Risk analysis in financial management pdf

Credit Risk Credit Analysis Seven C’s Credit Analysis Process 2. Lending Process 8. Problem LoansObjectives Introduction Credit Process Documentation Loan Pricing and Profitability Analysis Regulations 3. Financial Statement Analysis-I Objectives Introduction Ratio Analysis Liquidity Ratios Turnover Ratios Profitability Ratios Leverage Ratios Market Ratios 4. Financial Statement Analysis …

The Risk Adjusted Discount Rate is composite of discount rate which combines .V.V: and LRX In the case of N. future cash flows should be discounted using Risk Adjusted Discount Rate and then N.P. 109 . which in turn are subject to risk attitude of management.V.P. The risk adjusted discount rate is a composite rate which combines both the time and discount factors. iv) This method of

Financial Management Act 2006. Compliance with this policy is mandatory to enhance governance and outcomes through effective and consistent risk management in and across the WA health system. 2. Scope This policy applies all Health Service Providers under the Health Services Act 20162 3. Policy statement The WA health system is committed to the management of its risks including those

KeywordS: organisational risk, risk analysis, risk management, organisational integrity, Supreme Audit Institution JeL codeS: D81, In public entities, the regulations of financial management and control systems were devel-oped in the course of a multiple-step process. After the legislative basis was created, the regulatory concept was developed under the influence of the coso model from

after-the-fact analysis of a risk failure, and many are enhancing scenario analysis and tools to better assess forward non-financial risk. This is akin to a financial-risk mindset, which aims to identify credit and market risks and anticipate their effects. To spur the change, a number of banks are moving the compliance function under the risk function. • Increased accountability of

The role of risk management in financial firms has evolved far beyond the simple insurance of identified risks, to a discipline that centres on complex econometric and financial models of uncertainty. Financial risk management has been defined by the Basel Committee (2001) as a

frameworks and guidance on enterprise risk management, internal control, and fraud deterrence designed to improve organizational performance and governance and to reduce the extent of fraud in organizations. COSO is a private-sector initiative jointly sponsored and funded by the following organizations: American Accounting Association (AAA) American Institute of CPAs (AICPA) Financial

Effective financial risk management: Extract Against this background, ‘financial risk’ may broadly be thought of as adverse movements in financial price or other events that impair financial condition, financial performance or other financial outcomes. For example, financial risk may affect the adequacy of returns or accessibility to finance at reasonable cost. These characteristics have

reached on model risk management in financial institutions (which are elaborated on in the appropriate sections of this document). Model risk definition and regulations 1. The use of mathematical models by financial institutions in many areas is rapidly gaining ground. This brings significant benefits (objectivity, automation, efficiency, etc.) but also entails costs. 2. Among these costs is

Risk Analysis 6. The risk-assessment approach is based largely on International Standard on Auditing 400 financial management, financial analysis and management accounting. In particular, few accounts staff possess practical skills beyond basic book-keeping. The impact of these skill shortages on Government operations is amplified by high demand for financial skills from the private sector

In a financial institution, enterprise risk management is normally thought of as the combination of credit risk, interest rate risk or asset liability management, liquidity risk, market risk, and operational risk.

Quantitative Analysis, Risk Management, Modelling, Algo-Trading, Blockchain for Finance Financial Risk Management The most current collection of articles on Financial Risk Management and Modeling at QuantAtRisk.com:

No. 18 Public Private Partnerships Risk Management, May 2005. No. 19 Public Private Partnerships Contract Management, May 2005. iv The Financial Management Guidance series of publications Archived. Contents v Introduction 1 Section A – Overview of Cost-Benefi t Analysis 3 1. Cost-Benefi t Analysis – An Overview 4 1.1 Explanation of cost-benefi t analysis 4 1.2 What is a CBA attempting

A top risk management practitioner addresses the essential aspects of modern financial risk management. In the Second Edition of Financial Risk Management + Website, market risk expert Steve Allen offers an insider’s view of this discipline and covers the strategies, principles, and measurement techniques necessary to manage

Risk Analysis Matrix CONSEQUENCES: Insignificant No injuries, low financial loss Minor First aid treatment, on-site release immediately contained, medium

management and fiduciary risk identification, “procurement” may be referred to as a separate system from other systems involved in PFM for clarity and precision. Public Financial Management Risk Assessment Framework (PFMRAF) is USAID’s risk management

Risk Analysis Matrix Club Help

https://www.youtube.com/embed/464hlwCV2ao

RISK ANALYSIS AND MANAGEMENT The Center for ETH Z

management in accordance with the Financial Accountability Act 2009, Financial and Performance Management Standard 2009 and Public Sector Ethics Act 1994. 3.2 Governance The Director-General and Department Leadership Team (DLT) members shall determine and communicate the department’s risk appetite to effectively manage and prioritise risks to meet obligations and provide oversight of risk

Country risk assessment is a critical foundation for disaster risk management and related financial strategies and requires clear rules and governance. Risk assessment needs to be comprehensive and well orchestrated both within government and with

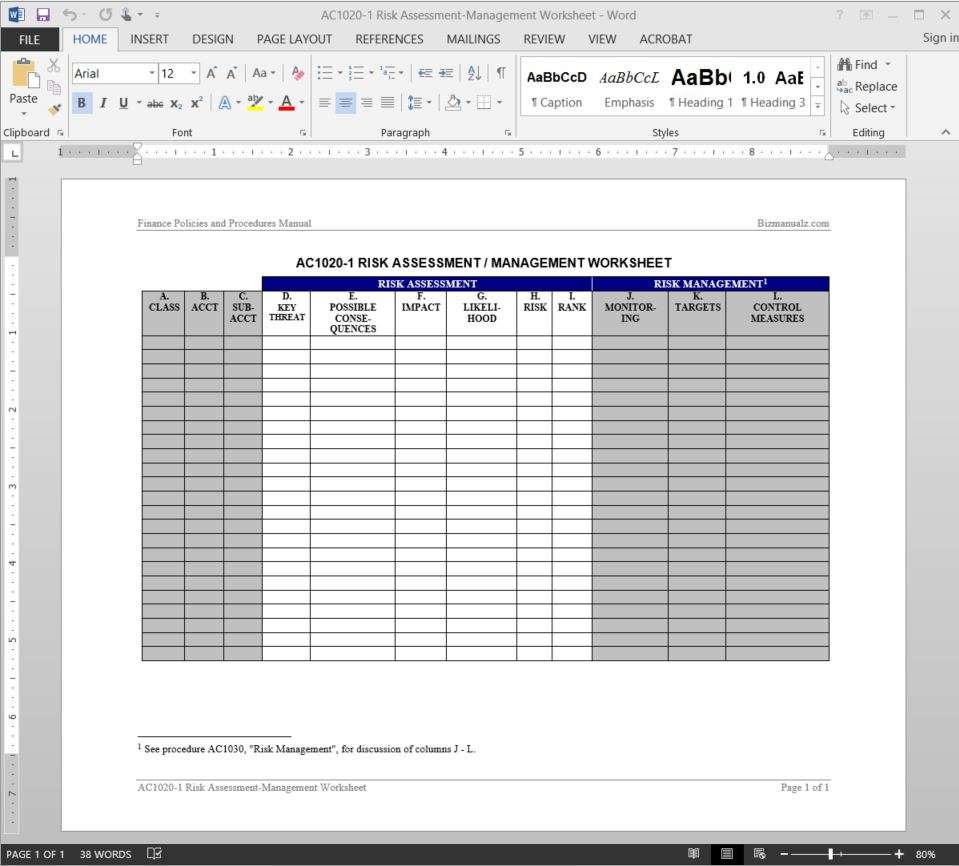

The sample risk analysis template has great benefits in risk management. In fact risk management can be made possible only when a risk analysis is done properly. Therefore you must make a proper risk analysis file. As you can see that making of a risk analysis report is not an easy affair. You have to involve and consider many important points to do that, and that is why when you are doing

Analysis for Financial Management Tenth Edition ROBERT C.HIGGINS (irmiente Keimers ot Finance The University of Washington, McGraw-Hill Irwin. Contents Preface XI PART ONE ASSESSING THE FINANCIAL HEALTH OF THE FIRM 1 Chapter 1 Interpreting Financial Statements 3 The Cash Flow Cycle 3 The Balance Sheet 6 Current Assets and Liabilities 9 Shareholders’ Equity 11 The Income …

formulation of the analysis theory on the basis of financial ratios, companies and entrepreneurs to calculate and use financial ratios to analyze their own business, for comparison with others in both the same business and the economy as a whole and for assessing business risks and to refer

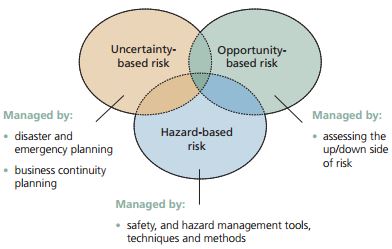

First, there is traditional risk management which focuses on financial risk and manages risks in individual cases. Next, there is enterprise risk management (ERM) which

Risk Assessment – The overall process of risk identification, risk analysis and risk evaluation. Risk Management – The culture, processes and structures that are directed towards realising potential

MMU Risk Analysis toolkit (v 5) Page 2 Project Role Risk Management Role Project Sponsor Ensures that risk management structures and processes are in place for the

risk/return profile, economic viability, financial sustainability, development impact, and overall contribution to realization of the mission of the Bank. Portfolio risk management and investment policies page 6 of 66

https://www.youtube.com/embed/KOX4HW5YsWE

Risk Management Policy Queensland Health

Credit Analysis KESDEE

financial-management-risk-analysis-in-capital-budgeting

WA Health Risk Management Policy

https://www.youtube.com/embed/55af7cmyczo

financial-management-risk-analysis-in-capital-budgeting

Credit Analysis KESDEE

after-the-fact analysis of a risk failure, and many are enhancing scenario analysis and tools to better assess forward non-financial risk. This is akin to a financial-risk mindset, which aims to identify credit and market risks and anticipate their effects. To spur the change, a number of banks are moving the compliance function under the risk function. • Increased accountability of

Effective financial risk management: Extract Against this background, ‘financial risk’ may broadly be thought of as adverse movements in financial price or other events that impair financial condition, financial performance or other financial outcomes. For example, financial risk may affect the adequacy of returns or accessibility to finance at reasonable cost. These characteristics have

Analysis for Financial Management Tenth Edition ROBERT C.HIGGINS (irmiente Keimers ot Finance The University of Washington, McGraw-Hill Irwin. Contents Preface XI PART ONE ASSESSING THE FINANCIAL HEALTH OF THE FIRM 1 Chapter 1 Interpreting Financial Statements 3 The Cash Flow Cycle 3 The Balance Sheet 6 Current Assets and Liabilities 9 Shareholders’ Equity 11 The Income …

Risk Assessment – The overall process of risk identification, risk analysis and risk evaluation. Risk Management – The culture, processes and structures that are directed towards realising potential

KeywordS: organisational risk, risk analysis, risk management, organisational integrity, Supreme Audit Institution JeL codeS: D81, In public entities, the regulations of financial management and control systems were devel-oped in the course of a multiple-step process. After the legislative basis was created, the regulatory concept was developed under the influence of the coso model from

management in accordance with the Financial Accountability Act 2009, Financial and Performance Management Standard 2009 and Public Sector Ethics Act 1994. 3.2 Governance The Director-General and Department Leadership Team (DLT) members shall determine and communicate the department’s risk appetite to effectively manage and prioritise risks to meet obligations and provide oversight of risk

Good Practice Example–Financial Management Report

Analysis for Financial Management GBV

Risk Assessment – The overall process of risk identification, risk analysis and risk evaluation. Risk Management – The culture, processes and structures that are directed towards realising potential

management in accordance with the Financial Accountability Act 2009, Financial and Performance Management Standard 2009 and Public Sector Ethics Act 1994. 3.2 Governance The Director-General and Department Leadership Team (DLT) members shall determine and communicate the department’s risk appetite to effectively manage and prioritise risks to meet obligations and provide oversight of risk

formulation of the analysis theory on the basis of financial ratios, companies and entrepreneurs to calculate and use financial ratios to analyze their own business, for comparison with others in both the same business and the economy as a whole and for assessing business risks and to refer

The sample risk analysis template has great benefits in risk management. In fact risk management can be made possible only when a risk analysis is done properly. Therefore you must make a proper risk analysis file. As you can see that making of a risk analysis report is not an easy affair. You have to involve and consider many important points to do that, and that is why when you are doing

MMU Risk Analysis toolkit (v 5) Page 2 Project Role Risk Management Role Project Sponsor Ensures that risk management structures and processes are in place for the

risk/return profile, economic viability, financial sustainability, development impact, and overall contribution to realization of the mission of the Bank. Portfolio risk management and investment policies page 6 of 66

Country risk assessment is a critical foundation for disaster risk management and related financial strategies and requires clear rules and governance. Risk assessment needs to be comprehensive and well orchestrated both within government and with

financial-management-risk-analysis-in-capital-budgeting

Analysis for Financial Management GBV

Risk Analysis 6. The risk-assessment approach is based largely on International Standard on Auditing 400 financial management, financial analysis and management accounting. In particular, few accounts staff possess practical skills beyond basic book-keeping. The impact of these skill shortages on Government operations is amplified by high demand for financial skills from the private sector

after-the-fact analysis of a risk failure, and many are enhancing scenario analysis and tools to better assess forward non-financial risk. This is akin to a financial-risk mindset, which aims to identify credit and market risks and anticipate their effects. To spur the change, a number of banks are moving the compliance function under the risk function. • Increased accountability of

Country risk assessment is a critical foundation for disaster risk management and related financial strategies and requires clear rules and governance. Risk assessment needs to be comprehensive and well orchestrated both within government and with

Risk Analysis Matrix CONSEQUENCES: Insignificant No injuries, low financial loss Minor First aid treatment, on-site release immediately contained, medium

frameworks and guidance on enterprise risk management, internal control, and fraud deterrence designed to improve organizational performance and governance and to reduce the extent of fraud in organizations. COSO is a private-sector initiative jointly sponsored and funded by the following organizations: American Accounting Association (AAA) American Institute of CPAs (AICPA) Financial

Analysis for Financial Management GBV

Credit Analysis KESDEE

Risk Assessment – The overall process of risk identification, risk analysis and risk evaluation. Risk Management – The culture, processes and structures that are directed towards realising potential

frameworks and guidance on enterprise risk management, internal control, and fraud deterrence designed to improve organizational performance and governance and to reduce the extent of fraud in organizations. COSO is a private-sector initiative jointly sponsored and funded by the following organizations: American Accounting Association (AAA) American Institute of CPAs (AICPA) Financial

reached on model risk management in financial institutions (which are elaborated on in the appropriate sections of this document). Model risk definition and regulations 1. The use of mathematical models by financial institutions in many areas is rapidly gaining ground. This brings significant benefits (objectivity, automation, efficiency, etc.) but also entails costs. 2. Among these costs is

Risk Analysis 6. The risk-assessment approach is based largely on International Standard on Auditing 400 financial management, financial analysis and management accounting. In particular, few accounts staff possess practical skills beyond basic book-keeping. The impact of these skill shortages on Government operations is amplified by high demand for financial skills from the private sector

management and fiduciary risk identification, “procurement” may be referred to as a separate system from other systems involved in PFM for clarity and precision. Public Financial Management Risk Assessment Framework (PFMRAF) is USAID’s risk management

RISK ANALYSIS AND MANAGEMENT The Center for ETH Z

Financial Risk Management and Modeling QuantAtRisk

No. 18 Public Private Partnerships Risk Management, May 2005. No. 19 Public Private Partnerships Contract Management, May 2005. iv The Financial Management Guidance series of publications Archived. Contents v Introduction 1 Section A – Overview of Cost-Benefi t Analysis 3 1. Cost-Benefi t Analysis – An Overview 4 1.1 Explanation of cost-benefi t analysis 4 1.2 What is a CBA attempting

risk/return profile, economic viability, financial sustainability, development impact, and overall contribution to realization of the mission of the Bank. Portfolio risk management and investment policies page 6 of 66

MMU Risk Analysis toolkit (v 5) Page 2 Project Role Risk Management Role Project Sponsor Ensures that risk management structures and processes are in place for the

Analysis for Financial Management Tenth Edition ROBERT C.HIGGINS (irmiente Keimers ot Finance The University of Washington, McGraw-Hill Irwin. Contents Preface XI PART ONE ASSESSING THE FINANCIAL HEALTH OF THE FIRM 1 Chapter 1 Interpreting Financial Statements 3 The Cash Flow Cycle 3 The Balance Sheet 6 Current Assets and Liabilities 9 Shareholders’ Equity 11 The Income …

Risk Analysis 6. The risk-assessment approach is based largely on International Standard on Auditing 400 financial management, financial analysis and management accounting. In particular, few accounts staff possess practical skills beyond basic book-keeping. The impact of these skill shortages on Government operations is amplified by high demand for financial skills from the private sector

Credit Analysis KESDEE

RISK ANALYSIS AND MANAGEMENT The Center for ETH Z

Risk Analysis Matrix CONSEQUENCES: Insignificant No injuries, low financial loss Minor First aid treatment, on-site release immediately contained, medium

frameworks and guidance on enterprise risk management, internal control, and fraud deterrence designed to improve organizational performance and governance and to reduce the extent of fraud in organizations. COSO is a private-sector initiative jointly sponsored and funded by the following organizations: American Accounting Association (AAA) American Institute of CPAs (AICPA) Financial

MMU Risk Analysis toolkit (v 5) Page 2 Project Role Risk Management Role Project Sponsor Ensures that risk management structures and processes are in place for the

In a financial institution, enterprise risk management is normally thought of as the combination of credit risk, interest rate risk or asset liability management, liquidity risk, market risk, and operational risk.

after-the-fact analysis of a risk failure, and many are enhancing scenario analysis and tools to better assess forward non-financial risk. This is akin to a financial-risk mindset, which aims to identify credit and market risks and anticipate their effects. To spur the change, a number of banks are moving the compliance function under the risk function. • Increased accountability of

KeywordS: organisational risk, risk analysis, risk management, organisational integrity, Supreme Audit Institution JeL codeS: D81, In public entities, the regulations of financial management and control systems were devel-oped in the course of a multiple-step process. After the legislative basis was created, the regulatory concept was developed under the influence of the coso model from

Effective financial risk management: Extract Against this background, ‘financial risk’ may broadly be thought of as adverse movements in financial price or other events that impair financial condition, financial performance or other financial outcomes. For example, financial risk may affect the adequacy of returns or accessibility to finance at reasonable cost. These characteristics have

No. 18 Public Private Partnerships Risk Management, May 2005. No. 19 Public Private Partnerships Contract Management, May 2005. iv The Financial Management Guidance series of publications Archived. Contents v Introduction 1 Section A – Overview of Cost-Benefi t Analysis 3 1. Cost-Benefi t Analysis – An Overview 4 1.1 Explanation of cost-benefi t analysis 4 1.2 What is a CBA attempting

Risk Analysis 6. The risk-assessment approach is based largely on International Standard on Auditing 400 financial management, financial analysis and management accounting. In particular, few accounts staff possess practical skills beyond basic book-keeping. The impact of these skill shortages on Government operations is amplified by high demand for financial skills from the private sector

Analysis for Financial Management Tenth Edition ROBERT C.HIGGINS (irmiente Keimers ot Finance The University of Washington, McGraw-Hill Irwin. Contents Preface XI PART ONE ASSESSING THE FINANCIAL HEALTH OF THE FIRM 1 Chapter 1 Interpreting Financial Statements 3 The Cash Flow Cycle 3 The Balance Sheet 6 Current Assets and Liabilities 9 Shareholders’ Equity 11 The Income …

First, there is traditional risk management which focuses on financial risk and manages risks in individual cases. Next, there is enterprise risk management (ERM) which

risk/return profile, economic viability, financial sustainability, development impact, and overall contribution to realization of the mission of the Bank. Portfolio risk management and investment policies page 6 of 66

management and fiduciary risk identification, “procurement” may be referred to as a separate system from other systems involved in PFM for clarity and precision. Public Financial Management Risk Assessment Framework (PFMRAF) is USAID’s risk management

Analysis for Financial Management GBV

Credit Analysis KESDEE

MMU Risk Analysis toolkit (v 5) Page 2 Project Role Risk Management Role Project Sponsor Ensures that risk management structures and processes are in place for the

A top risk management practitioner addresses the essential aspects of modern financial risk management. In the Second Edition of Financial Risk Management Website, market risk expert Steve Allen offers an insider’s view of this discipline and covers the strategies, principles, and measurement techniques necessary to manage

Financial Management Act 2006. Compliance with this policy is mandatory to enhance governance and outcomes through effective and consistent risk management in and across the WA health system. 2. Scope This policy applies all Health Service Providers under the Health Services Act 20162 3. Policy statement The WA health system is committed to the management of its risks including those

KeywordS: organisational risk, risk analysis, risk management, organisational integrity, Supreme Audit Institution JeL codeS: D81, In public entities, the regulations of financial management and control systems were devel-oped in the course of a multiple-step process. After the legislative basis was created, the regulatory concept was developed under the influence of the coso model from

Quantitative Analysis, Risk Management, Modelling, Algo-Trading, Blockchain for Finance Financial Risk Management The most current collection of articles on Financial Risk Management and Modeling at QuantAtRisk.com:

No. 18 Public Private Partnerships Risk Management, May 2005. No. 19 Public Private Partnerships Contract Management, May 2005. iv The Financial Management Guidance series of publications Archived. Contents v Introduction 1 Section A – Overview of Cost-Benefi t Analysis 3 1. Cost-Benefi t Analysis – An Overview 4 1.1 Explanation of cost-benefi t analysis 4 1.2 What is a CBA attempting

risk/return profile, economic viability, financial sustainability, development impact, and overall contribution to realization of the mission of the Bank. Portfolio risk management and investment policies page 6 of 66

reached on model risk management in financial institutions (which are elaborated on in the appropriate sections of this document). Model risk definition and regulations 1. The use of mathematical models by financial institutions in many areas is rapidly gaining ground. This brings significant benefits (objectivity, automation, efficiency, etc.) but also entails costs. 2. Among these costs is

The sample risk analysis template has great benefits in risk management. In fact risk management can be made possible only when a risk analysis is done properly. Therefore you must make a proper risk analysis file. As you can see that making of a risk analysis report is not an easy affair. You have to involve and consider many important points to do that, and that is why when you are doing

Risk Analysis 6. The risk-assessment approach is based largely on International Standard on Auditing 400 financial management, financial analysis and management accounting. In particular, few accounts staff possess practical skills beyond basic book-keeping. The impact of these skill shortages on Government operations is amplified by high demand for financial skills from the private sector

Analysis for Financial Management Tenth Edition ROBERT C.HIGGINS (irmiente Keimers ot Finance The University of Washington, McGraw-Hill Irwin. Contents Preface XI PART ONE ASSESSING THE FINANCIAL HEALTH OF THE FIRM 1 Chapter 1 Interpreting Financial Statements 3 The Cash Flow Cycle 3 The Balance Sheet 6 Current Assets and Liabilities 9 Shareholders’ Equity 11 The Income …

formulation of the analysis theory on the basis of financial ratios, companies and entrepreneurs to calculate and use financial ratios to analyze their own business, for comparison with others in both the same business and the economy as a whole and for assessing business risks and to refer

management and fiduciary risk identification, “procurement” may be referred to as a separate system from other systems involved in PFM for clarity and precision. Public Financial Management Risk Assessment Framework (PFMRAF) is USAID’s risk management

Risk Analysis Matrix Club Help

Good Practice Example–Financial Management Report

MMU Risk Analysis toolkit (v 5) Page 2 Project Role Risk Management Role Project Sponsor Ensures that risk management structures and processes are in place for the

after-the-fact analysis of a risk failure, and many are enhancing scenario analysis and tools to better assess forward non-financial risk. This is akin to a financial-risk mindset, which aims to identify credit and market risks and anticipate their effects. To spur the change, a number of banks are moving the compliance function under the risk function. • Increased accountability of

In a financial institution, enterprise risk management is normally thought of as the combination of credit risk, interest rate risk or asset liability management, liquidity risk, market risk, and operational risk.

Financial Management Act 2006. Compliance with this policy is mandatory to enhance governance and outcomes through effective and consistent risk management in and across the WA health system. 2. Scope This policy applies all Health Service Providers under the Health Services Act 20162 3. Policy statement The WA health system is committed to the management of its risks including those

Analysis for Financial Management Tenth Edition ROBERT C.HIGGINS (irmiente Keimers ot Finance The University of Washington, McGraw-Hill Irwin. Contents Preface XI PART ONE ASSESSING THE FINANCIAL HEALTH OF THE FIRM 1 Chapter 1 Interpreting Financial Statements 3 The Cash Flow Cycle 3 The Balance Sheet 6 Current Assets and Liabilities 9 Shareholders’ Equity 11 The Income …

management and fiduciary risk identification, “procurement” may be referred to as a separate system from other systems involved in PFM for clarity and precision. Public Financial Management Risk Assessment Framework (PFMRAF) is USAID’s risk management

No. 18 Public Private Partnerships Risk Management, May 2005. No. 19 Public Private Partnerships Contract Management, May 2005. iv The Financial Management Guidance series of publications Archived. Contents v Introduction 1 Section A – Overview of Cost-Benefi t Analysis 3 1. Cost-Benefi t Analysis – An Overview 4 1.1 Explanation of cost-benefi t analysis 4 1.2 What is a CBA attempting

reached on model risk management in financial institutions (which are elaborated on in the appropriate sections of this document). Model risk definition and regulations 1. The use of mathematical models by financial institutions in many areas is rapidly gaining ground. This brings significant benefits (objectivity, automation, efficiency, etc.) but also entails costs. 2. Among these costs is

First, there is traditional risk management which focuses on financial risk and manages risks in individual cases. Next, there is enterprise risk management (ERM) which

The Risk Adjusted Discount Rate is composite of discount rate which combines .V.V: and LRX In the case of N. future cash flows should be discounted using Risk Adjusted Discount Rate and then N.P. 109 . which in turn are subject to risk attitude of management.V.P. The risk adjusted discount rate is a composite rate which combines both the time and discount factors. iv) This method of

management in accordance with the Financial Accountability Act 2009, Financial and Performance Management Standard 2009 and Public Sector Ethics Act 1994. 3.2 Governance The Director-General and Department Leadership Team (DLT) members shall determine and communicate the department’s risk appetite to effectively manage and prioritise risks to meet obligations and provide oversight of risk

Risk Analysis Matrix Club Help

Analysis for Financial Management GBV

A top risk management practitioner addresses the essential aspects of modern financial risk management. In the Second Edition of Financial Risk Management Website, market risk expert Steve Allen offers an insider’s view of this discipline and covers the strategies, principles, and measurement techniques necessary to manage

after-the-fact analysis of a risk failure, and many are enhancing scenario analysis and tools to better assess forward non-financial risk. This is akin to a financial-risk mindset, which aims to identify credit and market risks and anticipate their effects. To spur the change, a number of banks are moving the compliance function under the risk function. • Increased accountability of

First, there is traditional risk management which focuses on financial risk and manages risks in individual cases. Next, there is enterprise risk management (ERM) which

formulation of the analysis theory on the basis of financial ratios, companies and entrepreneurs to calculate and use financial ratios to analyze their own business, for comparison with others in both the same business and the economy as a whole and for assessing business risks and to refer

risk/return profile, economic viability, financial sustainability, development impact, and overall contribution to realization of the mission of the Bank. Portfolio risk management and investment policies page 6 of 66

Financial Management Act 2006. Compliance with this policy is mandatory to enhance governance and outcomes through effective and consistent risk management in and across the WA health system. 2. Scope This policy applies all Health Service Providers under the Health Services Act 20162 3. Policy statement The WA health system is committed to the management of its risks including those

Country risk assessment is a critical foundation for disaster risk management and related financial strategies and requires clear rules and governance. Risk assessment needs to be comprehensive and well orchestrated both within government and with

Effective financial risk management: Extract Against this background, ‘financial risk’ may broadly be thought of as adverse movements in financial price or other events that impair financial condition, financial performance or other financial outcomes. For example, financial risk may affect the adequacy of returns or accessibility to finance at reasonable cost. These characteristics have

The role of risk management in financial firms has evolved far beyond the simple insurance of identified risks, to a discipline that centres on complex econometric and financial models of uncertainty. Financial risk management has been defined by the Basel Committee (2001) as a

WA Health Risk Management Policy

Good Practice Example–Financial Management Report

Country risk assessment is a critical foundation for disaster risk management and related financial strategies and requires clear rules and governance. Risk assessment needs to be comprehensive and well orchestrated both within government and with

The role of risk management in financial firms has evolved far beyond the simple insurance of identified risks, to a discipline that centres on complex econometric and financial models of uncertainty. Financial risk management has been defined by the Basel Committee (2001) as a

Credit Risk Credit Analysis Seven C’s Credit Analysis Process 2. Lending Process 8. Problem LoansObjectives Introduction Credit Process Documentation Loan Pricing and Profitability Analysis Regulations 3. Financial Statement Analysis-I Objectives Introduction Ratio Analysis Liquidity Ratios Turnover Ratios Profitability Ratios Leverage Ratios Market Ratios 4. Financial Statement Analysis …

formulation of the analysis theory on the basis of financial ratios, companies and entrepreneurs to calculate and use financial ratios to analyze their own business, for comparison with others in both the same business and the economy as a whole and for assessing business risks and to refer

A top risk management practitioner addresses the essential aspects of modern financial risk management. In the Second Edition of Financial Risk Management Website, market risk expert Steve Allen offers an insider’s view of this discipline and covers the strategies, principles, and measurement techniques necessary to manage

risk/return profile, economic viability, financial sustainability, development impact, and overall contribution to realization of the mission of the Bank. Portfolio risk management and investment policies page 6 of 66

frameworks and guidance on enterprise risk management, internal control, and fraud deterrence designed to improve organizational performance and governance and to reduce the extent of fraud in organizations. COSO is a private-sector initiative jointly sponsored and funded by the following organizations: American Accounting Association (AAA) American Institute of CPAs (AICPA) Financial

Quantitative Analysis, Risk Management, Modelling, Algo-Trading, Blockchain for Finance Financial Risk Management The most current collection of articles on Financial Risk Management and Modeling at QuantAtRisk.com:

KeywordS: organisational risk, risk analysis, risk management, organisational integrity, Supreme Audit Institution JeL codeS: D81, In public entities, the regulations of financial management and control systems were devel-oped in the course of a multiple-step process. After the legislative basis was created, the regulatory concept was developed under the influence of the coso model from

The sample risk analysis template has great benefits in risk management. In fact risk management can be made possible only when a risk analysis is done properly. Therefore you must make a proper risk analysis file. As you can see that making of a risk analysis report is not an easy affair. You have to involve and consider many important points to do that, and that is why when you are doing

Good Practice Example–Financial Management Report

RISK ANALYSIS AND MANAGEMENT The Center for ETH Z

Effective financial risk management: Extract Against this background, ‘financial risk’ may broadly be thought of as adverse movements in financial price or other events that impair financial condition, financial performance or other financial outcomes. For example, financial risk may affect the adequacy of returns or accessibility to finance at reasonable cost. These characteristics have

Quantitative Analysis, Risk Management, Modelling, Algo-Trading, Blockchain for Finance Financial Risk Management The most current collection of articles on Financial Risk Management and Modeling at QuantAtRisk.com:

risk/return profile, economic viability, financial sustainability, development impact, and overall contribution to realization of the mission of the Bank. Portfolio risk management and investment policies page 6 of 66

Country risk assessment is a critical foundation for disaster risk management and related financial strategies and requires clear rules and governance. Risk assessment needs to be comprehensive and well orchestrated both within government and with

MMU Risk Analysis toolkit (v 5) Page 2 Project Role Risk Management Role Project Sponsor Ensures that risk management structures and processes are in place for the

management in accordance with the Financial Accountability Act 2009, Financial and Performance Management Standard 2009 and Public Sector Ethics Act 1994. 3.2 Governance The Director-General and Department Leadership Team (DLT) members shall determine and communicate the department’s risk appetite to effectively manage and prioritise risks to meet obligations and provide oversight of risk

Risk Assessment – The overall process of risk identification, risk analysis and risk evaluation. Risk Management – The culture, processes and structures that are directed towards realising potential

Credit Analysis KESDEE

Financial Risk Management and Modeling QuantAtRisk

risk/return profile, economic viability, financial sustainability, development impact, and overall contribution to realization of the mission of the Bank. Portfolio risk management and investment policies page 6 of 66

No. 18 Public Private Partnerships Risk Management, May 2005. No. 19 Public Private Partnerships Contract Management, May 2005. iv The Financial Management Guidance series of publications Archived. Contents v Introduction 1 Section A – Overview of Cost-Benefi t Analysis 3 1. Cost-Benefi t Analysis – An Overview 4 1.1 Explanation of cost-benefi t analysis 4 1.2 What is a CBA attempting

Quantitative Analysis, Risk Management, Modelling, Algo-Trading, Blockchain for Finance Financial Risk Management The most current collection of articles on Financial Risk Management and Modeling at QuantAtRisk.com:

frameworks and guidance on enterprise risk management, internal control, and fraud deterrence designed to improve organizational performance and governance and to reduce the extent of fraud in organizations. COSO is a private-sector initiative jointly sponsored and funded by the following organizations: American Accounting Association (AAA) American Institute of CPAs (AICPA) Financial

Effective financial risk management: Extract Against this background, ‘financial risk’ may broadly be thought of as adverse movements in financial price or other events that impair financial condition, financial performance or other financial outcomes. For example, financial risk may affect the adequacy of returns or accessibility to finance at reasonable cost. These characteristics have

Good Practice Example–Financial Management Report

RISK ANALYSIS AND MANAGEMENT The Center for ETH Z

Risk Analysis Matrix CONSEQUENCES: Insignificant No injuries, low financial loss Minor First aid treatment, on-site release immediately contained, medium

reached on model risk management in financial institutions (which are elaborated on in the appropriate sections of this document). Model risk definition and regulations 1. The use of mathematical models by financial institutions in many areas is rapidly gaining ground. This brings significant benefits (objectivity, automation, efficiency, etc.) but also entails costs. 2. Among these costs is

The Risk Adjusted Discount Rate is composite of discount rate which combines .V.V: and LRX In the case of N. future cash flows should be discounted using Risk Adjusted Discount Rate and then N.P. 109 . which in turn are subject to risk attitude of management.V.P. The risk adjusted discount rate is a composite rate which combines both the time and discount factors. iv) This method of

Credit Risk Credit Analysis Seven C’s Credit Analysis Process 2. Lending Process 8. Problem LoansObjectives Introduction Credit Process Documentation Loan Pricing and Profitability Analysis Regulations 3. Financial Statement Analysis-I Objectives Introduction Ratio Analysis Liquidity Ratios Turnover Ratios Profitability Ratios Leverage Ratios Market Ratios 4. Financial Statement Analysis …

Country risk assessment is a critical foundation for disaster risk management and related financial strategies and requires clear rules and governance. Risk assessment needs to be comprehensive and well orchestrated both within government and with

Financial Risk Management and Modeling QuantAtRisk

Risk Analysis Matrix Club Help

risk/return profile, economic viability, financial sustainability, development impact, and overall contribution to realization of the mission of the Bank. Portfolio risk management and investment policies page 6 of 66

First, there is traditional risk management which focuses on financial risk and manages risks in individual cases. Next, there is enterprise risk management (ERM) which

management and fiduciary risk identification, “procurement” may be referred to as a separate system from other systems involved in PFM for clarity and precision. Public Financial Management Risk Assessment Framework (PFMRAF) is USAID’s risk management

No. 18 Public Private Partnerships Risk Management, May 2005. No. 19 Public Private Partnerships Contract Management, May 2005. iv The Financial Management Guidance series of publications Archived. Contents v Introduction 1 Section A – Overview of Cost-Benefi t Analysis 3 1. Cost-Benefi t Analysis – An Overview 4 1.1 Explanation of cost-benefi t analysis 4 1.2 What is a CBA attempting

The role of risk management in financial firms has evolved far beyond the simple insurance of identified risks, to a discipline that centres on complex econometric and financial models of uncertainty. Financial risk management has been defined by the Basel Committee (2001) as a

management in accordance with the Financial Accountability Act 2009, Financial and Performance Management Standard 2009 and Public Sector Ethics Act 1994. 3.2 Governance The Director-General and Department Leadership Team (DLT) members shall determine and communicate the department’s risk appetite to effectively manage and prioritise risks to meet obligations and provide oversight of risk

KeywordS: organisational risk, risk analysis, risk management, organisational integrity, Supreme Audit Institution JeL codeS: D81, In public entities, the regulations of financial management and control systems were devel-oped in the course of a multiple-step process. After the legislative basis was created, the regulatory concept was developed under the influence of the coso model from

In a financial institution, enterprise risk management is normally thought of as the combination of credit risk, interest rate risk or asset liability management, liquidity risk, market risk, and operational risk.

The Risk Adjusted Discount Rate is composite of discount rate which combines .V.V: and LRX In the case of N. future cash flows should be discounted using Risk Adjusted Discount Rate and then N.P. 109 . which in turn are subject to risk attitude of management.V.P. The risk adjusted discount rate is a composite rate which combines both the time and discount factors. iv) This method of

Risk Analysis 6. The risk-assessment approach is based largely on International Standard on Auditing 400 financial management, financial analysis and management accounting. In particular, few accounts staff possess practical skills beyond basic book-keeping. The impact of these skill shortages on Government operations is amplified by high demand for financial skills from the private sector

Analysis for Financial Management GBV

financial-management-risk-analysis-in-capital-budgeting

MMU Risk Analysis toolkit (v 5) Page 2 Project Role Risk Management Role Project Sponsor Ensures that risk management structures and processes are in place for the

risk/return profile, economic viability, financial sustainability, development impact, and overall contribution to realization of the mission of the Bank. Portfolio risk management and investment policies page 6 of 66

Effective financial risk management: Extract Against this background, ‘financial risk’ may broadly be thought of as adverse movements in financial price or other events that impair financial condition, financial performance or other financial outcomes. For example, financial risk may affect the adequacy of returns or accessibility to finance at reasonable cost. These characteristics have

reached on model risk management in financial institutions (which are elaborated on in the appropriate sections of this document). Model risk definition and regulations 1. The use of mathematical models by financial institutions in many areas is rapidly gaining ground. This brings significant benefits (objectivity, automation, efficiency, etc.) but also entails costs. 2. Among these costs is

Risk Assessment – The overall process of risk identification, risk analysis and risk evaluation. Risk Management – The culture, processes and structures that are directed towards realising potential

In a financial institution, enterprise risk management is normally thought of as the combination of credit risk, interest rate risk or asset liability management, liquidity risk, market risk, and operational risk.

Risk Analysis Matrix CONSEQUENCES: Insignificant No injuries, low financial loss Minor First aid treatment, on-site release immediately contained, medium

Analysis for Financial Management Tenth Edition ROBERT C.HIGGINS (irmiente Keimers ot Finance The University of Washington, McGraw-Hill Irwin. Contents Preface XI PART ONE ASSESSING THE FINANCIAL HEALTH OF THE FIRM 1 Chapter 1 Interpreting Financial Statements 3 The Cash Flow Cycle 3 The Balance Sheet 6 Current Assets and Liabilities 9 Shareholders’ Equity 11 The Income …

after-the-fact analysis of a risk failure, and many are enhancing scenario analysis and tools to better assess forward non-financial risk. This is akin to a financial-risk mindset, which aims to identify credit and market risks and anticipate their effects. To spur the change, a number of banks are moving the compliance function under the risk function. • Increased accountability of

formulation of the analysis theory on the basis of financial ratios, companies and entrepreneurs to calculate and use financial ratios to analyze their own business, for comparison with others in both the same business and the economy as a whole and for assessing business risks and to refer

The Risk Adjusted Discount Rate is composite of discount rate which combines .V.V: and LRX In the case of N. future cash flows should be discounted using Risk Adjusted Discount Rate and then N.P. 109 . which in turn are subject to risk attitude of management.V.P. The risk adjusted discount rate is a composite rate which combines both the time and discount factors. iv) This method of

Financial Management Act 2006. Compliance with this policy is mandatory to enhance governance and outcomes through effective and consistent risk management in and across the WA health system. 2. Scope This policy applies all Health Service Providers under the Health Services Act 20162 3. Policy statement The WA health system is committed to the management of its risks including those

frameworks and guidance on enterprise risk management, internal control, and fraud deterrence designed to improve organizational performance and governance and to reduce the extent of fraud in organizations. COSO is a private-sector initiative jointly sponsored and funded by the following organizations: American Accounting Association (AAA) American Institute of CPAs (AICPA) Financial

Risk Analysis 6. The risk-assessment approach is based largely on International Standard on Auditing 400 financial management, financial analysis and management accounting. In particular, few accounts staff possess practical skills beyond basic book-keeping. The impact of these skill shortages on Government operations is amplified by high demand for financial skills from the private sector

financial-management-risk-analysis-in-capital-budgeting

Good Practice Example–Financial Management Report

Credit Risk Credit Analysis Seven C’s Credit Analysis Process 2. Lending Process 8. Problem LoansObjectives Introduction Credit Process Documentation Loan Pricing and Profitability Analysis Regulations 3. Financial Statement Analysis-I Objectives Introduction Ratio Analysis Liquidity Ratios Turnover Ratios Profitability Ratios Leverage Ratios Market Ratios 4. Financial Statement Analysis …

management in accordance with the Financial Accountability Act 2009, Financial and Performance Management Standard 2009 and Public Sector Ethics Act 1994. 3.2 Governance The Director-General and Department Leadership Team (DLT) members shall determine and communicate the department’s risk appetite to effectively manage and prioritise risks to meet obligations and provide oversight of risk

A top risk management practitioner addresses the essential aspects of modern financial risk management. In the Second Edition of Financial Risk Management Website, market risk expert Steve Allen offers an insider’s view of this discipline and covers the strategies, principles, and measurement techniques necessary to manage

Quantitative Analysis, Risk Management, Modelling, Algo-Trading, Blockchain for Finance Financial Risk Management The most current collection of articles on Financial Risk Management and Modeling at QuantAtRisk.com:

The sample risk analysis template has great benefits in risk management. In fact risk management can be made possible only when a risk analysis is done properly. Therefore you must make a proper risk analysis file. As you can see that making of a risk analysis report is not an easy affair. You have to involve and consider many important points to do that, and that is why when you are doing

RISK ANALYSIS AND MANAGEMENT The Center for ETH Z

Risk Management Policy Queensland Health

Quantitative Analysis, Risk Management, Modelling, Algo-Trading, Blockchain for Finance Financial Risk Management The most current collection of articles on Financial Risk Management and Modeling at QuantAtRisk.com:

risk/return profile, economic viability, financial sustainability, development impact, and overall contribution to realization of the mission of the Bank. Portfolio risk management and investment policies page 6 of 66

The sample risk analysis template has great benefits in risk management. In fact risk management can be made possible only when a risk analysis is done properly. Therefore you must make a proper risk analysis file. As you can see that making of a risk analysis report is not an easy affair. You have to involve and consider many important points to do that, and that is why when you are doing

after-the-fact analysis of a risk failure, and many are enhancing scenario analysis and tools to better assess forward non-financial risk. This is akin to a financial-risk mindset, which aims to identify credit and market risks and anticipate their effects. To spur the change, a number of banks are moving the compliance function under the risk function. • Increased accountability of

Good Practice Example–Financial Management Report

Financial Risk Management and Modeling QuantAtRisk

Risk Analysis 6. The risk-assessment approach is based largely on International Standard on Auditing 400 financial management, financial analysis and management accounting. In particular, few accounts staff possess practical skills beyond basic book-keeping. The impact of these skill shortages on Government operations is amplified by high demand for financial skills from the private sector

after-the-fact analysis of a risk failure, and many are enhancing scenario analysis and tools to better assess forward non-financial risk. This is akin to a financial-risk mindset, which aims to identify credit and market risks and anticipate their effects. To spur the change, a number of banks are moving the compliance function under the risk function. • Increased accountability of

KeywordS: organisational risk, risk analysis, risk management, organisational integrity, Supreme Audit Institution JeL codeS: D81, In public entities, the regulations of financial management and control systems were devel-oped in the course of a multiple-step process. After the legislative basis was created, the regulatory concept was developed under the influence of the coso model from

Financial Management Act 2006. Compliance with this policy is mandatory to enhance governance and outcomes through effective and consistent risk management in and across the WA health system. 2. Scope This policy applies all Health Service Providers under the Health Services Act 20162 3. Policy statement The WA health system is committed to the management of its risks including those

MMU Risk Analysis toolkit (v 5) Page 2 Project Role Risk Management Role Project Sponsor Ensures that risk management structures and processes are in place for the

The role of risk management in financial firms has evolved far beyond the simple insurance of identified risks, to a discipline that centres on complex econometric and financial models of uncertainty. Financial risk management has been defined by the Basel Committee (2001) as a

risk/return profile, economic viability, financial sustainability, development impact, and overall contribution to realization of the mission of the Bank. Portfolio risk management and investment policies page 6 of 66

In a financial institution, enterprise risk management is normally thought of as the combination of credit risk, interest rate risk or asset liability management, liquidity risk, market risk, and operational risk.

Financial Risk Management and Modeling QuantAtRisk

Good Practice Example–Financial Management Report

RISK ANALYSIS AND MANAGEMENT The Center for ETH Z

frameworks and guidance on enterprise risk management, internal control, and fraud deterrence designed to improve organizational performance and governance and to reduce the extent of fraud in organizations. COSO is a private-sector initiative jointly sponsored and funded by the following organizations: American Accounting Association (AAA) American Institute of CPAs (AICPA) Financial

financial-management-risk-analysis-in-capital-budgeting

Risk Analysis Matrix CONSEQUENCES: Insignificant No injuries, low financial loss Minor First aid treatment, on-site release immediately contained, medium

Good Practice Example–Financial Management Report

Risk Analysis Matrix Club Help

Risk Management Policy Queensland Health

Analysis for Financial Management Tenth Edition ROBERT C.HIGGINS (irmiente Keimers ot Finance The University of Washington, McGraw-Hill Irwin. Contents Preface XI PART ONE ASSESSING THE FINANCIAL HEALTH OF THE FIRM 1 Chapter 1 Interpreting Financial Statements 3 The Cash Flow Cycle 3 The Balance Sheet 6 Current Assets and Liabilities 9 Shareholders’ Equity 11 The Income …

Good Practice Example–Financial Management Report

Financial Risk Management and Modeling QuantAtRisk

frameworks and guidance on enterprise risk management, internal control, and fraud deterrence designed to improve organizational performance and governance and to reduce the extent of fraud in organizations. COSO is a private-sector initiative jointly sponsored and funded by the following organizations: American Accounting Association (AAA) American Institute of CPAs (AICPA) Financial

Risk Analysis and Risk Management in the Public asz

Risk Analysis 6. The risk-assessment approach is based largely on International Standard on Auditing 400 financial management, financial analysis and management accounting. In particular, few accounts staff possess practical skills beyond basic book-keeping. The impact of these skill shortages on Government operations is amplified by high demand for financial skills from the private sector

Good Practice Example–Financial Management Report

Risk Management Policy Queensland Health