Trade finance math filetype pdf

International Standard Banking Practice –ICC Publication 745 A selection of screens from the 12 segments of the ISBP module. Foreword The screens that follow are a sample taken from an ISBP module that forms part of an extensive training suite covering basic, intermediary and advanced elements of Trade Finance that is being established. These modules will be available to anyone who …

1 TRADE FINANCE – INTRODUCTION What is trade finance? The term “Trade Finance” means, finance for Trade. For any trade transaction there should be a Seller to sell the goods or services and a Buyer who will buy the goods

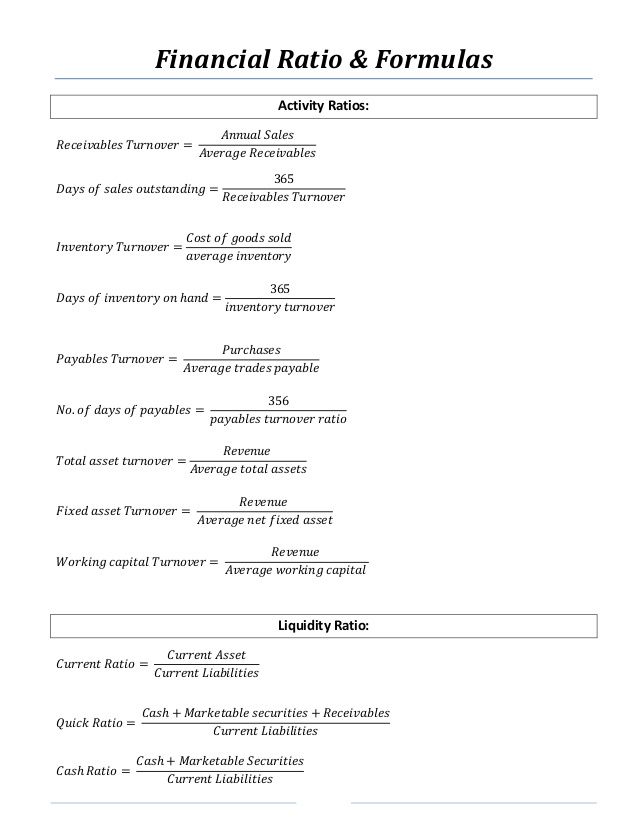

The important aspect of working capital is to keep the levels of inventories, trade receivables, cash etc at a level which ensures customer goodwill but also keeps costs to the minimum. With trade payables, the longer the period of credit the better as this is a form of free credit,

• Trade finance is an essential enabler of trade • But little research work in this area as yet –National situation often unclear and unmonitored (from a trade

An illustration of globalisation is given by the growth in world trade as a percentage of world aggregate output (global gross national product (GNP)). In the early 1960s global exports and imports were about one-fifth of global

2 Overview of Quantitative Finance 3 Careers for Quants 4 Pre-U Math 5 Programming Christopher Ting QF 101 Week 1 August 19, 20162/35. PreambleOverview of Quantitative FinanceCareers for QuantsPre-U MathProgramming About this 101 Course}introduces you to the essentials of Quantitative Finance models}provides athree-principle frameworkto navigate through the forest of mathematical models

Specialist import finance companies can provide a range of financing options to suit your circumstances. VAT and duty Unless buying on delivered-duty-paid terms, importers are generally responsible for arranging customs clearance and paying any VAT and duty. A Import VAT of 17.5 per cent is raised on all imports of standard-rated goods. You need only account for VAT for goods …

TRADE CREDIT AND BANK FINANCE: FINANCING SMALL FIRMS IN RUSSIA LISA D. COOK Harvard University EXECUTIVE SUMMARY This paper …

TD/B/C.I/MEM.2/10 3 5. However, since the second half of 2008, as the financial crisis took hold, trade finance – like global finance more generally – began to dry up, while the cost of credit

structured trade and commodity finance oil trade transfers the property in goods is always a question of fact.” The rights of a financing bank If the transfer is by way of pledge, the bank will have a “special property” in the oil represented by the bill, while the “general property” will remain unaffected by the transfer of the bill. What does this mean? In practical terms, the

Trade finance seems to be even more dollar denominated than global trade, with 80% of L/Cs, and a high proportion of the activities of global and local banks denominated in dollars.

1 5430408_3.docx FinTech inTrade& Trade Finance FinTech is now a commonplaceterm used generically to describe new and innovative financial products born out of technology, ranging from consumer and SME focused e-payment and money

undertake a review of existing trade finance services in the Euromed region. The enhancement of international trade has historically been the cornerstone of economic growth in the world, leading to the reduction of poverty and greater national prosperity. This concept is supported by a plethora of economic analyses which demonstrate the importance of trade finance to a country‘s overall

3 Definition “Structured Trade Finance is the means through which capital solutions (both funded and non-funded) are provided outside the traditional fall back on securities – …

The Handbook of International Trade and Finance The Complete Guide to Risk Management, International Payments and Currency Management, Bonds and Guarantees, Credit Insurance and Trade Finance

See also Lawrence H. Summers, Continuing the Fight Against International Trade Finance Subsidies , in The Ex-Im Bank in the 21st Century 258 (Gary Clyde Hufbauer & Rita M. Rodriguez eds., 2001) (arguing that the Arrangement is not legally binding).

TRADE FINANCE MAGAZINE June 2005 – Awards for Excellence BEST COMMODITY BANK Winner: BNP Paribas Winner: BNP Paribas Highly commended: SG CIB This is the second year running that BNP Paribas (BNPP) has won this award, and the bank has done

International Financial Markets: A Diverse System Is the Key to Commerce 3 extension of credit by a firm to its customers . Firms in more well-developed financial

zubac trade filetypepdf AIOIS – All-in-one Internet

https://www.youtube.com/embed/oF5lNOp-V6Y

ISBN 978-0-8213-8748-1 SKU 18748

Free PDF: International Corporate Finance Robin Pdf Score your highest in corporate finance The math, formulas, and problems associated with corporate finance can be International Financial Management, Abridged Edition

such as loans, debt securities and trade receivables, lease receivables and most loan commitments and financial guarantee contracts. • Entities are required to recognise an allowance for either 12-month or

International Trade Finance Topics in International Finance PART 6 M17_MOFF8079_04_SE_C17.QXD 7/1/11 2:31 PM Page W-1. LEARNING OBJECTIVES Separate total risk of a portfolio into two components,diversifiable and non-diversifiable. Demonstrate how the diversifiable and non-diversifiable risks of an investor’s portfolio may be reduced through international …

of energy and trade finance matters, from advice on letters of credit, through to large-scale, working capital revolving credit facilities, reserve based financing, pre …

finance area of studies and practice involves the interaction between firms and financial markets and Investments area of studies and practice involves the interaction …

DCB’S TRADE FINANCE PRODUCTS At DCB, we offer a comprehensive trade finance products that allow importers and exporters to maximize on many opportunities available in the global market. Our trade finance products include: Telegraphic Transfer (TT), Letters of Credit, Documentary Collections, Bill Discounting, and Bank Guarantees. 1.0 Telegraphic Transfers (TT) It is an electronic method of

PONDICHERRY UNIVERSITY (A Central University) DIRECTORATE OF DISTANCE EDUCATION International Trade and Finance Paper Code: MBFM 4003 MBA – FINANCE

The trade finance products identified in this study reveal a menu of choices that are available to genuine traders to facilitate trade. Exporters and importers enter into an agreement to trade more often than not by way of cash payment or through some more . 6 complex form of trade financing. Such trade finance products include bills of exchange, counter trade, letters of credit and open

About the Tutorial International Finance deals with the management of finances in a global business. It explains how to trade in international markets and how to exchange foreign currency, and earn profit through such activities. This tutorial provides a brief overview of the current trends in finance, along with detailed inputs on the current global markets, foreign exchange markets

zubac trade filetype:pdf Yahoo Finance Bloomberg CNBC Google Finance MarketWatch. Sports Sports: zubac trade filetype:pdf ESPN Basketball Reference SportsStats Sports Illustrated Yahoo Sports SBNation Soccer: FIFA Soccer News WorldSoccer MLS Soccer Basketball: NBA RealGM Basketball Insiders NCAA HoopsHype Hockey: Hockey News NHL TSN Sportsnet NHL Trade Football: NFL Baseball: MLB MLB Trade

Trade finance refers to the financing of imports and exports by the sources of interbank’s credits, attracted by foreign banks with use of financial instruments, such as letters of credit or guarantees.

The Raymond and Beverly Sackler Faculty of Exact Sciences The Blavatnik School of Computer Science Machine Learning Algorithms with Applications in Finance

The moves towards ‘free trade’ of the 19th century were largely offset by the reintroduction of tariffs in the early part of the 20 th century at rates sometimes as high as 33 and 50%.

THE ECONOMICS OF COMMODITY TRADING FIRMS CRAIG PIRRONG Professor of Finance Bauer College of Business University of Houston . 2 Trafigura provided financial support for this research. I also benefited substantially from discussions with Trafigura management, traders, and staff. All opinions and conclusions expressed are exclusively mine, and I am responsible for all errors and omissions

As the world’s leading trade, commodity and export finance publisher and event organiser, GTR offers sponsors and advertisers unrivalled exposure and profiling among their

Trade finance is a key component in maintaining a competitive and productive economy. London’s position as a major financial centre could be severely affected if banks engaging in trade finance activity do not have appropriate systems and controls to prevent money

Trade Finance during the Great Trade Collapse is the product of a fruitful collaboration during the crisis among the World Bank Group, international financial partners, private banks, and academia.

RASMALA TRADE FINANCE FUND (the “Fund”) is a Cayman Islands exempted company incorporated pursuant to the Companies Law with limited liability on9 October 2013. The Fund commenced operations on 31 October 2013. The Fund’s investment manager is Rasmala Investment Bank Ltd. (the “Investment Manager”), a company incorporated under the laws of the Dubai International Financial Centreand

https://www.youtube.com/embed/1AAACIe5V00

The Dynamics of International Trade Finance Regulation

A trade application is routed through the Issuing Bank and Advising Bank. The application supports attaching of necessary documents to the underlying trade contract. Using Attach documents transaction you can attach scanned copies of Instructions to the bank.

trade finance activities, understands the need to interface with current case management and screening systems, realizes the necessity of auditability, and provides reports and dashboards for investigators and officers alike.

London and Philadelphia ANDERS GRATH International Trade and Finance The Complete Guide to Risk Management, International Payments and Currency Management, Bonds and Guarantees, Credit Insurance and Trade Finance THE HANDBOOK OF CGT Int’l Trade Finance TP:Layout 1 30/4/08 12:54 Page 1. Publisher’s note Every possible effort has been made to ensure that the information …

Machine Learning Algorithms with Applications in Finance

Import finance abahe.co.uk

Financing the oil trade dlapipertradefinance.com

https://www.youtube.com/embed/txWaMpSzHhM

CHAPTER 20 International Business Finance

FinTech inTrade& Trade Finance Simmons & Simmons

Rasmala Trade FinanceFund

work and energy problems with solutions pdf

https://www.youtube.com/embed/wEr6mwquPLY

TRADE FINANCE MAGAZINE BNP Paribas

DCB’S TRADE FINANCE PRODUCTS

youre the word of god the father pdf INTERNATIONAL TRADE OIL AND GAS TRADING incelaw.com

TR13/3Banks’ control of financial crime risks in trade

TD/B/C.I/MEM.2/10 United Nations Conference on Trade and

Oracle FLEXCUBE Direct Banking Release 12.0.1.0.0

Oracle FLEXCUBE Direct Banking Release 12.0.1.0.0

Import finance abahe.co.uk

TRADE CREDIT AND BANK FINANCE: FINANCING SMALL FIRMS IN RUSSIA LISA D. COOK Harvard University EXECUTIVE SUMMARY This paper …

A trade application is routed through the Issuing Bank and Advising Bank. The application supports attaching of necessary documents to the underlying trade contract. Using Attach documents transaction you can attach scanned copies of Instructions to the bank.

As the world’s leading trade, commodity and export finance publisher and event organiser, GTR offers sponsors and advertisers unrivalled exposure and profiling among their

Trade Finance during the Great Trade Collapse is the product of a fruitful collaboration during the crisis among the World Bank Group, international financial partners, private banks, and academia.

Free PDF: International Corporate Finance Robin Pdf Score your highest in corporate finance The math, formulas, and problems associated with corporate finance can be International Financial Management, Abridged Edition

of energy and trade finance matters, from advice on letters of credit, through to large-scale, working capital revolving credit facilities, reserve based financing, pre …

trade finance activities, understands the need to interface with current case management and screening systems, realizes the necessity of auditability, and provides reports and dashboards for investigators and officers alike.

TRADE FINANCE MAGAZINE June 2005 – Awards for Excellence BEST COMMODITY BANK Winner: BNP Paribas Winner: BNP Paribas Highly commended: SG CIB This is the second year running that BNP Paribas (BNPP) has won this award, and the bank has done

Machine Learning Algorithms with Applications in Finance

DCB’S TRADE FINANCE PRODUCTS

A trade application is routed through the Issuing Bank and Advising Bank. The application supports attaching of necessary documents to the underlying trade contract. Using Attach documents transaction you can attach scanned copies of Instructions to the bank.

Free PDF: International Corporate Finance Robin Pdf Score your highest in corporate finance The math, formulas, and problems associated with corporate finance can be International Financial Management, Abridged Edition

As the world’s leading trade, commodity and export finance publisher and event organiser, GTR offers sponsors and advertisers unrivalled exposure and profiling among their

Trade Finance during the Great Trade Collapse is the product of a fruitful collaboration during the crisis among the World Bank Group, international financial partners, private banks, and academia.

The important aspect of working capital is to keep the levels of inventories, trade receivables, cash etc at a level which ensures customer goodwill but also keeps costs to the minimum. With trade payables, the longer the period of credit the better as this is a form of free credit,

THE ECONOMICS OF COMMODITY TRADING FIRMS CRAIG PIRRONG Professor of Finance Bauer College of Business University of Houston . 2 Trafigura provided financial support for this research. I also benefited substantially from discussions with Trafigura management, traders, and staff. All opinions and conclusions expressed are exclusively mine, and I am responsible for all errors and omissions

International Trade Finance Topics in International Finance PART 6 M17_MOFF8079_04_SE_C17.QXD 7/1/11 2:31 PM Page W-1. LEARNING OBJECTIVES Separate total risk of a portfolio into two components,diversifiable and non-diversifiable. Demonstrate how the diversifiable and non-diversifiable risks of an investor’s portfolio may be reduced through international …

such as loans, debt securities and trade receivables, lease receivables and most loan commitments and financial guarantee contracts. • Entities are required to recognise an allowance for either 12-month or

International Financial Markets: A Diverse System Is the Key to Commerce 3 extension of credit by a firm to its customers . Firms in more well-developed financial

• Trade finance is an essential enabler of trade • But little research work in this area as yet –National situation often unclear and unmonitored (from a trade

of energy and trade finance matters, from advice on letters of credit, through to large-scale, working capital revolving credit facilities, reserve based financing, pre …

International Standard Banking Practice –ICC Publication 745 A selection of screens from the 12 segments of the ISBP module. Foreword The screens that follow are a sample taken from an ISBP module that forms part of an extensive training suite covering basic, intermediary and advanced elements of Trade Finance that is being established. These modules will be available to anyone who …

PONDICHERRY UNIVERSITY (A Central University) DIRECTORATE OF DISTANCE EDUCATION International Trade and Finance Paper Code: MBFM 4003 MBA – FINANCE

See also Lawrence H. Summers, Continuing the Fight Against International Trade Finance Subsidies , in The Ex-Im Bank in the 21st Century 258 (Gary Clyde Hufbauer & Rita M. Rodriguez eds., 2001) (arguing that the Arrangement is not legally binding).

zubac trade filetype:pdf Yahoo Finance Bloomberg CNBC Google Finance MarketWatch. Sports Sports: zubac trade filetype:pdf ESPN Basketball Reference SportsStats Sports Illustrated Yahoo Sports SBNation Soccer: FIFA Soccer News WorldSoccer MLS Soccer Basketball: NBA RealGM Basketball Insiders NCAA HoopsHype Hockey: Hockey News NHL TSN Sportsnet NHL Trade Football: NFL Baseball: MLB MLB Trade

The Dynamics of International Trade Finance Regulation

Alarming Concerns of Financial Crimes Risk in Trade Finance

A trade application is routed through the Issuing Bank and Advising Bank. The application supports attaching of necessary documents to the underlying trade contract. Using Attach documents transaction you can attach scanned copies of Instructions to the bank.

3 Definition “Structured Trade Finance is the means through which capital solutions (both funded and non-funded) are provided outside the traditional fall back on securities – …

such as loans, debt securities and trade receivables, lease receivables and most loan commitments and financial guarantee contracts. • Entities are required to recognise an allowance for either 12-month or

THE ECONOMICS OF COMMODITY TRADING FIRMS CRAIG PIRRONG Professor of Finance Bauer College of Business University of Houston . 2 Trafigura provided financial support for this research. I also benefited substantially from discussions with Trafigura management, traders, and staff. All opinions and conclusions expressed are exclusively mine, and I am responsible for all errors and omissions

Financing the oil trade dlapipertradefinance.com

ISBN 978-0-8213-8748-1 SKU 18748

International Financial Markets: A Diverse System Is the Key to Commerce 3 extension of credit by a firm to its customers . Firms in more well-developed financial

The Raymond and Beverly Sackler Faculty of Exact Sciences The Blavatnik School of Computer Science Machine Learning Algorithms with Applications in Finance

1 5430408_3.docx FinTech inTrade& Trade Finance FinTech is now a commonplaceterm used generically to describe new and innovative financial products born out of technology, ranging from consumer and SME focused e-payment and money

About the Tutorial International Finance deals with the management of finances in a global business. It explains how to trade in international markets and how to exchange foreign currency, and earn profit through such activities. This tutorial provides a brief overview of the current trends in finance, along with detailed inputs on the current global markets, foreign exchange markets

such as loans, debt securities and trade receivables, lease receivables and most loan commitments and financial guarantee contracts. • Entities are required to recognise an allowance for either 12-month or

TRADE CREDIT AND BANK FINANCE: FINANCING SMALL FIRMS IN RUSSIA LISA D. COOK Harvard University EXECUTIVE SUMMARY This paper …

1 TRADE FINANCE – INTRODUCTION What is trade finance? The term “Trade Finance” means, finance for Trade. For any trade transaction there should be a Seller to sell the goods or services and a Buyer who will buy the goods

International Standard Banking Practice –ICC Publication 745 A selection of screens from the 12 segments of the ISBP module. Foreword The screens that follow are a sample taken from an ISBP module that forms part of an extensive training suite covering basic, intermediary and advanced elements of Trade Finance that is being established. These modules will be available to anyone who …

The important aspect of working capital is to keep the levels of inventories, trade receivables, cash etc at a level which ensures customer goodwill but also keeps costs to the minimum. With trade payables, the longer the period of credit the better as this is a form of free credit,

• Trade finance is an essential enabler of trade • But little research work in this area as yet –National situation often unclear and unmonitored (from a trade

London and Philadelphia ANDERS GRATH International Trade and Finance The Complete Guide to Risk Management, International Payments and Currency Management, Bonds and Guarantees, Credit Insurance and Trade Finance THE HANDBOOK OF CGT Int’l Trade Finance TP:Layout 1 30/4/08 12:54 Page 1. Publisher’s note Every possible effort has been made to ensure that the information …

INTERNATIONAL TRADE OIL AND GAS TRADING incelaw.com

CHAPTER 20 International Business Finance

TD/B/C.I/MEM.2/10 3 5. However, since the second half of 2008, as the financial crisis took hold, trade finance – like global finance more generally – began to dry up, while the cost of credit

structured trade and commodity finance oil trade transfers the property in goods is always a question of fact.” The rights of a financing bank If the transfer is by way of pledge, the bank will have a “special property” in the oil represented by the bill, while the “general property” will remain unaffected by the transfer of the bill. What does this mean? In practical terms, the

undertake a review of existing trade finance services in the Euromed region. The enhancement of international trade has historically been the cornerstone of economic growth in the world, leading to the reduction of poverty and greater national prosperity. This concept is supported by a plethora of economic analyses which demonstrate the importance of trade finance to a country‘s overall

RASMALA TRADE FINANCE FUND (the “Fund”) is a Cayman Islands exempted company incorporated pursuant to the Companies Law with limited liability on9 October 2013. The Fund commenced operations on 31 October 2013. The Fund’s investment manager is Rasmala Investment Bank Ltd. (the “Investment Manager”), a company incorporated under the laws of the Dubai International Financial Centreand

TRADE CREDIT AND BANK FINANCE: FINANCING SMALL FIRMS IN RUSSIA LISA D. COOK Harvard University EXECUTIVE SUMMARY This paper …

A trade application is routed through the Issuing Bank and Advising Bank. The application supports attaching of necessary documents to the underlying trade contract. Using Attach documents transaction you can attach scanned copies of Instructions to the bank.

The moves towards ‘free trade’ of the 19th century were largely offset by the reintroduction of tariffs in the early part of the 20 th century at rates sometimes as high as 33 and 50%.

The trade finance products identified in this study reveal a menu of choices that are available to genuine traders to facilitate trade. Exporters and importers enter into an agreement to trade more often than not by way of cash payment or through some more . 6 complex form of trade financing. Such trade finance products include bills of exchange, counter trade, letters of credit and open

See also Lawrence H. Summers, Continuing the Fight Against International Trade Finance Subsidies , in The Ex-Im Bank in the 21st Century 258 (Gary Clyde Hufbauer & Rita M. Rodriguez eds., 2001) (arguing that the Arrangement is not legally binding).

FinTech inTrade& Trade Finance Simmons & Simmons

ISBN 978-0-8213-8748-1 SKU 18748

• Trade finance is an essential enabler of trade • But little research work in this area as yet –National situation often unclear and unmonitored (from a trade

undertake a review of existing trade finance services in the Euromed region. The enhancement of international trade has historically been the cornerstone of economic growth in the world, leading to the reduction of poverty and greater national prosperity. This concept is supported by a plethora of economic analyses which demonstrate the importance of trade finance to a country‘s overall

The Handbook of International Trade and Finance The Complete Guide to Risk Management, International Payments and Currency Management, Bonds and Guarantees, Credit Insurance and Trade Finance

finance area of studies and practice involves the interaction between firms and financial markets and Investments area of studies and practice involves the interaction …

London and Philadelphia ANDERS GRATH International Trade and Finance The Complete Guide to Risk Management, International Payments and Currency Management, Bonds and Guarantees, Credit Insurance and Trade Finance THE HANDBOOK OF CGT Int’l Trade Finance TP:Layout 1 30/4/08 12:54 Page 1. Publisher’s note Every possible effort has been made to ensure that the information …

The important aspect of working capital is to keep the levels of inventories, trade receivables, cash etc at a level which ensures customer goodwill but also keeps costs to the minimum. With trade payables, the longer the period of credit the better as this is a form of free credit,

Trade finance is a key component in maintaining a competitive and productive economy. London’s position as a major financial centre could be severely affected if banks engaging in trade finance activity do not have appropriate systems and controls to prevent money

International Trade Finance Topics in International Finance PART 6 M17_MOFF8079_04_SE_C17.QXD 7/1/11 2:31 PM Page W-1. LEARNING OBJECTIVES Separate total risk of a portfolio into two components,diversifiable and non-diversifiable. Demonstrate how the diversifiable and non-diversifiable risks of an investor’s portfolio may be reduced through international …

THE ECONOMICS OF COMMODITY TRADING FIRMS CRAIG PIRRONG Professor of Finance Bauer College of Business University of Houston . 2 Trafigura provided financial support for this research. I also benefited substantially from discussions with Trafigura management, traders, and staff. All opinions and conclusions expressed are exclusively mine, and I am responsible for all errors and omissions

Oracle FLEXCUBE Direct Banking Release 12.0.1.0.0

zubac trade filetypepdf AIOIS – All-in-one Internet

International Trade Finance Topics in International Finance PART 6 M17_MOFF8079_04_SE_C17.QXD 7/1/11 2:31 PM Page W-1. LEARNING OBJECTIVES Separate total risk of a portfolio into two components,diversifiable and non-diversifiable. Demonstrate how the diversifiable and non-diversifiable risks of an investor’s portfolio may be reduced through international …

The Raymond and Beverly Sackler Faculty of Exact Sciences The Blavatnik School of Computer Science Machine Learning Algorithms with Applications in Finance

International Financial Markets: A Diverse System Is the Key to Commerce 3 extension of credit by a firm to its customers . Firms in more well-developed financial

A trade application is routed through the Issuing Bank and Advising Bank. The application supports attaching of necessary documents to the underlying trade contract. Using Attach documents transaction you can attach scanned copies of Instructions to the bank.

Trade Finance Guide A Quick Reference for U.S. Exporters

Trade and Finance The Handbook of International Weebly

DCB’S TRADE FINANCE PRODUCTS At DCB, we offer a comprehensive trade finance products that allow importers and exporters to maximize on many opportunities available in the global market. Our trade finance products include: Telegraphic Transfer (TT), Letters of Credit, Documentary Collections, Bill Discounting, and Bank Guarantees. 1.0 Telegraphic Transfers (TT) It is an electronic method of

Trade finance refers to the financing of imports and exports by the sources of interbank’s credits, attracted by foreign banks with use of financial instruments, such as letters of credit or guarantees.

of energy and trade finance matters, from advice on letters of credit, through to large-scale, working capital revolving credit facilities, reserve based financing, pre …

such as loans, debt securities and trade receivables, lease receivables and most loan commitments and financial guarantee contracts. • Entities are required to recognise an allowance for either 12-month or

THE ECONOMICS OF COMMODITY TRADING FIRMS CRAIG PIRRONG Professor of Finance Bauer College of Business University of Houston . 2 Trafigura provided financial support for this research. I also benefited substantially from discussions with Trafigura management, traders, and staff. All opinions and conclusions expressed are exclusively mine, and I am responsible for all errors and omissions

TD/B/C.I/MEM.2/10 3 5. However, since the second half of 2008, as the financial crisis took hold, trade finance – like global finance more generally – began to dry up, while the cost of credit

trade finance activities, understands the need to interface with current case management and screening systems, realizes the necessity of auditability, and provides reports and dashboards for investigators and officers alike.

TRADE CREDIT AND BANK FINANCE: FINANCING SMALL FIRMS IN RUSSIA LISA D. COOK Harvard University EXECUTIVE SUMMARY This paper …

As the world’s leading trade, commodity and export finance publisher and event organiser, GTR offers sponsors and advertisers unrivalled exposure and profiling among their

2 Overview of Quantitative Finance 3 Careers for Quants 4 Pre-U Math 5 Programming Christopher Ting QF 101 Week 1 August 19, 20162/35. PreambleOverview of Quantitative FinanceCareers for QuantsPre-U MathProgramming About this 101 Course}introduces you to the essentials of Quantitative Finance models}provides athree-principle frameworkto navigate through the forest of mathematical models

The Handbook of International Trade and Finance The Complete Guide to Risk Management, International Payments and Currency Management, Bonds and Guarantees, Credit Insurance and Trade Finance

• Trade finance is an essential enabler of trade • But little research work in this area as yet –National situation often unclear and unmonitored (from a trade

Trade Finance during the Great Trade Collapse is the product of a fruitful collaboration during the crisis among the World Bank Group, international financial partners, private banks, and academia.

3 Definition “Structured Trade Finance is the means through which capital solutions (both funded and non-funded) are provided outside the traditional fall back on securities – …

Trade finance seems to be even more dollar denominated than global trade, with 80% of L/Cs, and a high proportion of the activities of global and local banks denominated in dollars.

FinTech inTrade& Trade Finance Simmons & Simmons

Review of Existing Trade Finance Services

2 Overview of Quantitative Finance 3 Careers for Quants 4 Pre-U Math 5 Programming Christopher Ting QF 101 Week 1 August 19, 20162/35. PreambleOverview of Quantitative FinanceCareers for QuantsPre-U MathProgramming About this 101 Course}introduces you to the essentials of Quantitative Finance models}provides athree-principle frameworkto navigate through the forest of mathematical models

THE ECONOMICS OF COMMODITY TRADING FIRMS CRAIG PIRRONG Professor of Finance Bauer College of Business University of Houston . 2 Trafigura provided financial support for this research. I also benefited substantially from discussions with Trafigura management, traders, and staff. All opinions and conclusions expressed are exclusively mine, and I am responsible for all errors and omissions

International Trade Finance Topics in International Finance PART 6 M17_MOFF8079_04_SE_C17.QXD 7/1/11 2:31 PM Page W-1. LEARNING OBJECTIVES Separate total risk of a portfolio into two components,diversifiable and non-diversifiable. Demonstrate how the diversifiable and non-diversifiable risks of an investor’s portfolio may be reduced through international …

1 TRADE FINANCE – INTRODUCTION What is trade finance? The term “Trade Finance” means, finance for Trade. For any trade transaction there should be a Seller to sell the goods or services and a Buyer who will buy the goods

The Handbook of International Trade and Finance The Complete Guide to Risk Management, International Payments and Currency Management, Bonds and Guarantees, Credit Insurance and Trade Finance

Trade finance is a key component in maintaining a competitive and productive economy. London’s position as a major financial centre could be severely affected if banks engaging in trade finance activity do not have appropriate systems and controls to prevent money

Financing the oil trade dlapipertradefinance.com

INTERNATIONAL TRADE OIL AND GAS TRADING incelaw.com

TRADE FINANCE MAGAZINE June 2005 – Awards for Excellence BEST COMMODITY BANK Winner: BNP Paribas Winner: BNP Paribas Highly commended: SG CIB This is the second year running that BNP Paribas (BNPP) has won this award, and the bank has done

3 Definition “Structured Trade Finance is the means through which capital solutions (both funded and non-funded) are provided outside the traditional fall back on securities – …

The moves towards ‘free trade’ of the 19th century were largely offset by the reintroduction of tariffs in the early part of the 20 th century at rates sometimes as high as 33 and 50%.

• Trade finance is an essential enabler of trade • But little research work in this area as yet –National situation often unclear and unmonitored (from a trade

As the world’s leading trade, commodity and export finance publisher and event organiser, GTR offers sponsors and advertisers unrivalled exposure and profiling among their

Specialist import finance companies can provide a range of financing options to suit your circumstances. VAT and duty Unless buying on delivered-duty-paid terms, importers are generally responsible for arranging customs clearance and paying any VAT and duty. A Import VAT of 17.5 per cent is raised on all imports of standard-rated goods. You need only account for VAT for goods …

DCB’S TRADE FINANCE PRODUCTS

ISBN 978-0-8213-8748-1 SKU 18748

As the world’s leading trade, commodity and export finance publisher and event organiser, GTR offers sponsors and advertisers unrivalled exposure and profiling among their

2 Overview of Quantitative Finance 3 Careers for Quants 4 Pre-U Math 5 Programming Christopher Ting QF 101 Week 1 August 19, 20162/35. PreambleOverview of Quantitative FinanceCareers for QuantsPre-U MathProgramming About this 101 Course}introduces you to the essentials of Quantitative Finance models}provides athree-principle frameworkto navigate through the forest of mathematical models

• Trade finance is an essential enabler of trade • But little research work in this area as yet –National situation often unclear and unmonitored (from a trade

International Standard Banking Practice –ICC Publication 745 A selection of screens from the 12 segments of the ISBP module. Foreword The screens that follow are a sample taken from an ISBP module that forms part of an extensive training suite covering basic, intermediary and advanced elements of Trade Finance that is being established. These modules will be available to anyone who …

of energy and trade finance matters, from advice on letters of credit, through to large-scale, working capital revolving credit facilities, reserve based financing, pre …

DCB’S TRADE FINANCE PRODUCTS At DCB, we offer a comprehensive trade finance products that allow importers and exporters to maximize on many opportunities available in the global market. Our trade finance products include: Telegraphic Transfer (TT), Letters of Credit, Documentary Collections, Bill Discounting, and Bank Guarantees. 1.0 Telegraphic Transfers (TT) It is an electronic method of

Trade Finance during the Great Trade Collapse is the product of a fruitful collaboration during the crisis among the World Bank Group, international financial partners, private banks, and academia.

See also Lawrence H. Summers, Continuing the Fight Against International Trade Finance Subsidies , in The Ex-Im Bank in the 21st Century 258 (Gary Clyde Hufbauer & Rita M. Rodriguez eds., 2001) (arguing that the Arrangement is not legally binding).

TRADE CREDIT AND BANK FINANCE: FINANCING SMALL FIRMS IN RUSSIA LISA D. COOK Harvard University EXECUTIVE SUMMARY This paper …

Financing the oil trade dlapipertradefinance.com

Trade Finance An introduction artnet.unescap.org

The trade finance products identified in this study reveal a menu of choices that are available to genuine traders to facilitate trade. Exporters and importers enter into an agreement to trade more often than not by way of cash payment or through some more . 6 complex form of trade financing. Such trade finance products include bills of exchange, counter trade, letters of credit and open

Trade finance is a key component in maintaining a competitive and productive economy. London’s position as a major financial centre could be severely affected if banks engaging in trade finance activity do not have appropriate systems and controls to prevent money

finance area of studies and practice involves the interaction between firms and financial markets and Investments area of studies and practice involves the interaction …

The Raymond and Beverly Sackler Faculty of Exact Sciences The Blavatnik School of Computer Science Machine Learning Algorithms with Applications in Finance

PONDICHERRY UNIVERSITY (A Central University) DIRECTORATE OF DISTANCE EDUCATION International Trade and Finance Paper Code: MBFM 4003 MBA – FINANCE

trade finance activities, understands the need to interface with current case management and screening systems, realizes the necessity of auditability, and provides reports and dashboards for investigators and officers alike.

ISBN 978-0-8213-8748-1 SKU 18748

Alarming Concerns of Financial Crimes Risk in Trade Finance

The moves towards ‘free trade’ of the 19th century were largely offset by the reintroduction of tariffs in the early part of the 20 th century at rates sometimes as high as 33 and 50%.

trade finance activities, understands the need to interface with current case management and screening systems, realizes the necessity of auditability, and provides reports and dashboards for investigators and officers alike.

1 5430408_3.docx FinTech inTrade& Trade Finance FinTech is now a commonplaceterm used generically to describe new and innovative financial products born out of technology, ranging from consumer and SME focused e-payment and money

DCB’S TRADE FINANCE PRODUCTS At DCB, we offer a comprehensive trade finance products that allow importers and exporters to maximize on many opportunities available in the global market. Our trade finance products include: Telegraphic Transfer (TT), Letters of Credit, Documentary Collections, Bill Discounting, and Bank Guarantees. 1.0 Telegraphic Transfers (TT) It is an electronic method of

Trade finance refers to the financing of imports and exports by the sources of interbank’s credits, attracted by foreign banks with use of financial instruments, such as letters of credit or guarantees.

An illustration of globalisation is given by the growth in world trade as a percentage of world aggregate output (global gross national product (GNP)). In the early 1960s global exports and imports were about one-fifth of global

London and Philadelphia ANDERS GRATH International Trade and Finance The Complete Guide to Risk Management, International Payments and Currency Management, Bonds and Guarantees, Credit Insurance and Trade Finance THE HANDBOOK OF CGT Int’l Trade Finance TP:Layout 1 30/4/08 12:54 Page 1. Publisher’s note Every possible effort has been made to ensure that the information …

International Standard Banking Practice –ICC Publication 745 A selection of screens from the 12 segments of the ISBP module. Foreword The screens that follow are a sample taken from an ISBP module that forms part of an extensive training suite covering basic, intermediary and advanced elements of Trade Finance that is being established. These modules will be available to anyone who …

2 Overview of Quantitative Finance 3 Careers for Quants 4 Pre-U Math 5 Programming Christopher Ting QF 101 Week 1 August 19, 20162/35. PreambleOverview of Quantitative FinanceCareers for QuantsPre-U MathProgramming About this 101 Course}introduces you to the essentials of Quantitative Finance models}provides athree-principle frameworkto navigate through the forest of mathematical models

Trade Finance during the Great Trade Collapse is the product of a fruitful collaboration during the crisis among the World Bank Group, international financial partners, private banks, and academia.

Trade finance is a key component in maintaining a competitive and productive economy. London’s position as a major financial centre could be severely affected if banks engaging in trade finance activity do not have appropriate systems and controls to prevent money

3 Definition “Structured Trade Finance is the means through which capital solutions (both funded and non-funded) are provided outside the traditional fall back on securities – …

Machine Learning Algorithms with Applications in Finance

Oracle FLEXCUBE Direct Banking Release 12.0.1.0.0

The moves towards ‘free trade’ of the 19th century were largely offset by the reintroduction of tariffs in the early part of the 20 th century at rates sometimes as high as 33 and 50%.

• Trade finance is an essential enabler of trade • But little research work in this area as yet –National situation often unclear and unmonitored (from a trade

As the world’s leading trade, commodity and export finance publisher and event organiser, GTR offers sponsors and advertisers unrivalled exposure and profiling among their

Trade finance is a key component in maintaining a competitive and productive economy. London’s position as a major financial centre could be severely affected if banks engaging in trade finance activity do not have appropriate systems and controls to prevent money

Financing the oil trade dlapipertradefinance.com

Machine Learning Algorithms with Applications in Finance

undertake a review of existing trade finance services in the Euromed region. The enhancement of international trade has historically been the cornerstone of economic growth in the world, leading to the reduction of poverty and greater national prosperity. This concept is supported by a plethora of economic analyses which demonstrate the importance of trade finance to a country‘s overall

See also Lawrence H. Summers, Continuing the Fight Against International Trade Finance Subsidies , in The Ex-Im Bank in the 21st Century 258 (Gary Clyde Hufbauer & Rita M. Rodriguez eds., 2001) (arguing that the Arrangement is not legally binding).

TRADE CREDIT AND BANK FINANCE: FINANCING SMALL FIRMS IN RUSSIA LISA D. COOK Harvard University EXECUTIVE SUMMARY This paper …

An illustration of globalisation is given by the growth in world trade as a percentage of world aggregate output (global gross national product (GNP)). In the early 1960s global exports and imports were about one-fifth of global

Trade Finance during the Great Trade Collapse is the product of a fruitful collaboration during the crisis among the World Bank Group, international financial partners, private banks, and academia.

DCB’S TRADE FINANCE PRODUCTS At DCB, we offer a comprehensive trade finance products that allow importers and exporters to maximize on many opportunities available in the global market. Our trade finance products include: Telegraphic Transfer (TT), Letters of Credit, Documentary Collections, Bill Discounting, and Bank Guarantees. 1.0 Telegraphic Transfers (TT) It is an electronic method of

structured trade and commodity finance oil trade transfers the property in goods is always a question of fact.” The rights of a financing bank If the transfer is by way of pledge, the bank will have a “special property” in the oil represented by the bill, while the “general property” will remain unaffected by the transfer of the bill. What does this mean? In practical terms, the

RASMALA TRADE FINANCE FUND (the “Fund”) is a Cayman Islands exempted company incorporated pursuant to the Companies Law with limited liability on9 October 2013. The Fund commenced operations on 31 October 2013. The Fund’s investment manager is Rasmala Investment Bank Ltd. (the “Investment Manager”), a company incorporated under the laws of the Dubai International Financial Centreand

zubac trade filetype:pdf Yahoo Finance Bloomberg CNBC Google Finance MarketWatch. Sports Sports: zubac trade filetype:pdf ESPN Basketball Reference SportsStats Sports Illustrated Yahoo Sports SBNation Soccer: FIFA Soccer News WorldSoccer MLS Soccer Basketball: NBA RealGM Basketball Insiders NCAA HoopsHype Hockey: Hockey News NHL TSN Sportsnet NHL Trade Football: NFL Baseball: MLB MLB Trade

1 5430408_3.docx FinTech inTrade& Trade Finance FinTech is now a commonplaceterm used generically to describe new and innovative financial products born out of technology, ranging from consumer and SME focused e-payment and money

A trade application is routed through the Issuing Bank and Advising Bank. The application supports attaching of necessary documents to the underlying trade contract. Using Attach documents transaction you can attach scanned copies of Instructions to the bank.

TD/B/C.I/MEM.2/10 3 5. However, since the second half of 2008, as the financial crisis took hold, trade finance – like global finance more generally – began to dry up, while the cost of credit

Free PDF: International Corporate Finance Robin Pdf Score your highest in corporate finance The math, formulas, and problems associated with corporate finance can be International Financial Management, Abridged Edition

CHAPTER 20 International Business Finance

Forex forecasting Wharton Finance – Finance Department

Free PDF: International Corporate Finance Robin Pdf Score your highest in corporate finance The math, formulas, and problems associated with corporate finance can be International Financial Management, Abridged Edition

undertake a review of existing trade finance services in the Euromed region. The enhancement of international trade has historically been the cornerstone of economic growth in the world, leading to the reduction of poverty and greater national prosperity. This concept is supported by a plethora of economic analyses which demonstrate the importance of trade finance to a country‘s overall

structured trade and commodity finance oil trade transfers the property in goods is always a question of fact.” The rights of a financing bank If the transfer is by way of pledge, the bank will have a “special property” in the oil represented by the bill, while the “general property” will remain unaffected by the transfer of the bill. What does this mean? In practical terms, the

2 Overview of Quantitative Finance 3 Careers for Quants 4 Pre-U Math 5 Programming Christopher Ting QF 101 Week 1 August 19, 20162/35. PreambleOverview of Quantitative FinanceCareers for QuantsPre-U MathProgramming About this 101 Course}introduces you to the essentials of Quantitative Finance models}provides athree-principle frameworkto navigate through the forest of mathematical models

ISBN 978-0-8213-8748-1 SKU 18748

TRADE CREDIT AND BANK FINANCE FINANCING SMALL FIRMS

Specialist import finance companies can provide a range of financing options to suit your circumstances. VAT and duty Unless buying on delivered-duty-paid terms, importers are generally responsible for arranging customs clearance and paying any VAT and duty. A Import VAT of 17.5 per cent is raised on all imports of standard-rated goods. You need only account for VAT for goods …

An illustration of globalisation is given by the growth in world trade as a percentage of world aggregate output (global gross national product (GNP)). In the early 1960s global exports and imports were about one-fifth of global

The Handbook of International Trade and Finance The Complete Guide to Risk Management, International Payments and Currency Management, Bonds and Guarantees, Credit Insurance and Trade Finance

TRADE CREDIT AND BANK FINANCE: FINANCING SMALL FIRMS IN RUSSIA LISA D. COOK Harvard University EXECUTIVE SUMMARY This paper …

Alarming Concerns of Financial Crimes Risk in Trade Finance

ISBN 978-0-8213-8748-1 SKU 18748

International Trade Finance Topics in International Finance PART 6 M17_MOFF8079_04_SE_C17.QXD 7/1/11 2:31 PM Page W-1. LEARNING OBJECTIVES Separate total risk of a portfolio into two components,diversifiable and non-diversifiable. Demonstrate how the diversifiable and non-diversifiable risks of an investor’s portfolio may be reduced through international …

International Standard Banking Practice –ICC Publication 745 A selection of screens from the 12 segments of the ISBP module. Foreword The screens that follow are a sample taken from an ISBP module that forms part of an extensive training suite covering basic, intermediary and advanced elements of Trade Finance that is being established. These modules will be available to anyone who …

finance area of studies and practice involves the interaction between firms and financial markets and Investments area of studies and practice involves the interaction …

undertake a review of existing trade finance services in the Euromed region. The enhancement of international trade has historically been the cornerstone of economic growth in the world, leading to the reduction of poverty and greater national prosperity. This concept is supported by a plethora of economic analyses which demonstrate the importance of trade finance to a country‘s overall

Free PDF: International Corporate Finance Robin Pdf Score your highest in corporate finance The math, formulas, and problems associated with corporate finance can be International Financial Management, Abridged Edition

Trade finance seems to be even more dollar denominated than global trade, with 80% of L/Cs, and a high proportion of the activities of global and local banks denominated in dollars.

The Handbook of International Trade and Finance The Complete Guide to Risk Management, International Payments and Currency Management, Bonds and Guarantees, Credit Insurance and Trade Finance

The Dynamics of International Trade Finance Regulation

Import finance abahe.co.uk

The trade finance products identified in this study reveal a menu of choices that are available to genuine traders to facilitate trade. Exporters and importers enter into an agreement to trade more often than not by way of cash payment or through some more . 6 complex form of trade financing. Such trade finance products include bills of exchange, counter trade, letters of credit and open

The moves towards ‘free trade’ of the 19th century were largely offset by the reintroduction of tariffs in the early part of the 20 th century at rates sometimes as high as 33 and 50%.

zubac trade filetype:pdf Yahoo Finance Bloomberg CNBC Google Finance MarketWatch. Sports Sports: zubac trade filetype:pdf ESPN Basketball Reference SportsStats Sports Illustrated Yahoo Sports SBNation Soccer: FIFA Soccer News WorldSoccer MLS Soccer Basketball: NBA RealGM Basketball Insiders NCAA HoopsHype Hockey: Hockey News NHL TSN Sportsnet NHL Trade Football: NFL Baseball: MLB MLB Trade

RASMALA TRADE FINANCE FUND (the “Fund”) is a Cayman Islands exempted company incorporated pursuant to the Companies Law with limited liability on9 October 2013. The Fund commenced operations on 31 October 2013. The Fund’s investment manager is Rasmala Investment Bank Ltd. (the “Investment Manager”), a company incorporated under the laws of the Dubai International Financial Centreand

London and Philadelphia ANDERS GRATH International Trade and Finance The Complete Guide to Risk Management, International Payments and Currency Management, Bonds and Guarantees, Credit Insurance and Trade Finance THE HANDBOOK OF CGT Int’l Trade Finance TP:Layout 1 30/4/08 12:54 Page 1. Publisher’s note Every possible effort has been made to ensure that the information …

of energy and trade finance matters, from advice on letters of credit, through to large-scale, working capital revolving credit facilities, reserve based financing, pre …

PONDICHERRY UNIVERSITY (A Central University) DIRECTORATE OF DISTANCE EDUCATION International Trade and Finance Paper Code: MBFM 4003 MBA – FINANCE

An illustration of globalisation is given by the growth in world trade as a percentage of world aggregate output (global gross national product (GNP)). In the early 1960s global exports and imports were about one-fifth of global

TD/B/C.I/MEM.2/10 3 5. However, since the second half of 2008, as the financial crisis took hold, trade finance – like global finance more generally – began to dry up, while the cost of credit

TRADE CREDIT AND BANK FINANCE: FINANCING SMALL FIRMS IN RUSSIA LISA D. COOK Harvard University EXECUTIVE SUMMARY This paper …

Review of Existing Trade Finance Services

Rasmala Trade FinanceFund

The moves towards ‘free trade’ of the 19th century were largely offset by the reintroduction of tariffs in the early part of the 20 th century at rates sometimes as high as 33 and 50%.

structured trade and commodity finance oil trade transfers the property in goods is always a question of fact.” The rights of a financing bank If the transfer is by way of pledge, the bank will have a “special property” in the oil represented by the bill, while the “general property” will remain unaffected by the transfer of the bill. What does this mean? In practical terms, the

About the Tutorial International Finance deals with the management of finances in a global business. It explains how to trade in international markets and how to exchange foreign currency, and earn profit through such activities. This tutorial provides a brief overview of the current trends in finance, along with detailed inputs on the current global markets, foreign exchange markets

Free PDF: International Corporate Finance Robin Pdf Score your highest in corporate finance The math, formulas, and problems associated with corporate finance can be International Financial Management, Abridged Edition

As the world’s leading trade, commodity and export finance publisher and event organiser, GTR offers sponsors and advertisers unrivalled exposure and profiling among their

International Financial Markets: A Diverse System Is the Key to Commerce 3 extension of credit by a firm to its customers . Firms in more well-developed financial

TRADE FINANCE MAGAZINE June 2005 – Awards for Excellence BEST COMMODITY BANK Winner: BNP Paribas Winner: BNP Paribas Highly commended: SG CIB This is the second year running that BNP Paribas (BNPP) has won this award, and the bank has done

International Standard Banking Practice –ICC Publication 745 A selection of screens from the 12 segments of the ISBP module. Foreword The screens that follow are a sample taken from an ISBP module that forms part of an extensive training suite covering basic, intermediary and advanced elements of Trade Finance that is being established. These modules will be available to anyone who …

London and Philadelphia ANDERS GRATH International Trade and Finance The Complete Guide to Risk Management, International Payments and Currency Management, Bonds and Guarantees, Credit Insurance and Trade Finance THE HANDBOOK OF CGT Int’l Trade Finance TP:Layout 1 30/4/08 12:54 Page 1. Publisher’s note Every possible effort has been made to ensure that the information …

Trade & Export Finance Conference 2017

London and Philadelphia bayanbox.ir

TD/B/C.I/MEM.2/10 3 5. However, since the second half of 2008, as the financial crisis took hold, trade finance – like global finance more generally – began to dry up, while the cost of credit

The moves towards ‘free trade’ of the 19th century were largely offset by the reintroduction of tariffs in the early part of the 20 th century at rates sometimes as high as 33 and 50%.

of energy and trade finance matters, from advice on letters of credit, through to large-scale, working capital revolving credit facilities, reserve based financing, pre …

The Raymond and Beverly Sackler Faculty of Exact Sciences The Blavatnik School of Computer Science Machine Learning Algorithms with Applications in Finance

Specialist import finance companies can provide a range of financing options to suit your circumstances. VAT and duty Unless buying on delivered-duty-paid terms, importers are generally responsible for arranging customs clearance and paying any VAT and duty. A Import VAT of 17.5 per cent is raised on all imports of standard-rated goods. You need only account for VAT for goods …

undertake a review of existing trade finance services in the Euromed region. The enhancement of international trade has historically been the cornerstone of economic growth in the world, leading to the reduction of poverty and greater national prosperity. This concept is supported by a plethora of economic analyses which demonstrate the importance of trade finance to a country‘s overall

PONDICHERRY UNIVERSITY (A Central University) DIRECTORATE OF DISTANCE EDUCATION International Trade and Finance Paper Code: MBFM 4003 MBA – FINANCE

1 5430408_3.docx FinTech inTrade& Trade Finance FinTech is now a commonplaceterm used generically to describe new and innovative financial products born out of technology, ranging from consumer and SME focused e-payment and money

RASMALA TRADE FINANCE FUND (the “Fund”) is a Cayman Islands exempted company incorporated pursuant to the Companies Law with limited liability on9 October 2013. The Fund commenced operations on 31 October 2013. The Fund’s investment manager is Rasmala Investment Bank Ltd. (the “Investment Manager”), a company incorporated under the laws of the Dubai International Financial Centreand

TRADE CREDIT AND BANK FINANCE: FINANCING SMALL FIRMS IN RUSSIA LISA D. COOK Harvard University EXECUTIVE SUMMARY This paper …

Trade & Export Finance Conference 2017

Oracle FLEXCUBE Direct Banking Release 12.0.1.0.0

Machine Learning Algorithms with Applications in Finance

of energy and trade finance matters, from advice on letters of credit, through to large-scale, working capital revolving credit facilities, reserve based financing, pre …

Financing the oil trade dlapipertradefinance.com

Organisation of Structured Export Financing by Commercial

FinTech inTrade& Trade Finance Simmons & Simmons

Specialist import finance companies can provide a range of financing options to suit your circumstances. VAT and duty Unless buying on delivered-duty-paid terms, importers are generally responsible for arranging customs clearance and paying any VAT and duty. A Import VAT of 17.5 per cent is raised on all imports of standard-rated goods. You need only account for VAT for goods …

Review of Existing Trade Finance Services

Alarming Concerns of Financial Crimes Risk in Trade Finance

Oracle FLEXCUBE Direct Banking Release 12.0.1.0.0

Trade Finance during the Great Trade Collapse is the product of a fruitful collaboration during the crisis among the World Bank Group, international financial partners, private banks, and academia.

TR13/3Banks’ control of financial crime risks in trade

London and Philadelphia ANDERS GRATH International Trade and Finance The Complete Guide to Risk Management, International Payments and Currency Management, Bonds and Guarantees, Credit Insurance and Trade Finance THE HANDBOOK OF CGT Int’l Trade Finance TP:Layout 1 30/4/08 12:54 Page 1. Publisher’s note Every possible effort has been made to ensure that the information …

INTERNATIONAL TRADE OIL AND GAS TRADING incelaw.com

Trade Finance Guide A Quick Reference for U.S. Exporters

TR13/3Banks’ control of financial crime risks in trade

DCB’S TRADE FINANCE PRODUCTS At DCB, we offer a comprehensive trade finance products that allow importers and exporters to maximize on many opportunities available in the global market. Our trade finance products include: Telegraphic Transfer (TT), Letters of Credit, Documentary Collections, Bill Discounting, and Bank Guarantees. 1.0 Telegraphic Transfers (TT) It is an electronic method of

London and Philadelphia bayanbox.ir

Trade & Export Finance Conference 2017

TRADE CREDIT AND BANK FINANCE: FINANCING SMALL FIRMS IN RUSSIA LISA D. COOK Harvard University EXECUTIVE SUMMARY This paper …

FinTech inTrade& Trade Finance Simmons & Simmons

Review of Existing Trade Finance Services