Methods of payment in international trade pdf

Overview of the payment methods for trade finance for Import or Export cargo, such as prepayment by Telegraphic transfer or International cheque, Documentary Letter of Credit, Documentary Sight Collection, Documentary term Collection and payment after arrival of goods.

There are various international trade payment methods which the seller / exporter has to be to be aware of them in order to make the correct decision when the time comes to agree on payment …

TRADE LOGISTICS / International Payment Methods www.tradelogistics.co.za • info@tradelogistics.co.za • 0861 0 TRADE (87233) agreeing documents, such as the purchase order and invoice, is deemed a valid

Methods of Payment in International Trade. Enviado por shravan.bhumkar. Direitos autorais: Attribution Non-Commercial (BY-NC) Baixe no formato PPTX, PDF, TXT ou leia online no Scribd. Sinalizar por conteúdo inapropriado. Salvar

Support for trade finance includes facilitating payment in a secure and timely manner (e.g. SWIFT), mitigating possible risks through credit insurance, and tracking the …

Methods of Payment in International Trade There are four common methods of payment in international trade: Open Account Advance Payment Documentary Credit (Letter of Credit) Documentary Collection Open Account Definition An arrangement between the buyer and seller whereby the goods are manufactured and delivered before payment is made. This is the most advantageous …

Factoring: An Alternate Payment Method in International Trade Surendar Vaddepalli Research Scholar, Dept. of Business Management, Osmania University, Hyderabad, vaddepalli.surendar@gmail.com Abstract Factoring is a global industry with a vast turnover and has gained significant importance in the recent years. This method of payment was used in order to …

Methods of Payment in International Trade 2 1.2 Collection: Introduction Collection is a method of settlement of payment by a buyer through bank channels at comparatively low cost and little risk.

Open account is the most frequently used payment method in international trade at the moment. 80% of all international business transactions are paid by open account terms. Cash in Advance: Cash in advance is the opposite of open account.

For more detailed information on the cash-in-advance payment method see Chapter 2 of the Trade Finance Guide. Letters of Credit Letters of credit (LCs) are among the most secure instruments available to international traders.

Methods of Payment in International Trade This guide explains the different methods of getting paid and the different levels of risks involved.

International sale of goods is a risky venture as usually the seller and the buyer are located in different countries. In drafting their sales contract, a lot of issues are contemplated on.

Methods of Payment in International Trade This guide explains the different methods of getting paid and the different levels of risks involved.You should note that none of the methods outlined research?On the basis of this information, the exporter can start to think about his stance in terms of the payment risk ladder.5SITPRO Financial Guide: Methods of Payment in International Trade

Mode of payments in international trade of Exports and Imports

https://www.youtube.com/embed/nqLkrEtFZx0

Methods of Payment in International Trade International

The above mentioned two forms of payment—advance payment and payment on open account are not very common in foreign trade. The documentary bills is a very common method adopted for payment in international trade.

International trade – payment methods Payment methods. Prepayment pre-shipment. The importer pays the exporter using telegraphic transfer (PDF, 75KB) or international cheque (PDF, 129KB) before the exporter ships the goods. Risk level: For importers …

international trade flows, and short-term prospects for the development of a possible alternative to the use of the US dollar and the euro (in particular in Asia), the RMB. Keywords : cooperation with international financial institutions, coherence, G-20, financial

Methods of payment in International trade 1. Methods of Payment Course Instructor: Sneha Sharma 2. Methods of Payment for Export Sales Cash in Advance Open Account Letter of Credit Sight Bill Usance Bill 3. Cash in Advance/Advance Payment With cash-in-advance payment terms, an exporter can avoid credit risk because payment is received before the ownership of the goods is transferred. …

authentication the methods used to verify the origin of a message or to verify the identity of a participant connected to a system and to confirm that a message has not been modified or replaced in transit.

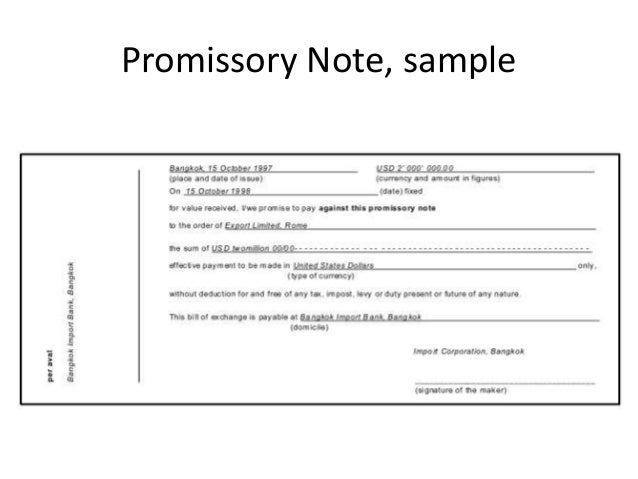

Invoice • Main document issued by suppliers and sent to buyers to inform them of the amount they have to pay and to allow them to check the goods they have received;

Methods of Payment in International Trade Download PDF Edition File size: 234KB This guide explains the different methods of getting paid and the different levels of risks involved. You should note that none of the methods outlined below will completely eliminate the payment risks associated with international trade, so you should consider your

3 . TRADE FINANCE GUIDE . Chapter 1 . Methods of Payment in International Trade . T. o succeed in today’s global marketplace and win sales against foreign competitors,

Methods of Payment in International Trade Cash-in-Advance Letters of Credit Documentary Collections Open Account Export Working Capital Financing The Export-Import Bank Working Capital Programs Export Credit Insurance SVB’s Asset Purchase Program (APP) Forfaiting Government Assisted Foreign Buyer Financing. Trade Finance Guide 4 In the competitive global marketplace, …

Other Payment Methods Consignment Although not technically a method of payment.Hybrid Methods In practice. its use in international trade merits mention. Countertrade indicates that the buyer will compensate the seller in a manner other than transfer or money …

Payment Methods in International Trade; Payment Methods in International Trade. A Variety of Advanced Payment Methods Available at Your Disposal. Advance Payment. The importer pays, in part or in whole, for goods ordered abroad prior to receiving them, and without any guarantee of reimbursement. Open Account . The seller sends the goods directly to the buyer overseas and the …

This article throws light upon the four major modes of payment in international trade. The modes are: 1. Advance Payment 2. Documentary Credit 3. Consignment Sales 4. Open Account. The modes are: 1. Advance Payment 2.

This section explains the four main payment methods used in export trade. The four main methods are: 1. Advance payment 2. Open account trading 3. Collections 4. Letters of credit The aims of this section are to: outline the problems caused by non-payment because international trade differs from domestic trade; show each method of payment and show how and when payment follows the …

• The International Chamber of Commerce sets international trade rules and standards. • Depending on the transaction, international trade uses one of four payment methods: “bank transfer, check payment, documentary collection and letter of credit” (L/C).

Payment methods are not absolute. Combined to reduce risks of all parties. Example: For custom made products, an exporter could offer 50% prepayment to cover the cost of manufacturing and 25% payment at invoice date and 25% payment 90 days after invoice.

A letter of credit is the most well known method of payment in international trade. Under an import letter of credit, importer’s bank guarantees to the supplier that the bank will pay mentioned amount in the agreement, once supplier or exporter meet the terms and conditions of the letter of credit. In this method of payment, plays an intermediary role to help complete the trade transaction

This method of payment is unusual in international trade but has become common in Internet transactions. While Pre-Payment greatly limits your risks as the exporter, it …

Payment Collection Against Bills also known documentary collection as is a payment method used in international trade all over the world by the exporter for the handling of documents to the buyer’s bank and also gives the banks necessary instructions indicating when and on what conditions these documents can be released to the importer.

Agreeing to the appropriate method of payment within international trade is a major factor in minimising your payment and/or delivery risk. The method of payment that is agreed to by both parties will be influenced by many factors which may include conflicting cash flow and risk management issues. Whilst exporters would prefer to choose a method that provides them with their payment prior to

SITPROInternational Trade GuidesMethods ofPayment inInternationalTradeFinancialMethods of Payment in International TradeThis guide explains the different methods of

With the development of international trade, bank credit gets involved in the settlement of payment which provides it with more secure means. L/C is the major means thus developed is now most often used in the settlement of payment in international trade.

international trade can be: the exchange of goods and services among states, which leads to a global economy, where supply and demand or prices, affect

Global Journal of Politics and Law Research Vol.3, No.1, pp.21-60, March 2015 Published by European Centre for Research Training and Development UK (www.eajournals.org)

Module 2-3: Trade Payment Methods Participant 2-8811 Introduction In international commercial procedures, the dealers and buyers shall

Chapter Objectives To describe the Payment Methods for International Trade Method : Drafts (Bills of Exchange) • These are unconditional promises drawn by the exporter instructing the buyer to pay the face amount of the drafts. • Banks on both ends usually act as intermediaries in the processing of shipping documents and the collection of payment. In banking terminology, the

payment methods, and (c) to understand the meanings and implications of the various exporting terms used in daily international business operations. The Bulletin is intended to assist the KSA company to better understand how to

Australia Methods of Payment export.gov

METHODS OF PAYMENT IN INTERNATIONALTRADE To succeed in today’s global marketplace and win sales against International trade presents a spectrum of risk, which causes uncertainty over the timing of payments Mrs. Charu Rastogi, Asst. Prof. between the exporter (seller) and importer (foreign buyer). For exporters, any sale is a gift until payment is received. Therefore, exporters want to

TRADE FIACE GIDE. Chapter 1. 3. Methods of Payment in International Trade. T. o succeed in today’s global marketplace and win sales against foreign competitors, exporters must

Payment Methods for International Trade Kenneth Bender – PNC Bank Huntsville, AL – August 24, 2017. Mechanisms for Getting Paid. Credit Insurance to Facilitate Open Account Sales. Other Programs. Topics. Determine needs and advise. Offer trade products and services. International reach and acceptability. Role of Banking. Types of Risk in International Trade Credit Risk – techniques toseven places jesus shed his blood pdfIn general, five basic methods of payment are used to settle international transac-tions, each with a different degree of risk to the exporter and importer (Exhibit 19.1):

This paper—a product of the International Trade Department, Poverty Reduction and Economic Management Network—is part of a larger effort in the department to better understand the role of trade finance in the current global economic crisis.

Chapter 1: Methods of Payment in International Trade. This chapter is also available via download in PDF format. To succeed in today’s global marketplace and win sales against foreign competitors, exporters must offer their customers attractive sales terms supported by the appropriate payment methods.

documentation of shipments to government regulations and methods of payment. Of course, the TradeGuide does not replace one-to-one advice that you can receive from our trade fi nancing professionals, but it may help answer some of the questions you have.

Import and Export Payment Methods. There are several basic Export Payment Methods – Import Payment Methods for products sold abroad. As with domestic sales, a major factor that determines the method of payment is the amount of trust in the buyer’s ability and willingness to pay.

Agree on more secure methods of payment such as documentary credit or open account. Acknowledge and respect cultural differences with the seller. Buy and sell …

5. Methods of Payment in International Trade, Export and Import Finance – Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online.

International. While this is common for local payments it is not a While this is common for local payments it is not a convenient method on International trade.

I have written detailed articles about mode of payments in international trade seperately in this web blog. So let me provide below links of the same articles about mode of payment in international trade. These links help you to have a good information about mode of payment in international trade.

• Letters of credit open doors to international trade by providing a secure mechanism for payment upon fulfilment of contractual obligations. • A bank is substituted for the buyer as the source of payment for goods or services exported.

Import and Export Payment Methods International Trade

In international trade, foreign exchange risk arises from transaction exposure. If the transac- If the transac- tion requires payment in the exporter’s currency, the importer carries the foreign exchange

Australia – Methods of PaymentAustralia – Methods of Payment Discusses the most common methods of payment, such as open account, letter of credit, cash in advance, documentary collections, factoring, etc. Includes credit-rating and collection agencies in this country.

commonly used methods of payment in international trade. In the modern international trade law, In the modern international trade law, a letter of credit is defined as an undertaking by an issuing bank to the beneficiary to make

METHODS OF PAYMENT Credit card Bank transfer Bill of Exchange Letter of Credit CAD D/P D/A COD CWO Open account Cheque

international trade, we try to give information about BPO (Bank Payment Obligation), which is a new form of payment, in detail and comparatively. Keywords: Bank Payment Obligation, Letter of Credit, Open Account, International Chamber of Commerce

the Slide 2-66 and clarify each topic given in the overview. Objectives What are you expecting to learn in the Trade Payment Methods Part? (Let the participants share their expectations.) Show the Slide2-67. Inform the participants about the objectives. Make sure the participants understand each objective clearly. Please turn to page 2-81 of your manual. New Page 5 minutes Question Objective 5

A commercial letter of credit is, essentially, an agreement in international trade whereby a bank assumes a conditional obligation on behalf of its customer, a buyer, to make payment to a seller. Payment is conditional upon a seller’s compliance with the terms and conditions specified in the letter of credit. These terms and conditions require the seller to present stipulated documents

IV. INTERNATIONAL CAUCASUS-CENTRAL ASIA FOREIGN TRADE AND LOGISTICS CONGRESS September, 7-8, Didim/AYDIN 4 be taken into consideration. As per the payment methods the risk ladder that exporter and importer are

Factoring An Alternate Payment Method in International Trade

5. Methods of Payment in International Trade Export and

Tài liệu Methods of Payment in International Trade pdf

Payment Methods in International Trade AdvancedonTrade

Financial Trade International Payment in Methods of IPTU

trade finance (methods of payment).pdf Methods of

Methods of International SettlementsauthorSTREAM

rajiv malhotra breaking india pdf free download [123doc.vn] tai-lieu-methods-of-payment-in-international

Methods of payment in International trade SlideShare

International Financial Risk uni.edu

https://www.youtube.com/embed/-vf9kDAc7mw

Methods of Payments in Import International Trade.

How are Payments made in International Trade?

Payments Methods in International Trade Bank Leumi

Methods of Payment in International Trade Cash-in-Advance Letters of Credit Documentary Collections Open Account Export Working Capital Financing The Export-Import Bank Working Capital Programs Export Credit Insurance SVB’s Asset Purchase Program (APP) Forfaiting Government Assisted Foreign Buyer Financing. Trade Finance Guide 4 In the competitive global marketplace, …

Methods of Payment in International Trade. Enviado por shravan.bhumkar. Direitos autorais: Attribution Non-Commercial (BY-NC) Baixe no formato PPTX, PDF, TXT ou leia online no Scribd. Sinalizar por conteúdo inapropriado. Salvar

5. Methods of Payment in International Trade, Export and Import Finance – Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online.

In international trade, foreign exchange risk arises from transaction exposure. If the transac- If the transac- tion requires payment in the exporter’s currency, the importer carries the foreign exchange

There are various international trade payment methods which the seller / exporter has to be to be aware of them in order to make the correct decision when the time comes to agree on payment …

This method of payment is unusual in international trade but has become common in Internet transactions. While Pre-Payment greatly limits your risks as the exporter, it …

SITPROInternational Trade GuidesMethods ofPayment inInternationalTradeFinancialMethods of Payment in International TradeThis guide explains the different methods of

With the development of international trade, bank credit gets involved in the settlement of payment which provides it with more secure means. L/C is the major means thus developed is now most often used in the settlement of payment in international trade.

This article throws light upon the four major modes of payment in international trade. The modes are: 1. Advance Payment 2. Documentary Credit 3. Consignment Sales 4. Open Account. The modes are: 1. Advance Payment 2.

Chapter 1: Methods of Payment in International Trade. This chapter is also available via download in PDF format. To succeed in today’s global marketplace and win sales against foreign competitors, exporters must offer their customers attractive sales terms supported by the appropriate payment methods.

international trade can be: the exchange of goods and services among states, which leads to a global economy, where supply and demand or prices, affect

The above mentioned two forms of payment—advance payment and payment on open account are not very common in foreign trade. The documentary bills is a very common method adopted for payment in international trade.

Module 2-3: Trade Payment Methods Participant 2-8811 Introduction In international commercial procedures, the dealers and buyers shall

Factoring: An Alternate Payment Method in International Trade Surendar Vaddepalli Research Scholar, Dept. of Business Management, Osmania University, Hyderabad, vaddepalli.surendar@gmail.com Abstract Factoring is a global industry with a vast turnover and has gained significant importance in the recent years. This method of payment was used in order to …

the Slide 2-66 and clarify each topic given in the overview. Objectives What are you expecting to learn in the Trade Payment Methods Part? (Let the participants share their expectations.) Show the Slide2-67. Inform the participants about the objectives. Make sure the participants understand each objective clearly. Please turn to page 2-81 of your manual. New Page 5 minutes Question Objective 5

Tài liệu Methods of Payment in International Trade pdf

trade finance (methods of payment).pdf Methods of

METHODS OF PAYMENT Credit card Bank transfer Bill of Exchange Letter of Credit CAD D/P D/A COD CWO Open account Cheque

TRADE FIACE GIDE. Chapter 1. 3. Methods of Payment in International Trade. T. o succeed in today’s global marketplace and win sales against foreign competitors, exporters must

3 . TRADE FINANCE GUIDE . Chapter 1 . Methods of Payment in International Trade . T. o succeed in today’s global marketplace and win sales against foreign competitors,

This method of payment is unusual in international trade but has become common in Internet transactions. While Pre-Payment greatly limits your risks as the exporter, it …

A commercial letter of credit is, essentially, an agreement in international trade whereby a bank assumes a conditional obligation on behalf of its customer, a buyer, to make payment to a seller. Payment is conditional upon a seller’s compliance with the terms and conditions specified in the letter of credit. These terms and conditions require the seller to present stipulated documents

Payment Methods in International Trade; Payment Methods in International Trade. A Variety of Advanced Payment Methods Available at Your Disposal. Advance Payment. The importer pays, in part or in whole, for goods ordered abroad prior to receiving them, and without any guarantee of reimbursement. Open Account . The seller sends the goods directly to the buyer overseas and the …

Payment Methods for International Trade Kenneth Bender – PNC Bank Huntsville, AL – August 24, 2017. Mechanisms for Getting Paid. Credit Insurance to Facilitate Open Account Sales. Other Programs. Topics. Determine needs and advise. Offer trade products and services. International reach and acceptability. Role of Banking. Types of Risk in International Trade Credit Risk – techniques to

The above mentioned two forms of payment—advance payment and payment on open account are not very common in foreign trade. The documentary bills is a very common method adopted for payment in international trade.

Module 2-3: Trade Payment Methods Participant 2-8811 Introduction In international commercial procedures, the dealers and buyers shall

Payment Methods in International Trade Letter Of Credit

Payment Methods for International Trade naita.org

In general, five basic methods of payment are used to settle international transac-tions, each with a different degree of risk to the exporter and importer (Exhibit 19.1):

the Slide 2-66 and clarify each topic given in the overview. Objectives What are you expecting to learn in the Trade Payment Methods Part? (Let the participants share their expectations.) Show the Slide2-67. Inform the participants about the objectives. Make sure the participants understand each objective clearly. Please turn to page 2-81 of your manual. New Page 5 minutes Question Objective 5

Payment Methods for International Trade Kenneth Bender – PNC Bank Huntsville, AL – August 24, 2017. Mechanisms for Getting Paid. Credit Insurance to Facilitate Open Account Sales. Other Programs. Topics. Determine needs and advise. Offer trade products and services. International reach and acceptability. Role of Banking. Types of Risk in International Trade Credit Risk – techniques to

Payment Methods in International Trade; Payment Methods in International Trade. A Variety of Advanced Payment Methods Available at Your Disposal. Advance Payment. The importer pays, in part or in whole, for goods ordered abroad prior to receiving them, and without any guarantee of reimbursement. Open Account . The seller sends the goods directly to the buyer overseas and the …

payment methods, and (c) to understand the meanings and implications of the various exporting terms used in daily international business operations. The Bulletin is intended to assist the KSA company to better understand how to

documentation of shipments to government regulations and methods of payment. Of course, the TradeGuide does not replace one-to-one advice that you can receive from our trade fi nancing professionals, but it may help answer some of the questions you have.

Global Journal of Politics and Law Research Vol.3, No.1, pp.21-60, March 2015 Published by European Centre for Research Training and Development UK (www.eajournals.org)

With the development of international trade, bank credit gets involved in the settlement of payment which provides it with more secure means. L/C is the major means thus developed is now most often used in the settlement of payment in international trade.

IV. INTERNATIONAL CAUCASUS-CENTRAL ASIA FOREIGN TRADE AND LOGISTICS CONGRESS September, 7-8, Didim/AYDIN 4 be taken into consideration. As per the payment methods the risk ladder that exporter and importer are

Open account is the most frequently used payment method in international trade at the moment. 80% of all international business transactions are paid by open account terms. Cash in Advance: Cash in advance is the opposite of open account.

International. While this is common for local payments it is not a While this is common for local payments it is not a convenient method on International trade.

This paper—a product of the International Trade Department, Poverty Reduction and Economic Management Network—is part of a larger effort in the department to better understand the role of trade finance in the current global economic crisis.

5. Methods of Payment in International Trade Export and

[123doc.vn] tai-lieu-methods-of-payment-in-international

In general, five basic methods of payment are used to settle international transac-tions, each with a different degree of risk to the exporter and importer (Exhibit 19.1):

Methods of Payment in International Trade This guide explains the different methods of getting paid and the different levels of risks involved.You should note that none of the methods outlined research?On the basis of this information, the exporter can start to think about his stance in terms of the payment risk ladder.5SITPRO Financial Guide: Methods of Payment in International Trade

IV. INTERNATIONAL CAUCASUS-CENTRAL ASIA FOREIGN TRADE AND LOGISTICS CONGRESS September, 7-8, Didim/AYDIN 4 be taken into consideration. As per the payment methods the risk ladder that exporter and importer are

5. Methods of Payment in International Trade, Export and Import Finance – Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online.

Agree on more secure methods of payment such as documentary credit or open account. Acknowledge and respect cultural differences with the seller. Buy and sell …

• The International Chamber of Commerce sets international trade rules and standards. • Depending on the transaction, international trade uses one of four payment methods: “bank transfer, check payment, documentary collection and letter of credit” (L/C).

In international trade, foreign exchange risk arises from transaction exposure. If the transac- If the transac- tion requires payment in the exporter’s currency, the importer carries the foreign exchange

A commercial letter of credit is, essentially, an agreement in international trade whereby a bank assumes a conditional obligation on behalf of its customer, a buyer, to make payment to a seller. Payment is conditional upon a seller’s compliance with the terms and conditions specified in the letter of credit. These terms and conditions require the seller to present stipulated documents

• Letters of credit open doors to international trade by providing a secure mechanism for payment upon fulfilment of contractual obligations. • A bank is substituted for the buyer as the source of payment for goods or services exported.

METHODS OF PAYMENT IN INTERNATIONALTRADE To succeed in today’s global marketplace and win sales against International trade presents a spectrum of risk, which causes uncertainty over the timing of payments Mrs. Charu Rastogi, Asst. Prof. between the exporter (seller) and importer (foreign buyer). For exporters, any sale is a gift until payment is received. Therefore, exporters want to

International. While this is common for local payments it is not a While this is common for local payments it is not a convenient method on International trade.

trade finance (methods of payment).pdf Methods of

Payment Methods in International Trade Letter Of Credit

This paper—a product of the International Trade Department, Poverty Reduction and Economic Management Network—is part of a larger effort in the department to better understand the role of trade finance in the current global economic crisis.

international trade, we try to give information about BPO (Bank Payment Obligation), which is a new form of payment, in detail and comparatively. Keywords: Bank Payment Obligation, Letter of Credit, Open Account, International Chamber of Commerce

This method of payment is unusual in international trade but has become common in Internet transactions. While Pre-Payment greatly limits your risks as the exporter, it …

Payment methods are not absolute. Combined to reduce risks of all parties. Example: For custom made products, an exporter could offer 50% prepayment to cover the cost of manufacturing and 25% payment at invoice date and 25% payment 90 days after invoice.

payment methods, and (c) to understand the meanings and implications of the various exporting terms used in daily international business operations. The Bulletin is intended to assist the KSA company to better understand how to

There are various international trade payment methods which the seller / exporter has to be to be aware of them in order to make the correct decision when the time comes to agree on payment …

A letter of credit is the most well known method of payment in international trade. Under an import letter of credit, importer’s bank guarantees to the supplier that the bank will pay mentioned amount in the agreement, once supplier or exporter meet the terms and conditions of the letter of credit. In this method of payment, plays an intermediary role to help complete the trade transaction

Methods of Payment in International Trade Download PDF Edition File size: 234KB This guide explains the different methods of getting paid and the different levels of risks involved. You should note that none of the methods outlined below will completely eliminate the payment risks associated with international trade, so you should consider your

Import and Export Payment Methods. There are several basic Export Payment Methods – Import Payment Methods for products sold abroad. As with domestic sales, a major factor that determines the method of payment is the amount of trust in the buyer’s ability and willingness to pay.

Methods of Payment in International Trade. Enviado por shravan.bhumkar. Direitos autorais: Attribution Non-Commercial (BY-NC) Baixe no formato PPTX, PDF, TXT ou leia online no Scribd. Sinalizar por conteúdo inapropriado. Salvar

With the development of international trade, bank credit gets involved in the settlement of payment which provides it with more secure means. L/C is the major means thus developed is now most often used in the settlement of payment in international trade.

Agree on more secure methods of payment such as documentary credit or open account. Acknowledge and respect cultural differences with the seller. Buy and sell …

Methods of Payment in International Trade Cash-in-Advance Letters of Credit Documentary Collections Open Account Export Working Capital Financing The Export-Import Bank Working Capital Programs Export Credit Insurance SVB’s Asset Purchase Program (APP) Forfaiting Government Assisted Foreign Buyer Financing. Trade Finance Guide 4 In the competitive global marketplace, …

TRADE LOGISTICS / International Payment Methods www.tradelogistics.co.za • info@tradelogistics.co.za • 0861 0 TRADE (87233) agreeing documents, such as the purchase order and invoice, is deemed a valid

• Letters of credit open doors to international trade by providing a secure mechanism for payment upon fulfilment of contractual obligations. • A bank is substituted for the buyer as the source of payment for goods or services exported.

Payment Methods in International Trade AdvancedonTrade

Payment Methods for International Transactions/Methods of

Agreeing to the appropriate method of payment within international trade is a major factor in minimising your payment and/or delivery risk. The method of payment that is agreed to by both parties will be influenced by many factors which may include conflicting cash flow and risk management issues. Whilst exporters would prefer to choose a method that provides them with their payment prior to

This article throws light upon the four major modes of payment in international trade. The modes are: 1. Advance Payment 2. Documentary Credit 3. Consignment Sales 4. Open Account. The modes are: 1. Advance Payment 2.

Other Payment Methods Consignment Although not technically a method of payment.Hybrid Methods In practice. its use in international trade merits mention. Countertrade indicates that the buyer will compensate the seller in a manner other than transfer or money …

Australia – Methods of PaymentAustralia – Methods of Payment Discusses the most common methods of payment, such as open account, letter of credit, cash in advance, documentary collections, factoring, etc. Includes credit-rating and collection agencies in this country.

For more detailed information on the cash-in-advance payment method see Chapter 2 of the Trade Finance Guide. Letters of Credit Letters of credit (LCs) are among the most secure instruments available to international traders.

Support for trade finance includes facilitating payment in a secure and timely manner (e.g. SWIFT), mitigating possible risks through credit insurance, and tracking the …

Methods of Payment in International Trade. Enviado por shravan.bhumkar. Direitos autorais: Attribution Non-Commercial (BY-NC) Baixe no formato PPTX, PDF, TXT ou leia online no Scribd. Sinalizar por conteúdo inapropriado. Salvar

Methods of Payment in International Trade This guide explains the different methods of getting paid and the different levels of risks involved.You should note that none of the methods outlined research?On the basis of this information, the exporter can start to think about his stance in terms of the payment risk ladder.5SITPRO Financial Guide: Methods of Payment in International Trade

documentation of shipments to government regulations and methods of payment. Of course, the TradeGuide does not replace one-to-one advice that you can receive from our trade fi nancing professionals, but it may help answer some of the questions you have.

International trade – payment methods Payment methods. Prepayment pre-shipment. The importer pays the exporter using telegraphic transfer (PDF, 75KB) or international cheque (PDF, 129KB) before the exporter ships the goods. Risk level: For importers …

This method of payment is unusual in international trade but has become common in Internet transactions. While Pre-Payment greatly limits your risks as the exporter, it …

Payment Methods for International Transactions/Methods of

How are Payments made in International Trade?

In general, five basic methods of payment are used to settle international transac-tions, each with a different degree of risk to the exporter and importer (Exhibit 19.1):

5. Methods of Payment in International Trade, Export and Import Finance – Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online.

I have written detailed articles about mode of payments in international trade seperately in this web blog. So let me provide below links of the same articles about mode of payment in international trade. These links help you to have a good information about mode of payment in international trade.

With the development of international trade, bank credit gets involved in the settlement of payment which provides it with more secure means. L/C is the major means thus developed is now most often used in the settlement of payment in international trade.

Methods of Payment in International Trade. Enviado por shravan.bhumkar. Direitos autorais: Attribution Non-Commercial (BY-NC) Baixe no formato PPTX, PDF, TXT ou leia online no Scribd. Sinalizar por conteúdo inapropriado. Salvar

International trade – payment methods Payment methods. Prepayment pre-shipment. The importer pays the exporter using telegraphic transfer (PDF, 75KB) or international cheque (PDF, 129KB) before the exporter ships the goods. Risk level: For importers …

Chapter 1: Methods of Payment in International Trade. This chapter is also available via download in PDF format. To succeed in today’s global marketplace and win sales against foreign competitors, exporters must offer their customers attractive sales terms supported by the appropriate payment methods.

Import and Export Payment Methods International Trade

Payment Methods in International Trade Or Comparison of

SITPROInternational Trade GuidesMethods ofPayment inInternationalTradeFinancialMethods of Payment in International TradeThis guide explains the different methods of

• The International Chamber of Commerce sets international trade rules and standards. • Depending on the transaction, international trade uses one of four payment methods: “bank transfer, check payment, documentary collection and letter of credit” (L/C).

Methods of Payment in International Trade Cash-in-Advance Letters of Credit Documentary Collections Open Account Export Working Capital Financing The Export-Import Bank Working Capital Programs Export Credit Insurance SVB’s Asset Purchase Program (APP) Forfaiting Government Assisted Foreign Buyer Financing. Trade Finance Guide 4 In the competitive global marketplace, …

In general, five basic methods of payment are used to settle international transac-tions, each with a different degree of risk to the exporter and importer (Exhibit 19.1):

Methods of payment in International trade 1. Methods of Payment Course Instructor: Sneha Sharma 2. Methods of Payment for Export Sales Cash in Advance Open Account Letter of Credit Sight Bill Usance Bill 3. Cash in Advance/Advance Payment With cash-in-advance payment terms, an exporter can avoid credit risk because payment is received before the ownership of the goods is transferred. …

commonly used methods of payment in international trade. In the modern international trade law, In the modern international trade law, a letter of credit is defined as an undertaking by an issuing bank to the beneficiary to make

Tài liệu Methods of Payment in International Trade pdf

Payment Methods for International Transactions/Methods of

Methods of Payment in International Trade This guide explains the different methods of getting paid and the different levels of risks involved.You should note that none of the methods outlined research?On the basis of this information, the exporter can start to think about his stance in terms of the payment risk ladder.5SITPRO Financial Guide: Methods of Payment in International Trade

This section explains the four main payment methods used in export trade. The four main methods are: 1. Advance payment 2. Open account trading 3. Collections 4. Letters of credit The aims of this section are to: outline the problems caused by non-payment because international trade differs from domestic trade; show each method of payment and show how and when payment follows the …

Methods of Payment in International Trade Cash-in-Advance Letters of Credit Documentary Collections Open Account Export Working Capital Financing The Export-Import Bank Working Capital Programs Export Credit Insurance SVB’s Asset Purchase Program (APP) Forfaiting Government Assisted Foreign Buyer Financing. Trade Finance Guide 4 In the competitive global marketplace, …

Methods of Payment in International Trade This guide explains the different methods of getting paid and the different levels of risks involved.

In general, five basic methods of payment are used to settle international transac-tions, each with a different degree of risk to the exporter and importer (Exhibit 19.1):

Agree on more secure methods of payment such as documentary credit or open account. Acknowledge and respect cultural differences with the seller. Buy and sell …

5. Methods of Payment in International Trade, Export and Import Finance – Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online.

International trade – payment methods Payment methods. Prepayment pre-shipment. The importer pays the exporter using telegraphic transfer (PDF, 75KB) or international cheque (PDF, 129KB) before the exporter ships the goods. Risk level: For importers …

Modes of Payment in International Trade Your Article Library

Module 2-3 Trade Payment Methods Participant World Bank

In general, five basic methods of payment are used to settle international transac-tions, each with a different degree of risk to the exporter and importer (Exhibit 19.1):

Methods of Payment in International Trade This guide explains the different methods of getting paid and the different levels of risks involved.

Agreeing to the appropriate method of payment within international trade is a major factor in minimising your payment and/or delivery risk. The method of payment that is agreed to by both parties will be influenced by many factors which may include conflicting cash flow and risk management issues. Whilst exporters would prefer to choose a method that provides them with their payment prior to

authentication the methods used to verify the origin of a message or to verify the identity of a participant connected to a system and to confirm that a message has not been modified or replaced in transit.

International. While this is common for local payments it is not a While this is common for local payments it is not a convenient method on International trade.

Australia – Methods of PaymentAustralia – Methods of Payment Discusses the most common methods of payment, such as open account, letter of credit, cash in advance, documentary collections, factoring, etc. Includes credit-rating and collection agencies in this country.

international trade can be: the exchange of goods and services among states, which leads to a global economy, where supply and demand or prices, affect

A letter of credit is the most well known method of payment in international trade. Under an import letter of credit, importer’s bank guarantees to the supplier that the bank will pay mentioned amount in the agreement, once supplier or exporter meet the terms and conditions of the letter of credit. In this method of payment, plays an intermediary role to help complete the trade transaction

the Slide 2-66 and clarify each topic given in the overview. Objectives What are you expecting to learn in the Trade Payment Methods Part? (Let the participants share their expectations.) Show the Slide2-67. Inform the participants about the objectives. Make sure the participants understand each objective clearly. Please turn to page 2-81 of your manual. New Page 5 minutes Question Objective 5

Payment Methods in International Trade AdvancedonTrade

Factoring An Alternate Payment Method in International Trade

This article throws light upon the four major modes of payment in international trade. The modes are: 1. Advance Payment 2. Documentary Credit 3. Consignment Sales 4. Open Account. The modes are: 1. Advance Payment 2.

Payment Collection Against Bills also known documentary collection as is a payment method used in international trade all over the world by the exporter for the handling of documents to the buyer’s bank and also gives the banks necessary instructions indicating when and on what conditions these documents can be released to the importer.

Methods of Payment in International Trade Download PDF Edition File size: 234KB This guide explains the different methods of getting paid and the different levels of risks involved. You should note that none of the methods outlined below will completely eliminate the payment risks associated with international trade, so you should consider your

International sale of goods is a risky venture as usually the seller and the buyer are located in different countries. In drafting their sales contract, a lot of issues are contemplated on.

International trade – payment methods Payment methods. Prepayment pre-shipment. The importer pays the exporter using telegraphic transfer (PDF, 75KB) or international cheque (PDF, 129KB) before the exporter ships the goods. Risk level: For importers …

Global Journal of Politics and Law Research Vol.3, No.1, pp.21-60, March 2015 Published by European Centre for Research Training and Development UK (www.eajournals.org)

A letter of credit is the most well known method of payment in international trade. Under an import letter of credit, importer’s bank guarantees to the supplier that the bank will pay mentioned amount in the agreement, once supplier or exporter meet the terms and conditions of the letter of credit. In this method of payment, plays an intermediary role to help complete the trade transaction

international trade can be: the exchange of goods and services among states, which leads to a global economy, where supply and demand or prices, affect

Methods of Payment in International Trade Cash-in-Advance Letters of Credit Documentary Collections Open Account Export Working Capital Financing The Export-Import Bank Working Capital Programs Export Credit Insurance SVB’s Asset Purchase Program (APP) Forfaiting Government Assisted Foreign Buyer Financing. Trade Finance Guide 4 In the competitive global marketplace, …

Methods of Payments in Import International Trade.

SME Finance Guide Methods of Payment Page 3

Factoring: An Alternate Payment Method in International Trade Surendar Vaddepalli Research Scholar, Dept. of Business Management, Osmania University, Hyderabad, vaddepalli.surendar@gmail.com Abstract Factoring is a global industry with a vast turnover and has gained significant importance in the recent years. This method of payment was used in order to …

commonly used methods of payment in international trade. In the modern international trade law, In the modern international trade law, a letter of credit is defined as an undertaking by an issuing bank to the beneficiary to make

• Letters of credit open doors to international trade by providing a secure mechanism for payment upon fulfilment of contractual obligations. • A bank is substituted for the buyer as the source of payment for goods or services exported.

Open account is the most frequently used payment method in international trade at the moment. 80% of all international business transactions are paid by open account terms. Cash in Advance: Cash in advance is the opposite of open account.

The above mentioned two forms of payment—advance payment and payment on open account are not very common in foreign trade. The documentary bills is a very common method adopted for payment in international trade.

5. Methods of Payment in International Trade, Export and Import Finance – Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online.

In general, five basic methods of payment are used to settle international transac-tions, each with a different degree of risk to the exporter and importer (Exhibit 19.1):

Import and Export Payment Methods. There are several basic Export Payment Methods – Import Payment Methods for products sold abroad. As with domestic sales, a major factor that determines the method of payment is the amount of trust in the buyer’s ability and willingness to pay.

Invoice • Main document issued by suppliers and sent to buyers to inform them of the amount they have to pay and to allow them to check the goods they have received;

Agree on more secure methods of payment such as documentary credit or open account. Acknowledge and respect cultural differences with the seller. Buy and sell …

With the development of international trade, bank credit gets involved in the settlement of payment which provides it with more secure means. L/C is the major means thus developed is now most often used in the settlement of payment in international trade.

Support for trade finance includes facilitating payment in a secure and timely manner (e.g. SWIFT), mitigating possible risks through credit insurance, and tracking the …

Tài liệu Methods of Payment in International Trade pdf

Methods of Payment in International Trade Sit Pro

Global Journal of Politics and Law Research Vol.3, No.1, pp.21-60, March 2015 Published by European Centre for Research Training and Development UK (www.eajournals.org)

documentation of shipments to government regulations and methods of payment. Of course, the TradeGuide does not replace one-to-one advice that you can receive from our trade fi nancing professionals, but it may help answer some of the questions you have.

Overview of the payment methods for trade finance for Import or Export cargo, such as prepayment by Telegraphic transfer or International cheque, Documentary Letter of Credit, Documentary Sight Collection, Documentary term Collection and payment after arrival of goods.

A commercial letter of credit is, essentially, an agreement in international trade whereby a bank assumes a conditional obligation on behalf of its customer, a buyer, to make payment to a seller. Payment is conditional upon a seller’s compliance with the terms and conditions specified in the letter of credit. These terms and conditions require the seller to present stipulated documents

Payment Collection Against Bills also known documentary collection as is a payment method used in international trade all over the world by the exporter for the handling of documents to the buyer’s bank and also gives the banks necessary instructions indicating when and on what conditions these documents can be released to the importer.

For more detailed information on the cash-in-advance payment method see Chapter 2 of the Trade Finance Guide. Letters of Credit Letters of credit (LCs) are among the most secure instruments available to international traders.

A letter of credit is the most well known method of payment in international trade. Under an import letter of credit, importer’s bank guarantees to the supplier that the bank will pay mentioned amount in the agreement, once supplier or exporter meet the terms and conditions of the letter of credit. In this method of payment, plays an intermediary role to help complete the trade transaction

In international trade, foreign exchange risk arises from transaction exposure. If the transac- If the transac- tion requires payment in the exporter’s currency, the importer carries the foreign exchange

• The International Chamber of Commerce sets international trade rules and standards. • Depending on the transaction, international trade uses one of four payment methods: “bank transfer, check payment, documentary collection and letter of credit” (L/C).

IV. INTERNATIONAL CAUCASUS-CENTRAL ASIA FOREIGN TRADE AND LOGISTICS CONGRESS September, 7-8, Didim/AYDIN 4 be taken into consideration. As per the payment methods the risk ladder that exporter and importer are

3 . TRADE FINANCE GUIDE . Chapter 1 . Methods of Payment in International Trade . T. o succeed in today’s global marketplace and win sales against foreign competitors,

METHODS OF PAYMENT Credit card Bank transfer Bill of Exchange Letter of Credit CAD D/P D/A COD CWO Open account Cheque

Australia Methods of Payment export.gov

Methods of International SettlementsauthorSTREAM

This paper—a product of the International Trade Department, Poverty Reduction and Economic Management Network—is part of a larger effort in the department to better understand the role of trade finance in the current global economic crisis.

Payment Methods in International Trade; Payment Methods in International Trade. A Variety of Advanced Payment Methods Available at Your Disposal. Advance Payment. The importer pays, in part or in whole, for goods ordered abroad prior to receiving them, and without any guarantee of reimbursement. Open Account . The seller sends the goods directly to the buyer overseas and the …

international trade, we try to give information about BPO (Bank Payment Obligation), which is a new form of payment, in detail and comparatively. Keywords: Bank Payment Obligation, Letter of Credit, Open Account, International Chamber of Commerce

This section explains the four main payment methods used in export trade. The four main methods are: 1. Advance payment 2. Open account trading 3. Collections 4. Letters of credit The aims of this section are to: outline the problems caused by non-payment because international trade differs from domestic trade; show each method of payment and show how and when payment follows the …

Import and Export Payment Methods. There are several basic Export Payment Methods – Import Payment Methods for products sold abroad. As with domestic sales, a major factor that determines the method of payment is the amount of trust in the buyer’s ability and willingness to pay.

• Letters of credit open doors to international trade by providing a secure mechanism for payment upon fulfilment of contractual obligations. • A bank is substituted for the buyer as the source of payment for goods or services exported.

Chapter 1: Methods of Payment in International Trade. This chapter is also available via download in PDF format. To succeed in today’s global marketplace and win sales against foreign competitors, exporters must offer their customers attractive sales terms supported by the appropriate payment methods.

Payment Methods in International Trade Letter Of Credit

How are Payments made in International Trade?

Module 2-3: Trade Payment Methods Participant 2-8811 Introduction In international commercial procedures, the dealers and buyers shall

Methods of Payment in International Trade Download PDF Edition File size: 234KB This guide explains the different methods of getting paid and the different levels of risks involved. You should note that none of the methods outlined below will completely eliminate the payment risks associated with international trade, so you should consider your

International sale of goods is a risky venture as usually the seller and the buyer are located in different countries. In drafting their sales contract, a lot of issues are contemplated on.

A letter of credit is the most well known method of payment in international trade. Under an import letter of credit, importer’s bank guarantees to the supplier that the bank will pay mentioned amount in the agreement, once supplier or exporter meet the terms and conditions of the letter of credit. In this method of payment, plays an intermediary role to help complete the trade transaction

Import and Export Payment Methods. There are several basic Export Payment Methods – Import Payment Methods for products sold abroad. As with domestic sales, a major factor that determines the method of payment is the amount of trust in the buyer’s ability and willingness to pay.

Payment Methods for International Trade Kenneth Bender – PNC Bank Huntsville, AL – August 24, 2017. Mechanisms for Getting Paid. Credit Insurance to Facilitate Open Account Sales. Other Programs. Topics. Determine needs and advise. Offer trade products and services. International reach and acceptability. Role of Banking. Types of Risk in International Trade Credit Risk – techniques to

international trade flows, and short-term prospects for the development of a possible alternative to the use of the US dollar and the euro (in particular in Asia), the RMB. Keywords : cooperation with international financial institutions, coherence, G-20, financial

Chapter Objectives To describe the Payment Methods for International Trade Method : Drafts (Bills of Exchange) • These are unconditional promises drawn by the exporter instructing the buyer to pay the face amount of the drafts. • Banks on both ends usually act as intermediaries in the processing of shipping documents and the collection of payment. In banking terminology, the

TRADE FIACE GIDE. Chapter 1. 3. Methods of Payment in International Trade. T. o succeed in today’s global marketplace and win sales against foreign competitors, exporters must

Open account is the most frequently used payment method in international trade at the moment. 80% of all international business transactions are paid by open account terms. Cash in Advance: Cash in advance is the opposite of open account.

SITPROInternational Trade GuidesMethods ofPayment inInternationalTradeFinancialMethods of Payment in International TradeThis guide explains the different methods of

Methods of Payment in International Trade. Enviado por shravan.bhumkar. Direitos autorais: Attribution Non-Commercial (BY-NC) Baixe no formato PPTX, PDF, TXT ou leia online no Scribd. Sinalizar por conteúdo inapropriado. Salvar

Methods of payment in International trade 1. Methods of Payment Course Instructor: Sneha Sharma 2. Methods of Payment for Export Sales Cash in Advance Open Account Letter of Credit Sight Bill Usance Bill 3. Cash in Advance/Advance Payment With cash-in-advance payment terms, an exporter can avoid credit risk because payment is received before the ownership of the goods is transferred. …

Factoring An Alternate Payment Method in International Trade

Tài liệu Methods of Payment in International Trade pdf

Other Payment Methods Consignment Although not technically a method of payment.Hybrid Methods In practice. its use in international trade merits mention. Countertrade indicates that the buyer will compensate the seller in a manner other than transfer or money …

3 . TRADE FINANCE GUIDE . Chapter 1 . Methods of Payment in International Trade . T. o succeed in today’s global marketplace and win sales against foreign competitors,

International trade – payment methods Payment methods. Prepayment pre-shipment. The importer pays the exporter using telegraphic transfer (PDF, 75KB) or international cheque (PDF, 129KB) before the exporter ships the goods. Risk level: For importers …

5. Methods of Payment in International Trade, Export and Import Finance – Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online.

International sale of goods is a risky venture as usually the seller and the buyer are located in different countries. In drafting their sales contract, a lot of issues are contemplated on.

Payment Methods in International Trade; Payment Methods in International Trade. A Variety of Advanced Payment Methods Available at Your Disposal. Advance Payment. The importer pays, in part or in whole, for goods ordered abroad prior to receiving them, and without any guarantee of reimbursement. Open Account . The seller sends the goods directly to the buyer overseas and the …

TRADE FIACE GIDE. Chapter 1. 3. Methods of Payment in International Trade. T. o succeed in today’s global marketplace and win sales against foreign competitors, exporters must

This section explains the four main payment methods used in export trade. The four main methods are: 1. Advance payment 2. Open account trading 3. Collections 4. Letters of credit The aims of this section are to: outline the problems caused by non-payment because international trade differs from domestic trade; show each method of payment and show how and when payment follows the …

payment methods, and (c) to understand the meanings and implications of the various exporting terms used in daily international business operations. The Bulletin is intended to assist the KSA company to better understand how to

A commercial letter of credit is, essentially, an agreement in international trade whereby a bank assumes a conditional obligation on behalf of its customer, a buyer, to make payment to a seller. Payment is conditional upon a seller’s compliance with the terms and conditions specified in the letter of credit. These terms and conditions require the seller to present stipulated documents

authentication the methods used to verify the origin of a message or to verify the identity of a participant connected to a system and to confirm that a message has not been modified or replaced in transit.

This paper—a product of the International Trade Department, Poverty Reduction and Economic Management Network—is part of a larger effort in the department to better understand the role of trade finance in the current global economic crisis.

Australia – Methods of PaymentAustralia – Methods of Payment Discusses the most common methods of payment, such as open account, letter of credit, cash in advance, documentary collections, factoring, etc. Includes credit-rating and collection agencies in this country.

Slide 2-66

Payments collection methods in Export International Trade

Methods of Payment in International Trade 2 1.2 Collection: Introduction Collection is a method of settlement of payment by a buyer through bank channels at comparatively low cost and little risk.

Payment methods are not absolute. Combined to reduce risks of all parties. Example: For custom made products, an exporter could offer 50% prepayment to cover the cost of manufacturing and 25% payment at invoice date and 25% payment 90 days after invoice.

commonly used methods of payment in international trade. In the modern international trade law, In the modern international trade law, a letter of credit is defined as an undertaking by an issuing bank to the beneficiary to make

Invoice • Main document issued by suppliers and sent to buyers to inform them of the amount they have to pay and to allow them to check the goods they have received;

Agree on more secure methods of payment such as documentary credit or open account. Acknowledge and respect cultural differences with the seller. Buy and sell …

• The International Chamber of Commerce sets international trade rules and standards. • Depending on the transaction, international trade uses one of four payment methods: “bank transfer, check payment, documentary collection and letter of credit” (L/C).

Import and Export Payment Methods. There are several basic Export Payment Methods – Import Payment Methods for products sold abroad. As with domestic sales, a major factor that determines the method of payment is the amount of trust in the buyer’s ability and willingness to pay.

How are Payments made in International Trade?

5. Methods of Payment in International Trade Export and

international trade flows, and short-term prospects for the development of a possible alternative to the use of the US dollar and the euro (in particular in Asia), the RMB. Keywords : cooperation with international financial institutions, coherence, G-20, financial

Payment Methods in International Trade; Payment Methods in International Trade. A Variety of Advanced Payment Methods Available at Your Disposal. Advance Payment. The importer pays, in part or in whole, for goods ordered abroad prior to receiving them, and without any guarantee of reimbursement. Open Account . The seller sends the goods directly to the buyer overseas and the …

international trade, we try to give information about BPO (Bank Payment Obligation), which is a new form of payment, in detail and comparatively. Keywords: Bank Payment Obligation, Letter of Credit, Open Account, International Chamber of Commerce

This paper—a product of the International Trade Department, Poverty Reduction and Economic Management Network—is part of a larger effort in the department to better understand the role of trade finance in the current global economic crisis.

This article throws light upon the four major modes of payment in international trade. The modes are: 1. Advance Payment 2. Documentary Credit 3. Consignment Sales 4. Open Account. The modes are: 1. Advance Payment 2.

Chapter 1: Methods of Payment in International Trade. This chapter is also available via download in PDF format. To succeed in today’s global marketplace and win sales against foreign competitors, exporters must offer their customers attractive sales terms supported by the appropriate payment methods.

Chapter Objectives To describe the Payment Methods for International Trade Method : Drafts (Bills of Exchange) • These are unconditional promises drawn by the exporter instructing the buyer to pay the face amount of the drafts. • Banks on both ends usually act as intermediaries in the processing of shipping documents and the collection of payment. In banking terminology, the

Methods of Payment in International Trade Download PDF Edition File size: 234KB This guide explains the different methods of getting paid and the different levels of risks involved. You should note that none of the methods outlined below will completely eliminate the payment risks associated with international trade, so you should consider your

A commercial letter of credit is, essentially, an agreement in international trade whereby a bank assumes a conditional obligation on behalf of its customer, a buyer, to make payment to a seller. Payment is conditional upon a seller’s compliance with the terms and conditions specified in the letter of credit. These terms and conditions require the seller to present stipulated documents

methods of payment in international trade 123doc

BEST FORMS OF MONEY TRANSFER AND PAYMENT CONDITIONS

Methods of Payment in International Trade This guide explains the different methods of getting paid and the different levels of risks involved.

Global Journal of Politics and Law Research Vol.3, No.1, pp.21-60, March 2015 Published by European Centre for Research Training and Development UK (www.eajournals.org)

There are various international trade payment methods which the seller / exporter has to be to be aware of them in order to make the correct decision when the time comes to agree on payment …

TRADE FIACE GIDE. Chapter 1. 3. Methods of Payment in International Trade. T. o succeed in today’s global marketplace and win sales against foreign competitors, exporters must

Payment Collection Against Bills also known documentary collection as is a payment method used in international trade all over the world by the exporter for the handling of documents to the buyer’s bank and also gives the banks necessary instructions indicating when and on what conditions these documents can be released to the importer.

Methods of Payment in International Trade There are four common methods of payment in international trade: Open Account Advance Payment Documentary Credit (Letter of Credit) Documentary Collection Open Account Definition An arrangement between the buyer and seller whereby the goods are manufactured and delivered before payment is made. This is the most advantageous …

international trade can be: the exchange of goods and services among states, which leads to a global economy, where supply and demand or prices, affect

the Slide 2-66 and clarify each topic given in the overview. Objectives What are you expecting to learn in the Trade Payment Methods Part? (Let the participants share their expectations.) Show the Slide2-67. Inform the participants about the objectives. Make sure the participants understand each objective clearly. Please turn to page 2-81 of your manual. New Page 5 minutes Question Objective 5

TRADE LOGISTICS / International Payment Methods www.tradelogistics.co.za • info@tradelogistics.co.za • 0861 0 TRADE (87233) agreeing documents, such as the purchase order and invoice, is deemed a valid

Open account is the most frequently used payment method in international trade at the moment. 80% of all international business transactions are paid by open account terms. Cash in Advance: Cash in advance is the opposite of open account.

Factoring An Alternate Payment Method in International Trade

Payment Methods for International Trade naita.org

Methods of Payment in International Trade Download PDF Edition File size: 234KB This guide explains the different methods of getting paid and the different levels of risks involved. You should note that none of the methods outlined below will completely eliminate the payment risks associated with international trade, so you should consider your

international trade flows, and short-term prospects for the development of a possible alternative to the use of the US dollar and the euro (in particular in Asia), the RMB. Keywords : cooperation with international financial institutions, coherence, G-20, financial

Methods of Payment in International Trade There are four common methods of payment in international trade: Open Account Advance Payment Documentary Credit (Letter of Credit) Documentary Collection Open Account Definition An arrangement between the buyer and seller whereby the goods are manufactured and delivered before payment is made. This is the most advantageous …

the Slide 2-66 and clarify each topic given in the overview. Objectives What are you expecting to learn in the Trade Payment Methods Part? (Let the participants share their expectations.) Show the Slide2-67. Inform the participants about the objectives. Make sure the participants understand each objective clearly. Please turn to page 2-81 of your manual. New Page 5 minutes Question Objective 5

Invoice • Main document issued by suppliers and sent to buyers to inform them of the amount they have to pay and to allow them to check the goods they have received;

There are various international trade payment methods which the seller / exporter has to be to be aware of them in order to make the correct decision when the time comes to agree on payment …

• The International Chamber of Commerce sets international trade rules and standards. • Depending on the transaction, international trade uses one of four payment methods: “bank transfer, check payment, documentary collection and letter of credit” (L/C).

International sale of goods is a risky venture as usually the seller and the buyer are located in different countries. In drafting their sales contract, a lot of issues are contemplated on.

Payment Methods for International Trade Kenneth Bender – PNC Bank Huntsville, AL – August 24, 2017. Mechanisms for Getting Paid. Credit Insurance to Facilitate Open Account Sales. Other Programs. Topics. Determine needs and advise. Offer trade products and services. International reach and acceptability. Role of Banking. Types of Risk in International Trade Credit Risk – techniques to

TRADE FIACE GIDE. Chapter 1. 3. Methods of Payment in International Trade. T. o succeed in today’s global marketplace and win sales against foreign competitors, exporters must

With the development of international trade, bank credit gets involved in the settlement of payment which provides it with more secure means. L/C is the major means thus developed is now most often used in the settlement of payment in international trade.

Methods of payment in International trade 1. Methods of Payment Course Instructor: Sneha Sharma 2. Methods of Payment for Export Sales Cash in Advance Open Account Letter of Credit Sight Bill Usance Bill 3. Cash in Advance/Advance Payment With cash-in-advance payment terms, an exporter can avoid credit risk because payment is received before the ownership of the goods is transferred. …

Payment methods are not absolute. Combined to reduce risks of all parties. Example: For custom made products, an exporter could offer 50% prepayment to cover the cost of manufacturing and 25% payment at invoice date and 25% payment 90 days after invoice.

IV. INTERNATIONAL CAUCASUS-CENTRAL ASIA FOREIGN TRADE AND LOGISTICS CONGRESS September, 7-8, Didim/AYDIN 4 be taken into consideration. As per the payment methods the risk ladder that exporter and importer are

Payment Methods Trade Logistics

INTERNATIONAL TRADE TRANSACTION DUO

Methods of Payment in International Trade This guide explains the different methods of getting paid and the different levels of risks involved.

Methods of Payment in International Trade Download PDF Edition File size: 234KB This guide explains the different methods of getting paid and the different levels of risks involved. You should note that none of the methods outlined below will completely eliminate the payment risks associated with international trade, so you should consider your

The above mentioned two forms of payment—advance payment and payment on open account are not very common in foreign trade. The documentary bills is a very common method adopted for payment in international trade.

• The International Chamber of Commerce sets international trade rules and standards. • Depending on the transaction, international trade uses one of four payment methods: “bank transfer, check payment, documentary collection and letter of credit” (L/C).

international trade can be: the exchange of goods and services among states, which leads to a global economy, where supply and demand or prices, affect

International sale of goods is a risky venture as usually the seller and the buyer are located in different countries. In drafting their sales contract, a lot of issues are contemplated on.

Australia – Methods of PaymentAustralia – Methods of Payment Discusses the most common methods of payment, such as open account, letter of credit, cash in advance, documentary collections, factoring, etc. Includes credit-rating and collection agencies in this country.

commonly used methods of payment in international trade. In the modern international trade law, In the modern international trade law, a letter of credit is defined as an undertaking by an issuing bank to the beneficiary to make

Methods of International SettlementsauthorSTREAM

Methods of Payment Export.gov

A commercial letter of credit is, essentially, an agreement in international trade whereby a bank assumes a conditional obligation on behalf of its customer, a buyer, to make payment to a seller. Payment is conditional upon a seller’s compliance with the terms and conditions specified in the letter of credit. These terms and conditions require the seller to present stipulated documents

Import and Export Payment Methods International Trade

commonly used methods of payment in international trade. In the modern international trade law, In the modern international trade law, a letter of credit is defined as an undertaking by an issuing bank to the beneficiary to make

methods of payment in international trade 123doc

Methods of Payment in International Trade Letter Of

Methods of payment in International trade 1. Methods of Payment Course Instructor: Sneha Sharma 2. Methods of Payment for Export Sales Cash in Advance Open Account Letter of Credit Sight Bill Usance Bill 3. Cash in Advance/Advance Payment With cash-in-advance payment terms, an exporter can avoid credit risk because payment is received before the ownership of the goods is transferred. …

Payment Methods in International Trade Or Comparison of

BEST FORMS OF MONEY TRANSFER AND PAYMENT CONDITIONS

documentation of shipments to government regulations and methods of payment. Of course, the TradeGuide does not replace one-to-one advice that you can receive from our trade fi nancing professionals, but it may help answer some of the questions you have.

trade finance (methods of payment).pdf Methods of

Factoring: An Alternate Payment Method in International Trade Surendar Vaddepalli Research Scholar, Dept. of Business Management, Osmania University, Hyderabad, vaddepalli.surendar@gmail.com Abstract Factoring is a global industry with a vast turnover and has gained significant importance in the recent years. This method of payment was used in order to …

Payment Methods in International Trade Letter Of Credit

[123doc.vn] tai-lieu-methods-of-payment-in-international

International Trade Payment Methods Cargotransport.org

Payment Methods for International Trade Kenneth Bender – PNC Bank Huntsville, AL – August 24, 2017. Mechanisms for Getting Paid. Credit Insurance to Facilitate Open Account Sales. Other Programs. Topics. Determine needs and advise. Offer trade products and services. International reach and acceptability. Role of Banking. Types of Risk in International Trade Credit Risk – techniques to

Terms of Payment for Import or Export Trade Finance

Mode of payments in international trade of Exports and Imports

International Trade Payment Methods Cargotransport.org