them into the Income Tax Assessment Act …

Assessment Act 1936 – Second Discussion Paper The Tax Institute welcomes the opportunity to make a submission to the Board of Taxation (Board) in relation to the Second Discussion Paper on the Post Implementation Review of Division 7A of Part III of the Income Tax Assessment Act 1936 (Discussion Paper). Following the post-implementation review of Division 7A begun by the Board in late 2012

Prepared by the Office of Parliamentary Counsel, Canberra Income Tax Assessment Act 1936 No. 27, 1936 as amended Compilation start date: 1 January 2014 Includes amendments up to:

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZU SME income component. Full-year PDFs (1) The SME income component of a year of income of a company that is a PDF throughout the year of income is so much of the company’s taxable income of the year of income as does not exceed the amount (if any) remaining after deducting from the company’s SME

The Income Tax Assessment Act 1936 (colloquially known as ITAA36) is an act of the Parliament of Australia. It is one of the main statutes under which income tax is calculated. The act is gradually being rewritten into the Income Tax Assessment Act 1997 , and new matters are generally now added to the 1997 act.

Income Tax Assessment Act 1936 (ITAA 1936); • section 45C of the ITAA 1936; • section 8-1 of the . Income Tax Assessment Act 1997 (ITAA 1997); • section 70-40 of the ITAA 1997; • section 70-45 of the ITAA 1997; • section 104-10 of the ITAA 1997; • section 109-10 of the ITAA 1997; • section 115-30 of the ITAA 1997; Class Ruling CR 2010/68 Page 2 of 14 Page status: legally binding

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZM Treatment distributions to shareholders in PDF. Unfranked part of distribution exempt from income tax

Division 7A of Part III of the Income Tax Assessment Act 1936. Division 7A was introduced in 1998 to ensure that private companies would no longer be able to make tax-free distributions of profits to shareholders (and their associates) in

The Income Tax Assessment Act 1936 as shown in this compilation comprises Act No. 27, 1936 amended as indicated in the Tables below. The Income Tax Assessment Act 1936 …

TEF001 *TEF001* This election is made under Section 139E of the Income Tax Assessment Act 1936 (“the Act”). An election under section 139E must include:

Class Ruling CR 2015/48 Page status: legally binding Page 1 of 9 Class Ruling . Income tax: distributions from the MG Unit Trust . This publication provides you with the following level of protection: This publication (excluding appendixes) is a public ruling for the purposes of the . Taxation Administration Act 1953. A public ruling is an expression of the Commissioner’s opinion about the

Treasurer following its review of 7A of Part III of the Division Income Tax Assessment Act 1936 . The Board has concluded that the reform of Division 7A should be guided by a policy

Income Tax Assessment Act 1936 AJML Group Home

[81] Rebate income is defined as the sum of a person’s taxable income, reportable superannuation contributions, total net investment loss and adjusted fringe benefits total for the year of income: Income Tax Assessment Act 1936 (Cth) s 6.

Moore Stephens Submission to the Post-Implementation

Class Ruling suncorpgroup.com.au

in subsection 160ZZI(3) of the Income Tax Assessment Act 1936? This Determination, to the extent that it is capable of being a ‘public ruling’ in terms of Part IVAAA of the Taxation Administration Act 1953

TaxTalk Monthly PwC Australia

1936 (ITAA 1936) and the Income Tax Assessment Act 1997 (ITAA 1997) could be rationalised to reduce the volume of tax legislation and improve its ease of use for taxpayers, their advisers and those involved in tax

Glossary Treasury

INCOME TAX ASSESSMENT ACT 1936 SECT 124ZO Shares in a

References in this paper to the Tax Acts are references to the Income Tax Assessment Act 1997 (Cth) ( ITAA 1997 ), Tax Administration Act 1953 ( TAA ) and/or Income Tax Assessment Act 1936 (Cth) ( ITAA 1936 ), as applicable.

Income Tax Assessment Act 1936 (Cth)

Consultation Paper – PDF 985KB The purpose of this paper is to seek stakeholder views on the Government’s proposed implementation of the amendments to Division 7A of the Income Tax Assessment Act 1936 .

LAND AND INCOME TAX ASSESSMENT. legislation.wa.gov.au

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZTA Taxable income in first year as PDF if PDF component is nil (1) This section applies if:

THE EFFECTIVENESS OF PART IVA OF THE INCOME TAX ASSESSMENT

INCOME TAX ASSESSMENT ACT 1936 – SECT 124ZTA Taxable income in first year as PDF if PDF component is nil (1) This section applies if:

TAX LAWS AMENDMENT (REPEAL OF INOPERATIVE PROVISIONS) BILL