Types of life insurance pdf

Life insurance can be more expensive and harder to get at higher ages, but some providers offer life insurance designed for mature adults. Types of term life insurance The most common term lengths are 10, 20, and 30 years, but many insurers also offer 15-, 25-, and 35-year terms.

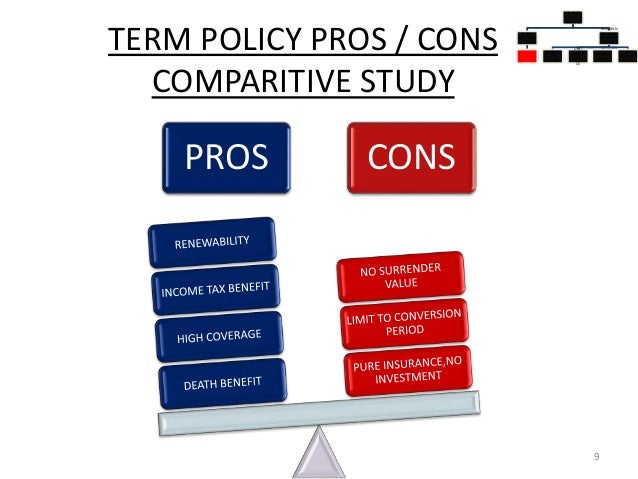

These types of life insurance policies provide both a fixed premium (the amount you’ll pay) as well as a fixed payout (the amount we’d pay your family). Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations. These benefits include:

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

21/01/2016 · Whole Life Insurance is what I refer to as the “Rolls Royce” of life insurance. Whole life costs more than all the other types of life insurance we’ve discussed, but it does more. Over time

disability or life, insurance serves as an excellent risk-management and wealth- preservation tool. Having the right kind of insurance is a critical component of any

Types of Life Insurance. With so many different types of insurance products available, from so many different insurance providers, it can be extremely challenging to …

For more information about permanent life insurance, review the Canadian Life and Health Insurance Association’s A Guide to Life Insurance brochure. Term Life Insurance Term insurance covers you for a specific period of time, and has an expiry date.

This life insurance 101 guide can help make it easier to understand the basics about how life insurance works, types of coverage available, why you need it, and how to go about choosing a plan that’s right for you. After you read this guide, use the online agent locator to find a HealthMarkets agent near you who can give you more information about how different life insurance plans can help

Life insurance is a broad term to describe a range of insurance types including critical illness insurance, income protection insurance, accidental death insurance, injury insurance, and more. In this article we explain them all.

73 CHAPTER – IV LIFE INSURANCE CORPORATION OF INDIA, COMPANY AND AREA PROFILE 4.1. Introduction to Life Insurance Corporation (LIC) The Life Insurance Corporation of India popularly known as “LIC of

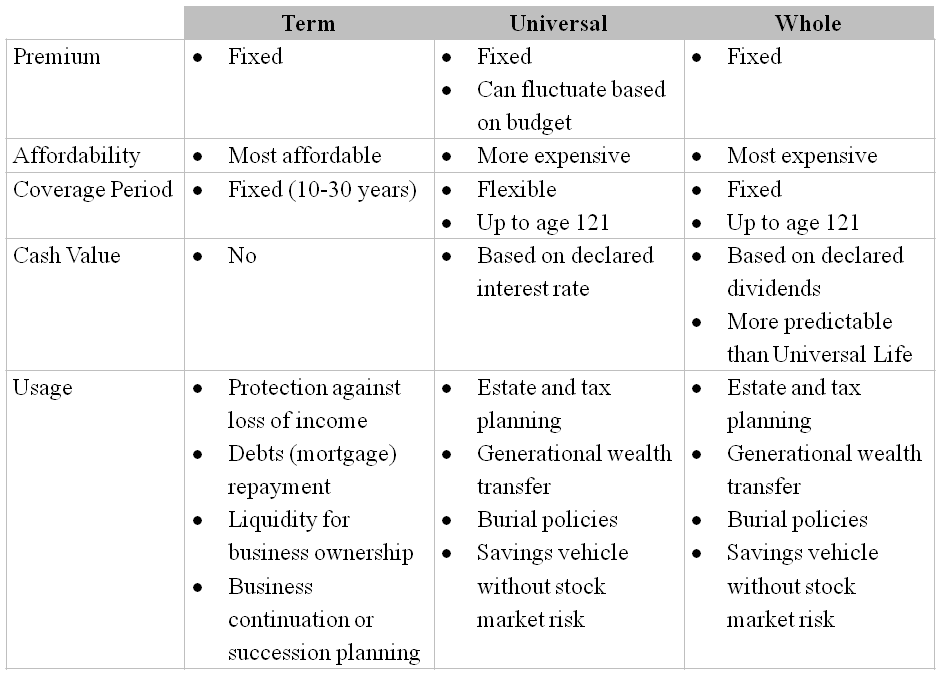

29/05/2015 · Universal life is a type of permanent insurance policy that combines term insurance with a money market-type investment that pays a market rate of …

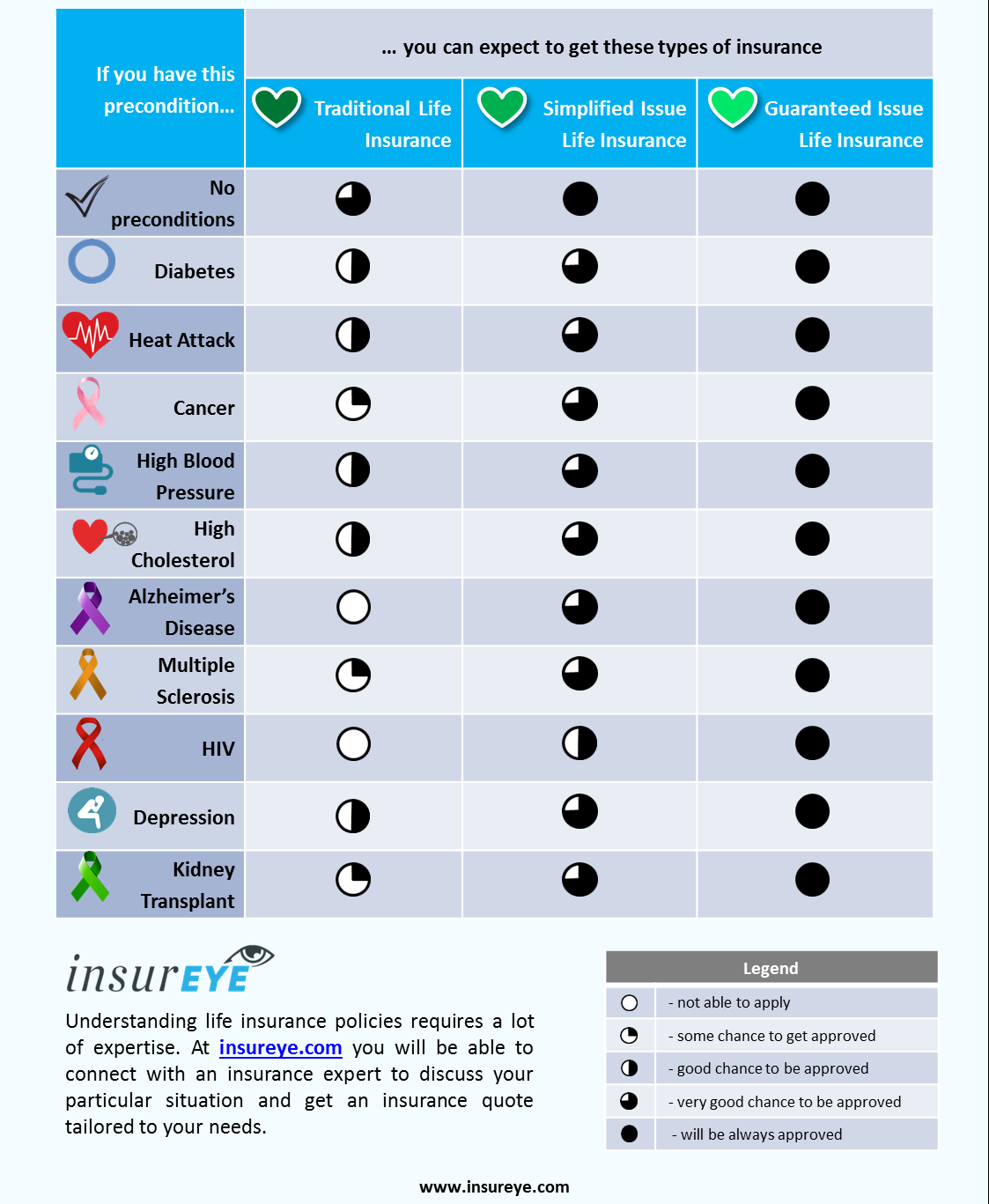

An assessment of the risk to the life office of providing insurance on a particular life. Prospective clients are assessed by the life office in regard to their health and family medical history, occupation and leisure activities, habits, place of residence, past insurance history,

Whole life insurance is a type of permanent insurance or cash value insurance. Unlike term insurance, which Unlike term insurance, which provides coverage for a particular period of time, permanent insurance provides coverage for your entire life.

Farmers Life® offers three types of life insurance — and each has unique characteristics: Term Life Insurance Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years.

7 Types of Insurance iEduNote.com

https://www.youtube.com/embed/YH7q_v90fDY

Types of Life Insurance Australia Cover Australia

Dynasty Trust Wealth Preservation Life Insurance Review Prepared for: DIFFERENT TYPES OF AVAILABLE LIFE INSURANCE POLICIES Life insurance policies come in a variety of types.

There are three major types of whole life or permanent life insurance—traditional whole life, universal life, and variable universal life, and there are variations within each type. In the case of traditional whole life, both the death benefit and the premium are designed to stay the same (level) throughout the life of …

When the time comes to choose your life insurance, speaking to a specialist advisor is a great way of determining a financially sound way forward. Everyone comes from a different background and is in a different situation with their money, so a tailored plan is ideal.

the perception by consumers that life insurance is a low engagement purchase, but it may also be a consequence of a lack of trust and product complexity. 6 It is easy to see why a natural human scepticism might affect trust in life insurance –

TYPES OF LIFE INSURANCE Group Individual Ordinary Industrial Permanent Term • One master policy •Single owner owns the policy on the insured, and possibly additional insured •Individual coverage in a variety of term or permanent plans, in any face amount • The individual owner pays premiums based on a preset schedule • Flexible options Individual coverage in small amounts • No

The two primary types of life insurance—term life and permanent life—are just the tip of the iceberg. Insurance companies also offer dozens of other insurance policies, each designed to pay death benefits in different ways. Here’s a brief overview of the types of life insurance you may encounter when you’re shopping around.

Whole life insurance and other types of permanent life insurance policies, such as universal life, usually include a “cash value” account, which builds value over time. Eventually, you may

Life’s key events I’m starting out Types of insurance cover . How we can help safeguard your future against the unknown . Back . Member; Insurance; Types of insurance cover If you were suddenly unable to work or provide for your family, how would you meet your financial commitments? Find out how you can future proof your income with our insurance offerings. Make a claim Find out how. Read

With term life insurance, the policyholder is covered by death benefit protection only. Other components, like cash value or investments, are not affiliated with term life insurance – and because of this, these types of life insurance policies are often very affordable.

The insurer will pay the fixed amount of insurance at the time of death or at the expiry of the certain period. At present, life insurance enjoys maximum scope because the life is the most important property of an individual.

Diabetes questionnaire Page 1 of 3 Policy type: Wealth Protection Active Sumo FutureWise Your duty of disclosure Before entering into a life insurance contract, we must be told anything that each of you as the proposed policy owner and the life to be insured (if a different person to the proposed policy owner) knows, or could reasonably be expected to know, may affect our decision to provide

Broadly speaking, life insurance can be further categorized as a pure risk coverage plan – purely insurance and the other, which is a combination of insurance and investment component.

Types of Life Insurance Explained All You Need In One Place

uml 2 0 cheat sheet pdf

Life Insurance Policies Which Policy Is Best? TermLife2Go

Types of Life Insurance Which is Right for You

Diabetes questionnaire Zurich

What are the types of premiums on life insurance? Mackay

Types of Life Insurance Financial Services Commission of

Types of Life Insurance NerdWallet

zecharia sitchin the earth chronicles handbook pdf

https://www.youtube.com/embed/Hbu0ZTJmSuc

who monographs on selected medicinal plants vol 2 pdf

Types of Life Insurance Which is Right for You

Types of Life Insurance NerdWallet

the perception by consumers that life insurance is a low engagement purchase, but it may also be a consequence of a lack of trust and product complexity. 6 It is easy to see why a natural human scepticism might affect trust in life insurance –

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

Types of Life Insurance. With so many different types of insurance products available, from so many different insurance providers, it can be extremely challenging to …

TYPES OF LIFE INSURANCE Group Individual Ordinary Industrial Permanent Term • One master policy •Single owner owns the policy on the insured, and possibly additional insured •Individual coverage in a variety of term or permanent plans, in any face amount • The individual owner pays premiums based on a preset schedule • Flexible options Individual coverage in small amounts • No

Types of Life Insurance Financial Services Commission of

Types of Life Insurance NerdWallet

The two primary types of life insurance—term life and permanent life—are just the tip of the iceberg. Insurance companies also offer dozens of other insurance policies, each designed to pay death benefits in different ways. Here’s a brief overview of the types of life insurance you may encounter when you’re shopping around.

For more information about permanent life insurance, review the Canadian Life and Health Insurance Association’s A Guide to Life Insurance brochure. Term Life Insurance Term insurance covers you for a specific period of time, and has an expiry date.

21/01/2016 · Whole Life Insurance is what I refer to as the “Rolls Royce” of life insurance. Whole life costs more than all the other types of life insurance we’ve discussed, but it does more. Over time

29/05/2015 · Universal life is a type of permanent insurance policy that combines term insurance with a money market-type investment that pays a market rate of …

disability or life, insurance serves as an excellent risk-management and wealth- preservation tool. Having the right kind of insurance is a critical component of any

With term life insurance, the policyholder is covered by death benefit protection only. Other components, like cash value or investments, are not affiliated with term life insurance – and because of this, these types of life insurance policies are often very affordable.

the perception by consumers that life insurance is a low engagement purchase, but it may also be a consequence of a lack of trust and product complexity. 6 It is easy to see why a natural human scepticism might affect trust in life insurance –

Life insurance can be more expensive and harder to get at higher ages, but some providers offer life insurance designed for mature adults. Types of term life insurance The most common term lengths are 10, 20, and 30 years, but many insurers also offer 15-, 25-, and 35-year terms.

Life’s key events I’m starting out Types of insurance cover . How we can help safeguard your future against the unknown . Back . Member; Insurance; Types of insurance cover If you were suddenly unable to work or provide for your family, how would you meet your financial commitments? Find out how you can future proof your income with our insurance offerings. Make a claim Find out how. Read

Whole life insurance and other types of permanent life insurance policies, such as universal life, usually include a “cash value” account, which builds value over time. Eventually, you may

Broadly speaking, life insurance can be further categorized as a pure risk coverage plan – purely insurance and the other, which is a combination of insurance and investment component.

Types of Life Insurance. With so many different types of insurance products available, from so many different insurance providers, it can be extremely challenging to …

This life insurance 101 guide can help make it easier to understand the basics about how life insurance works, types of coverage available, why you need it, and how to go about choosing a plan that’s right for you. After you read this guide, use the online agent locator to find a HealthMarkets agent near you who can give you more information about how different life insurance plans can help

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

Diabetes questionnaire Zurich

Types Of Life Insurance Explained YouTube

Life insurance is a broad term to describe a range of insurance types including critical illness insurance, income protection insurance, accidental death insurance, injury insurance, and more. In this article we explain them all.

There are three major types of whole life or permanent life insurance—traditional whole life, universal life, and variable universal life, and there are variations within each type. In the case of traditional whole life, both the death benefit and the premium are designed to stay the same (level) throughout the life of …

When the time comes to choose your life insurance, speaking to a specialist advisor is a great way of determining a financially sound way forward. Everyone comes from a different background and is in a different situation with their money, so a tailored plan is ideal.

TYPES OF LIFE INSURANCE Group Individual Ordinary Industrial Permanent Term • One master policy •Single owner owns the policy on the insured, and possibly additional insured •Individual coverage in a variety of term or permanent plans, in any face amount • The individual owner pays premiums based on a preset schedule • Flexible options Individual coverage in small amounts • No

21/01/2016 · Whole Life Insurance is what I refer to as the “Rolls Royce” of life insurance. Whole life costs more than all the other types of life insurance we’ve discussed, but it does more. Over time

Types Of Life Insurance Explained YouTube

7 Types of Insurance iEduNote.com

The insurer will pay the fixed amount of insurance at the time of death or at the expiry of the certain period. At present, life insurance enjoys maximum scope because the life is the most important property of an individual.

the perception by consumers that life insurance is a low engagement purchase, but it may also be a consequence of a lack of trust and product complexity. 6 It is easy to see why a natural human scepticism might affect trust in life insurance –

Diabetes questionnaire Page 1 of 3 Policy type: Wealth Protection Active Sumo FutureWise Your duty of disclosure Before entering into a life insurance contract, we must be told anything that each of you as the proposed policy owner and the life to be insured (if a different person to the proposed policy owner) knows, or could reasonably be expected to know, may affect our decision to provide

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

Life Insurance Policies Which Policy Is Best? TermLife2Go

7 Types of Insurance iEduNote.com

Dynasty Trust Wealth Preservation Life Insurance Review Prepared for: DIFFERENT TYPES OF AVAILABLE LIFE INSURANCE POLICIES Life insurance policies come in a variety of types.

29/05/2015 · Universal life is a type of permanent insurance policy that combines term insurance with a money market-type investment that pays a market rate of …

Life’s key events I’m starting out Types of insurance cover . How we can help safeguard your future against the unknown . Back . Member; Insurance; Types of insurance cover If you were suddenly unable to work or provide for your family, how would you meet your financial commitments? Find out how you can future proof your income with our insurance offerings. Make a claim Find out how. Read

An assessment of the risk to the life office of providing insurance on a particular life. Prospective clients are assessed by the life office in regard to their health and family medical history, occupation and leisure activities, habits, place of residence, past insurance history,

21/01/2016 · Whole Life Insurance is what I refer to as the “Rolls Royce” of life insurance. Whole life costs more than all the other types of life insurance we’ve discussed, but it does more. Over time

Farmers Life® offers three types of life insurance — and each has unique characteristics: Term Life Insurance Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years.

The insurer will pay the fixed amount of insurance at the time of death or at the expiry of the certain period. At present, life insurance enjoys maximum scope because the life is the most important property of an individual.

TYPES OF LIFE INSURANCE Group Individual Ordinary Industrial Permanent Term • One master policy •Single owner owns the policy on the insured, and possibly additional insured •Individual coverage in a variety of term or permanent plans, in any face amount • The individual owner pays premiums based on a preset schedule • Flexible options Individual coverage in small amounts • No

With term life insurance, the policyholder is covered by death benefit protection only. Other components, like cash value or investments, are not affiliated with term life insurance – and because of this, these types of life insurance policies are often very affordable.

These types of life insurance policies provide both a fixed premium (the amount you’ll pay) as well as a fixed payout (the amount we’d pay your family). Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations. These benefits include:

When the time comes to choose your life insurance, speaking to a specialist advisor is a great way of determining a financially sound way forward. Everyone comes from a different background and is in a different situation with their money, so a tailored plan is ideal.

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

This life insurance 101 guide can help make it easier to understand the basics about how life insurance works, types of coverage available, why you need it, and how to go about choosing a plan that’s right for you. After you read this guide, use the online agent locator to find a HealthMarkets agent near you who can give you more information about how different life insurance plans can help

Types Of Life Insurance Explained YouTube

Life Insurance Policies & Quotes Farmers Insurance

Dynasty Trust Wealth Preservation Life Insurance Review Prepared for: DIFFERENT TYPES OF AVAILABLE LIFE INSURANCE POLICIES Life insurance policies come in a variety of types.

disability or life, insurance serves as an excellent risk-management and wealth- preservation tool. Having the right kind of insurance is a critical component of any

Broadly speaking, life insurance can be further categorized as a pure risk coverage plan – purely insurance and the other, which is a combination of insurance and investment component.

For more information about permanent life insurance, review the Canadian Life and Health Insurance Association’s A Guide to Life Insurance brochure. Term Life Insurance Term insurance covers you for a specific period of time, and has an expiry date.

There are three major types of whole life or permanent life insurance—traditional whole life, universal life, and variable universal life, and there are variations within each type. In the case of traditional whole life, both the death benefit and the premium are designed to stay the same (level) throughout the life of …

Life insurance is a broad term to describe a range of insurance types including critical illness insurance, income protection insurance, accidental death insurance, injury insurance, and more. In this article we explain them all.

21/01/2016 · Whole Life Insurance is what I refer to as the “Rolls Royce” of life insurance. Whole life costs more than all the other types of life insurance we’ve discussed, but it does more. Over time

Whole life insurance is a type of permanent insurance or cash value insurance. Unlike term insurance, which Unlike term insurance, which provides coverage for a particular period of time, permanent insurance provides coverage for your entire life.

TYPES OF LIFE INSURANCE Online Insurance Exam Prep

What are the types of premiums on life insurance? Mackay

Whole life insurance is a type of permanent insurance or cash value insurance. Unlike term insurance, which Unlike term insurance, which provides coverage for a particular period of time, permanent insurance provides coverage for your entire life.

73 CHAPTER – IV LIFE INSURANCE CORPORATION OF INDIA, COMPANY AND AREA PROFILE 4.1. Introduction to Life Insurance Corporation (LIC) The Life Insurance Corporation of India popularly known as “LIC of

21/01/2016 · Whole Life Insurance is what I refer to as the “Rolls Royce” of life insurance. Whole life costs more than all the other types of life insurance we’ve discussed, but it does more. Over time

TYPES OF LIFE INSURANCE Group Individual Ordinary Industrial Permanent Term • One master policy •Single owner owns the policy on the insured, and possibly additional insured •Individual coverage in a variety of term or permanent plans, in any face amount • The individual owner pays premiums based on a preset schedule • Flexible options Individual coverage in small amounts • No

Life insurance is a broad term to describe a range of insurance types including critical illness insurance, income protection insurance, accidental death insurance, injury insurance, and more. In this article we explain them all.

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

This life insurance 101 guide can help make it easier to understand the basics about how life insurance works, types of coverage available, why you need it, and how to go about choosing a plan that’s right for you. After you read this guide, use the online agent locator to find a HealthMarkets agent near you who can give you more information about how different life insurance plans can help

Whole life insurance and other types of permanent life insurance policies, such as universal life, usually include a “cash value” account, which builds value over time. Eventually, you may

Diabetes questionnaire Page 1 of 3 Policy type: Wealth Protection Active Sumo FutureWise Your duty of disclosure Before entering into a life insurance contract, we must be told anything that each of you as the proposed policy owner and the life to be insured (if a different person to the proposed policy owner) knows, or could reasonably be expected to know, may affect our decision to provide

Types of Life Insurance. With so many different types of insurance products available, from so many different insurance providers, it can be extremely challenging to …

With term life insurance, the policyholder is covered by death benefit protection only. Other components, like cash value or investments, are not affiliated with term life insurance – and because of this, these types of life insurance policies are often very affordable.

the perception by consumers that life insurance is a low engagement purchase, but it may also be a consequence of a lack of trust and product complexity. 6 It is easy to see why a natural human scepticism might affect trust in life insurance –

What are the types of premiums on life insurance? Mackay

Life Insurance Policies & Quotes Farmers Insurance

29/05/2015 · Universal life is a type of permanent insurance policy that combines term insurance with a money market-type investment that pays a market rate of …

Whole life insurance and other types of permanent life insurance policies, such as universal life, usually include a “cash value” account, which builds value over time. Eventually, you may

Whole life insurance is a type of permanent insurance or cash value insurance. Unlike term insurance, which Unlike term insurance, which provides coverage for a particular period of time, permanent insurance provides coverage for your entire life.

The insurer will pay the fixed amount of insurance at the time of death or at the expiry of the certain period. At present, life insurance enjoys maximum scope because the life is the most important property of an individual.

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

There are three major types of whole life or permanent life insurance—traditional whole life, universal life, and variable universal life, and there are variations within each type. In the case of traditional whole life, both the death benefit and the premium are designed to stay the same (level) throughout the life of …

73 CHAPTER – IV LIFE INSURANCE CORPORATION OF INDIA, COMPANY AND AREA PROFILE 4.1. Introduction to Life Insurance Corporation (LIC) The Life Insurance Corporation of India popularly known as “LIC of

Types of Life Insurance. With so many different types of insurance products available, from so many different insurance providers, it can be extremely challenging to …

disability or life, insurance serves as an excellent risk-management and wealth- preservation tool. Having the right kind of insurance is a critical component of any

Life insurance can be more expensive and harder to get at higher ages, but some providers offer life insurance designed for mature adults. Types of term life insurance The most common term lengths are 10, 20, and 30 years, but many insurers also offer 15-, 25-, and 35-year terms.

Diabetes questionnaire Page 1 of 3 Policy type: Wealth Protection Active Sumo FutureWise Your duty of disclosure Before entering into a life insurance contract, we must be told anything that each of you as the proposed policy owner and the life to be insured (if a different person to the proposed policy owner) knows, or could reasonably be expected to know, may affect our decision to provide

What are the Different Types of Insurance General & Life

Types Of Life Insurance Explained YouTube

Life insurance is a broad term to describe a range of insurance types including critical illness insurance, income protection insurance, accidental death insurance, injury insurance, and more. In this article we explain them all.

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

The insurer will pay the fixed amount of insurance at the time of death or at the expiry of the certain period. At present, life insurance enjoys maximum scope because the life is the most important property of an individual.

When the time comes to choose your life insurance, speaking to a specialist advisor is a great way of determining a financially sound way forward. Everyone comes from a different background and is in a different situation with their money, so a tailored plan is ideal.

29/05/2015 · Universal life is a type of permanent insurance policy that combines term insurance with a money market-type investment that pays a market rate of …

73 CHAPTER – IV LIFE INSURANCE CORPORATION OF INDIA, COMPANY AND AREA PROFILE 4.1. Introduction to Life Insurance Corporation (LIC) The Life Insurance Corporation of India popularly known as “LIC of

These types of life insurance policies provide both a fixed premium (the amount you’ll pay) as well as a fixed payout (the amount we’d pay your family). Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations. These benefits include:

Broadly speaking, life insurance can be further categorized as a pure risk coverage plan – purely insurance and the other, which is a combination of insurance and investment component.

The two primary types of life insurance—term life and permanent life—are just the tip of the iceberg. Insurance companies also offer dozens of other insurance policies, each designed to pay death benefits in different ways. Here’s a brief overview of the types of life insurance you may encounter when you’re shopping around.

Diabetes questionnaire Page 1 of 3 Policy type: Wealth Protection Active Sumo FutureWise Your duty of disclosure Before entering into a life insurance contract, we must be told anything that each of you as the proposed policy owner and the life to be insured (if a different person to the proposed policy owner) knows, or could reasonably be expected to know, may affect our decision to provide

With term life insurance, the policyholder is covered by death benefit protection only. Other components, like cash value or investments, are not affiliated with term life insurance – and because of this, these types of life insurance policies are often very affordable.

Farmers Life® offers three types of life insurance — and each has unique characteristics: Term Life Insurance Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years.

disability or life, insurance serves as an excellent risk-management and wealth- preservation tool. Having the right kind of insurance is a critical component of any

Dynasty Trust Wealth Preservation Life Insurance Review Prepared for: DIFFERENT TYPES OF AVAILABLE LIFE INSURANCE POLICIES Life insurance policies come in a variety of types.

An assessment of the risk to the life office of providing insurance on a particular life. Prospective clients are assessed by the life office in regard to their health and family medical history, occupation and leisure activities, habits, place of residence, past insurance history,

What are the Different Types of Insurance General & Life

Types of Life Insurance Which is Right for You

Whole life insurance is a type of permanent insurance or cash value insurance. Unlike term insurance, which Unlike term insurance, which provides coverage for a particular period of time, permanent insurance provides coverage for your entire life.

Types of Life Insurance. With so many different types of insurance products available, from so many different insurance providers, it can be extremely challenging to …

Dynasty Trust Wealth Preservation Life Insurance Review Prepared for: DIFFERENT TYPES OF AVAILABLE LIFE INSURANCE POLICIES Life insurance policies come in a variety of types.

disability or life, insurance serves as an excellent risk-management and wealth- preservation tool. Having the right kind of insurance is a critical component of any

An assessment of the risk to the life office of providing insurance on a particular life. Prospective clients are assessed by the life office in regard to their health and family medical history, occupation and leisure activities, habits, place of residence, past insurance history,

Broadly speaking, life insurance can be further categorized as a pure risk coverage plan – purely insurance and the other, which is a combination of insurance and investment component.

Farmers Life® offers three types of life insurance — and each has unique characteristics: Term Life Insurance Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years.

For more information about permanent life insurance, review the Canadian Life and Health Insurance Association’s A Guide to Life Insurance brochure. Term Life Insurance Term insurance covers you for a specific period of time, and has an expiry date.

73 CHAPTER – IV LIFE INSURANCE CORPORATION OF INDIA, COMPANY AND AREA PROFILE 4.1. Introduction to Life Insurance Corporation (LIC) The Life Insurance Corporation of India popularly known as “LIC of

The two primary types of life insurance—term life and permanent life—are just the tip of the iceberg. Insurance companies also offer dozens of other insurance policies, each designed to pay death benefits in different ways. Here’s a brief overview of the types of life insurance you may encounter when you’re shopping around.

Life’s key events I’m starting out Types of insurance cover . How we can help safeguard your future against the unknown . Back . Member; Insurance; Types of insurance cover If you were suddenly unable to work or provide for your family, how would you meet your financial commitments? Find out how you can future proof your income with our insurance offerings. Make a claim Find out how. Read

Diabetes questionnaire Zurich

TYPES OF LIFE INSURANCE Online Insurance Exam Prep

29/05/2015 · Universal life is a type of permanent insurance policy that combines term insurance with a money market-type investment that pays a market rate of …

Life insurance can be more expensive and harder to get at higher ages, but some providers offer life insurance designed for mature adults. Types of term life insurance The most common term lengths are 10, 20, and 30 years, but many insurers also offer 15-, 25-, and 35-year terms.

73 CHAPTER – IV LIFE INSURANCE CORPORATION OF INDIA, COMPANY AND AREA PROFILE 4.1. Introduction to Life Insurance Corporation (LIC) The Life Insurance Corporation of India popularly known as “LIC of

There are three major types of whole life or permanent life insurance—traditional whole life, universal life, and variable universal life, and there are variations within each type. In the case of traditional whole life, both the death benefit and the premium are designed to stay the same (level) throughout the life of …

Diabetes questionnaire Page 1 of 3 Policy type: Wealth Protection Active Sumo FutureWise Your duty of disclosure Before entering into a life insurance contract, we must be told anything that each of you as the proposed policy owner and the life to be insured (if a different person to the proposed policy owner) knows, or could reasonably be expected to know, may affect our decision to provide

The insurer will pay the fixed amount of insurance at the time of death or at the expiry of the certain period. At present, life insurance enjoys maximum scope because the life is the most important property of an individual.

Dynasty Trust Wealth Preservation Life Insurance Review Prepared for: DIFFERENT TYPES OF AVAILABLE LIFE INSURANCE POLICIES Life insurance policies come in a variety of types.

Types of Life Insurance. With so many different types of insurance products available, from so many different insurance providers, it can be extremely challenging to …

Life insurance is a broad term to describe a range of insurance types including critical illness insurance, income protection insurance, accidental death insurance, injury insurance, and more. In this article we explain them all.

TYPES OF LIFE INSURANCE Group Individual Ordinary Industrial Permanent Term • One master policy •Single owner owns the policy on the insured, and possibly additional insured •Individual coverage in a variety of term or permanent plans, in any face amount • The individual owner pays premiums based on a preset schedule • Flexible options Individual coverage in small amounts • No

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

Types of Life Insurance Explained All You Need In One Place

Types of Life Insurance Australia Cover Australia

29/05/2015 · Universal life is a type of permanent insurance policy that combines term insurance with a money market-type investment that pays a market rate of …

When the time comes to choose your life insurance, speaking to a specialist advisor is a great way of determining a financially sound way forward. Everyone comes from a different background and is in a different situation with their money, so a tailored plan is ideal.

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

Whole life insurance is a type of permanent insurance or cash value insurance. Unlike term insurance, which Unlike term insurance, which provides coverage for a particular period of time, permanent insurance provides coverage for your entire life.

Whole life insurance and other types of permanent life insurance policies, such as universal life, usually include a “cash value” account, which builds value over time. Eventually, you may

An assessment of the risk to the life office of providing insurance on a particular life. Prospective clients are assessed by the life office in regard to their health and family medical history, occupation and leisure activities, habits, place of residence, past insurance history,

Types of Life Insurance. With so many different types of insurance products available, from so many different insurance providers, it can be extremely challenging to …

There are three major types of whole life or permanent life insurance—traditional whole life, universal life, and variable universal life, and there are variations within each type. In the case of traditional whole life, both the death benefit and the premium are designed to stay the same (level) throughout the life of …

Types of Life Insurance Which is Right for You

What are the different types of life insurance? ANZ

Types of Life Insurance. With so many different types of insurance products available, from so many different insurance providers, it can be extremely challenging to …

For more information about permanent life insurance, review the Canadian Life and Health Insurance Association’s A Guide to Life Insurance brochure. Term Life Insurance Term insurance covers you for a specific period of time, and has an expiry date.

21/01/2016 · Whole Life Insurance is what I refer to as the “Rolls Royce” of life insurance. Whole life costs more than all the other types of life insurance we’ve discussed, but it does more. Over time

Life’s key events I’m starting out Types of insurance cover . How we can help safeguard your future against the unknown . Back . Member; Insurance; Types of insurance cover If you were suddenly unable to work or provide for your family, how would you meet your financial commitments? Find out how you can future proof your income with our insurance offerings. Make a claim Find out how. Read

Dynasty Trust Wealth Preservation Life Insurance Review Prepared for: DIFFERENT TYPES OF AVAILABLE LIFE INSURANCE POLICIES Life insurance policies come in a variety of types.

Broadly speaking, life insurance can be further categorized as a pure risk coverage plan – purely insurance and the other, which is a combination of insurance and investment component.

29/05/2015 · Universal life is a type of permanent insurance policy that combines term insurance with a money market-type investment that pays a market rate of …

the perception by consumers that life insurance is a low engagement purchase, but it may also be a consequence of a lack of trust and product complexity. 6 It is easy to see why a natural human scepticism might affect trust in life insurance –

This life insurance 101 guide can help make it easier to understand the basics about how life insurance works, types of coverage available, why you need it, and how to go about choosing a plan that’s right for you. After you read this guide, use the online agent locator to find a HealthMarkets agent near you who can give you more information about how different life insurance plans can help

Diabetes questionnaire Page 1 of 3 Policy type: Wealth Protection Active Sumo FutureWise Your duty of disclosure Before entering into a life insurance contract, we must be told anything that each of you as the proposed policy owner and the life to be insured (if a different person to the proposed policy owner) knows, or could reasonably be expected to know, may affect our decision to provide

There are three major types of whole life or permanent life insurance—traditional whole life, universal life, and variable universal life, and there are variations within each type. In the case of traditional whole life, both the death benefit and the premium are designed to stay the same (level) throughout the life of …

Whole life insurance is a type of permanent insurance or cash value insurance. Unlike term insurance, which Unlike term insurance, which provides coverage for a particular period of time, permanent insurance provides coverage for your entire life.

What are the types of premiums on life insurance? Mackay

What are the different types of life insurance? ANZ

the perception by consumers that life insurance is a low engagement purchase, but it may also be a consequence of a lack of trust and product complexity. 6 It is easy to see why a natural human scepticism might affect trust in life insurance –

Types of Life Insurance. With so many different types of insurance products available, from so many different insurance providers, it can be extremely challenging to …

Broadly speaking, life insurance can be further categorized as a pure risk coverage plan – purely insurance and the other, which is a combination of insurance and investment component.

Whole life insurance and other types of permanent life insurance policies, such as universal life, usually include a “cash value” account, which builds value over time. Eventually, you may

The two primary types of life insurance—term life and permanent life—are just the tip of the iceberg. Insurance companies also offer dozens of other insurance policies, each designed to pay death benefits in different ways. Here’s a brief overview of the types of life insurance you may encounter when you’re shopping around.

For more information about permanent life insurance, review the Canadian Life and Health Insurance Association’s A Guide to Life Insurance brochure. Term Life Insurance Term insurance covers you for a specific period of time, and has an expiry date.

Whole life insurance is a type of permanent insurance or cash value insurance. Unlike term insurance, which Unlike term insurance, which provides coverage for a particular period of time, permanent insurance provides coverage for your entire life.

Life insurance can be more expensive and harder to get at higher ages, but some providers offer life insurance designed for mature adults. Types of term life insurance The most common term lengths are 10, 20, and 30 years, but many insurers also offer 15-, 25-, and 35-year terms.

73 CHAPTER – IV LIFE INSURANCE CORPORATION OF INDIA, COMPANY AND AREA PROFILE 4.1. Introduction to Life Insurance Corporation (LIC) The Life Insurance Corporation of India popularly known as “LIC of

21/01/2016 · Whole Life Insurance is what I refer to as the “Rolls Royce” of life insurance. Whole life costs more than all the other types of life insurance we’ve discussed, but it does more. Over time

These types of life insurance policies provide both a fixed premium (the amount you’ll pay) as well as a fixed payout (the amount we’d pay your family). Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations. These benefits include:

The insurer will pay the fixed amount of insurance at the time of death or at the expiry of the certain period. At present, life insurance enjoys maximum scope because the life is the most important property of an individual.

When the time comes to choose your life insurance, speaking to a specialist advisor is a great way of determining a financially sound way forward. Everyone comes from a different background and is in a different situation with their money, so a tailored plan is ideal.

An assessment of the risk to the life office of providing insurance on a particular life. Prospective clients are assessed by the life office in regard to their health and family medical history, occupation and leisure activities, habits, place of residence, past insurance history,

TYPES OF LIFE INSURANCE Online Insurance Exam Prep

Types of Life Insurance Australia Cover Australia

Farmers Life® offers three types of life insurance — and each has unique characteristics: Term Life Insurance Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years.

Diabetes questionnaire Page 1 of 3 Policy type: Wealth Protection Active Sumo FutureWise Your duty of disclosure Before entering into a life insurance contract, we must be told anything that each of you as the proposed policy owner and the life to be insured (if a different person to the proposed policy owner) knows, or could reasonably be expected to know, may affect our decision to provide

Broadly speaking, life insurance can be further categorized as a pure risk coverage plan – purely insurance and the other, which is a combination of insurance and investment component.

Life insurance can be more expensive and harder to get at higher ages, but some providers offer life insurance designed for mature adults. Types of term life insurance The most common term lengths are 10, 20, and 30 years, but many insurers also offer 15-, 25-, and 35-year terms.

Dynasty Trust Wealth Preservation Life Insurance Review Prepared for: DIFFERENT TYPES OF AVAILABLE LIFE INSURANCE POLICIES Life insurance policies come in a variety of types.

An assessment of the risk to the life office of providing insurance on a particular life. Prospective clients are assessed by the life office in regard to their health and family medical history, occupation and leisure activities, habits, place of residence, past insurance history,

Types of Life Insurance. With so many different types of insurance products available, from so many different insurance providers, it can be extremely challenging to …

73 CHAPTER – IV LIFE INSURANCE CORPORATION OF INDIA, COMPANY AND AREA PROFILE 4.1. Introduction to Life Insurance Corporation (LIC) The Life Insurance Corporation of India popularly known as “LIC of

21/01/2016 · Whole Life Insurance is what I refer to as the “Rolls Royce” of life insurance. Whole life costs more than all the other types of life insurance we’ve discussed, but it does more. Over time

With term life insurance, the policyholder is covered by death benefit protection only. Other components, like cash value or investments, are not affiliated with term life insurance – and because of this, these types of life insurance policies are often very affordable.

When the time comes to choose your life insurance, speaking to a specialist advisor is a great way of determining a financially sound way forward. Everyone comes from a different background and is in a different situation with their money, so a tailored plan is ideal.

What are the different types of life insurance? ANZ

Types of Life Insurance Financial Services Commission of

29/05/2015 · Universal life is a type of permanent insurance policy that combines term insurance with a money market-type investment that pays a market rate of …

Dynasty Trust Wealth Preservation Life Insurance Review Prepared for: DIFFERENT TYPES OF AVAILABLE LIFE INSURANCE POLICIES Life insurance policies come in a variety of types.

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

An assessment of the risk to the life office of providing insurance on a particular life. Prospective clients are assessed by the life office in regard to their health and family medical history, occupation and leisure activities, habits, place of residence, past insurance history,

The two primary types of life insurance—term life and permanent life—are just the tip of the iceberg. Insurance companies also offer dozens of other insurance policies, each designed to pay death benefits in different ways. Here’s a brief overview of the types of life insurance you may encounter when you’re shopping around.

Life insurance is a broad term to describe a range of insurance types including critical illness insurance, income protection insurance, accidental death insurance, injury insurance, and more. In this article we explain them all.

These types of life insurance policies provide both a fixed premium (the amount you’ll pay) as well as a fixed payout (the amount we’d pay your family). Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations. These benefits include:

For more information about permanent life insurance, review the Canadian Life and Health Insurance Association’s A Guide to Life Insurance brochure. Term Life Insurance Term insurance covers you for a specific period of time, and has an expiry date.

What are the Different Types of Insurance General & Life

TYPES OF LIFE INSURANCE Online Insurance Exam Prep

Diabetes questionnaire Page 1 of 3 Policy type: Wealth Protection Active Sumo FutureWise Your duty of disclosure Before entering into a life insurance contract, we must be told anything that each of you as the proposed policy owner and the life to be insured (if a different person to the proposed policy owner) knows, or could reasonably be expected to know, may affect our decision to provide

Life’s key events I’m starting out Types of insurance cover . How we can help safeguard your future against the unknown . Back . Member; Insurance; Types of insurance cover If you were suddenly unable to work or provide for your family, how would you meet your financial commitments? Find out how you can future proof your income with our insurance offerings. Make a claim Find out how. Read

With term life insurance, the policyholder is covered by death benefit protection only. Other components, like cash value or investments, are not affiliated with term life insurance – and because of this, these types of life insurance policies are often very affordable.

Broadly speaking, life insurance can be further categorized as a pure risk coverage plan – purely insurance and the other, which is a combination of insurance and investment component.

For more information about permanent life insurance, review the Canadian Life and Health Insurance Association’s A Guide to Life Insurance brochure. Term Life Insurance Term insurance covers you for a specific period of time, and has an expiry date.

There are three major types of whole life or permanent life insurance—traditional whole life, universal life, and variable universal life, and there are variations within each type. In the case of traditional whole life, both the death benefit and the premium are designed to stay the same (level) throughout the life of …

Life insurance can be more expensive and harder to get at higher ages, but some providers offer life insurance designed for mature adults. Types of term life insurance The most common term lengths are 10, 20, and 30 years, but many insurers also offer 15-, 25-, and 35-year terms.

The insurer will pay the fixed amount of insurance at the time of death or at the expiry of the certain period. At present, life insurance enjoys maximum scope because the life is the most important property of an individual.

disability or life, insurance serves as an excellent risk-management and wealth- preservation tool. Having the right kind of insurance is a critical component of any

Whole life insurance and other types of permanent life insurance policies, such as universal life, usually include a “cash value” account, which builds value over time. Eventually, you may

Life insurance is a broad term to describe a range of insurance types including critical illness insurance, income protection insurance, accidental death insurance, injury insurance, and more. In this article we explain them all.

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

7 Types of Insurance iEduNote.com

What are the Different Types of Insurance General & Life

21/01/2016 · Whole Life Insurance is what I refer to as the “Rolls Royce” of life insurance. Whole life costs more than all the other types of life insurance we’ve discussed, but it does more. Over time

There are three major types of whole life or permanent life insurance—traditional whole life, universal life, and variable universal life, and there are variations within each type. In the case of traditional whole life, both the death benefit and the premium are designed to stay the same (level) throughout the life of …

Diabetes questionnaire Page 1 of 3 Policy type: Wealth Protection Active Sumo FutureWise Your duty of disclosure Before entering into a life insurance contract, we must be told anything that each of you as the proposed policy owner and the life to be insured (if a different person to the proposed policy owner) knows, or could reasonably be expected to know, may affect our decision to provide

These types of life insurance policies provide both a fixed premium (the amount you’ll pay) as well as a fixed payout (the amount we’d pay your family). Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations. These benefits include:

Life’s key events I’m starting out Types of insurance cover . How we can help safeguard your future against the unknown . Back . Member; Insurance; Types of insurance cover If you were suddenly unable to work or provide for your family, how would you meet your financial commitments? Find out how you can future proof your income with our insurance offerings. Make a claim Find out how. Read

The two primary types of life insurance—term life and permanent life—are just the tip of the iceberg. Insurance companies also offer dozens of other insurance policies, each designed to pay death benefits in different ways. Here’s a brief overview of the types of life insurance you may encounter when you’re shopping around.

This life insurance 101 guide can help make it easier to understand the basics about how life insurance works, types of coverage available, why you need it, and how to go about choosing a plan that’s right for you. After you read this guide, use the online agent locator to find a HealthMarkets agent near you who can give you more information about how different life insurance plans can help

The insurer will pay the fixed amount of insurance at the time of death or at the expiry of the certain period. At present, life insurance enjoys maximum scope because the life is the most important property of an individual.

What are the different types of life insurance? ANZ

Life Insurance Policies & Quotes Farmers Insurance

Broadly speaking, life insurance can be further categorized as a pure risk coverage plan – purely insurance and the other, which is a combination of insurance and investment component.

Types of Life Insurance. With so many different types of insurance products available, from so many different insurance providers, it can be extremely challenging to …

Diabetes questionnaire Page 1 of 3 Policy type: Wealth Protection Active Sumo FutureWise Your duty of disclosure Before entering into a life insurance contract, we must be told anything that each of you as the proposed policy owner and the life to be insured (if a different person to the proposed policy owner) knows, or could reasonably be expected to know, may affect our decision to provide

73 CHAPTER – IV LIFE INSURANCE CORPORATION OF INDIA, COMPANY AND AREA PROFILE 4.1. Introduction to Life Insurance Corporation (LIC) The Life Insurance Corporation of India popularly known as “LIC of

disability or life, insurance serves as an excellent risk-management and wealth- preservation tool. Having the right kind of insurance is a critical component of any

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

21/01/2016 · Whole Life Insurance is what I refer to as the “Rolls Royce” of life insurance. Whole life costs more than all the other types of life insurance we’ve discussed, but it does more. Over time

This life insurance 101 guide can help make it easier to understand the basics about how life insurance works, types of coverage available, why you need it, and how to go about choosing a plan that’s right for you. After you read this guide, use the online agent locator to find a HealthMarkets agent near you who can give you more information about how different life insurance plans can help

An assessment of the risk to the life office of providing insurance on a particular life. Prospective clients are assessed by the life office in regard to their health and family medical history, occupation and leisure activities, habits, place of residence, past insurance history,

These types of life insurance policies provide both a fixed premium (the amount you’ll pay) as well as a fixed payout (the amount we’d pay your family). Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations. These benefits include:

Dynasty Trust Wealth Preservation Life Insurance Review Prepared for: DIFFERENT TYPES OF AVAILABLE LIFE INSURANCE POLICIES Life insurance policies come in a variety of types.

Types of Life Insurance Financial Services Commission of

Whole life insurance is a type of permanent insurance or cash value insurance. Unlike term insurance, which Unlike term insurance, which provides coverage for a particular period of time, permanent insurance provides coverage for your entire life.

What are the Different Types of Insurance General & Life

Types of Life Insurance Explained All You Need In One Place

7 Types of Insurance iEduNote.com

For more information about permanent life insurance, review the Canadian Life and Health Insurance Association’s A Guide to Life Insurance brochure. Term Life Insurance Term insurance covers you for a specific period of time, and has an expiry date.

Diabetes questionnaire Zurich

What are the types of premiums on life insurance? Mackay

Types of Life Insurance Explained All You Need In One Place

Life insurance is a broad term to describe a range of insurance types including critical illness insurance, income protection insurance, accidental death insurance, injury insurance, and more. In this article we explain them all.

Types of Life Insurance Financial Services Commission of

What are the Different Types of Insurance General & Life

What are the types of premiums on life insurance? Mackay

Whole life insurance and other types of permanent life insurance policies, such as universal life, usually include a “cash value” account, which builds value over time. Eventually, you may

What are the different types of life insurance? ANZ

Life Insurance Policies & Quotes Farmers Insurance

What are the Different Types of Insurance General & Life

When the time comes to choose your life insurance, speaking to a specialist advisor is a great way of determining a financially sound way forward. Everyone comes from a different background and is in a different situation with their money, so a tailored plan is ideal.

Types of Life Insurance Financial Services Commission of

73 CHAPTER – IV LIFE INSURANCE CORPORATION OF INDIA, COMPANY AND AREA PROFILE 4.1. Introduction to Life Insurance Corporation (LIC) The Life Insurance Corporation of India popularly known as “LIC of

Life Insurance Policies Which Policy Is Best? TermLife2Go

What is Life Insurance. Life insurance is a contract that offers financial compensation in case of death or disability. Some life insurance policies even offer financial compensation after retirement or …

Life Insurance Policies Which Policy Is Best? TermLife2Go

With term life insurance, the policyholder is covered by death benefit protection only. Other components, like cash value or investments, are not affiliated with term life insurance – and because of this, these types of life insurance policies are often very affordable.

Types of Life Insurance Financial Services Commission of

What are the different types of life insurance? ANZ

Types of Life Insurance NerdWallet

Life insurance can be more expensive and harder to get at higher ages, but some providers offer life insurance designed for mature adults. Types of term life insurance The most common term lengths are 10, 20, and 30 years, but many insurers also offer 15-, 25-, and 35-year terms.

Types of Life Insurance Explained All You Need In One Place

Life Insurance Policies Which Policy Is Best? TermLife2Go

Whole life insurance and other types of permanent life insurance policies, such as universal life, usually include a “cash value” account, which builds value over time. Eventually, you may

TYPES OF LIFE INSURANCE Online Insurance Exam Prep

Types of Life Insurance NerdWallet

TYPES OF LIFE INSURANCE Group Individual Ordinary Industrial Permanent Term • One master policy •Single owner owns the policy on the insured, and possibly additional insured •Individual coverage in a variety of term or permanent plans, in any face amount • The individual owner pays premiums based on a preset schedule • Flexible options Individual coverage in small amounts • No

Types Of Life Insurance Explained YouTube